This is the 18th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

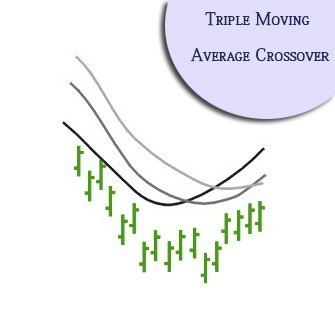

Triple Moving Average Crossover

Effect of Triple M.A.

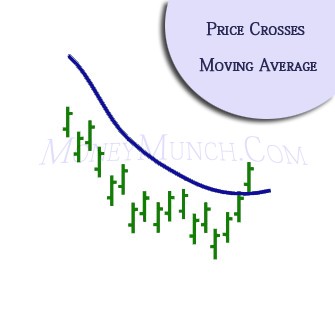

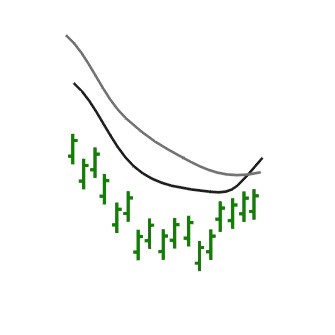

When a shorter moving average (of a security’s price) crosses a moderate moving average, as well as the medium crosses a longer moving average, a bullish or bearish signal is produced this depends on the way of the crossovers.

Story

A moving average is an indicator that concerts the average worth of a security’s price more than a period of time. This excellent type of event occurs whenever a shorter moving average crosses a moderate moving average, and also the medium moving average crosses a longer moving average. The moving average times used in the celebration are really 4, 9 and 18 day. Whenever the 4-day crosses above/below the 9-day moving average, the event possess “started”. The celebration is “confirmed” whenever 9-day moving average crosses above/below the 18-day moving average.

A bullish signal is produced once the direction of the crossovers is above e.g. the shorter crosses above the moderate plus the moderate crosses above the longer. A bearish alert is generated whenever the movement of the crossovers is below.

These games are really based on top of straight forward moving averages. A straight forward moving average is certainly one just where equal weight is taking into account to any single price around the calculation period. For instance, a 9-day straight forward moving average is calculated if you take the sum of the very last 9 days of a stock’s close price and additionally then separating by 9. Other kinds of moving averages, that are not supported in this case, are really weighted averages and additionally exponentially smoothed averages.

Trading Factors

Moving averages are lagging indicators because they use ancient information. Making use of them because indicators will likely not get you in during the bottom and also away during the top but can get you in and additionally out somewhere between.

The couple work ideal in trending price designs, in which a good uptrend or downtrend is strongly in place.

Factors that Supports

Indicators that are fine appropriate to using moving averages consist of the MACD and Momentum.

Main Behavior

Moving averages flourish in trending markets even so they generate numerous false signals in choppy, sideways markets.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?