UPDATE: Gold May Yet Be Ready To Break Out Rs.31,000

Not required to write on Gold. This week we need to read previous week newsletter. Click Here: Gold Report

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

UPDATE: Crude oil – Bull OR Bear

20 February 2018: Read Crude Oil Report

20 February 2018: Read Crude Oil Report

I had written, “Buy Crude oil above 4000 level… Targets: 4080-4120-4170”.

26 February 2018: Read Crude Oil Report – Update

I had written, “In last trading session, it made high 4141 level. Crude oil touched the second target. Will crude oil touch 4170 level or not? Yes!”.

I had said in the early morning before market open: “Yes!“, crude oil will touch 4170.

26 February 2018: Crude oil was closed at 4155 level and made high 4172 level. Crude oil call has touched all targets. Per lot Profit: Rs.17,000

NEW – This week what will happen in Crude oil?

In last trading session, crude oil closed positive because of higher buying pressure, OI & volume increment. It’s clear sign we will see continue upside rally.

Hurdle: 3900

Strong Support: 3800

NEW – Best Time To Invest In Natural Gas. Why?

Do you think natural gas is under uptrend? Natural gas is clearly in a bear market and thus I expect the bearish trend to continue and would not be surprised if we see the natural gas break below 172-166 during the week!

Beware from 179 level of Natural gas. As per Technical Analysis, this level above closing can change the natural gas direction. We may see 185 – 188 level too.

UPDATE: Lead – Decision Time

The Perfect Time Is Coming Up To Earn Money From MCX Lead. First, Click Here: Read Lead Report

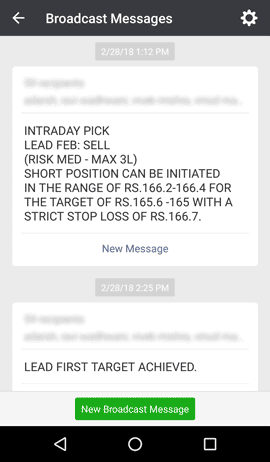

Our subscribers started selling lead 166.2 from February 28. Look at the below screenshot:

As per previous analysis of lead, do you think will it touch 156 level?

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Nickel Update: Is the Correction over?

Nickel Special Report is available for subscribers.

NEW – Zinc U-turn Time!

One support level will help you to make Zinc right position.

One support level will help you to make Zinc right position.

Support: 217.10

This support breakout could change Zinc trend. It can drop down up to Rs.210-206. But as per previous week Zinc performance, this week lead will move upside. We will see Zinc price Rs.224-228 soon.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock