This is the 112th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Inside Bar Chart Pattern

Effect of Inside Bar

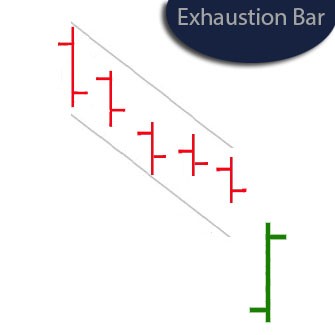

Any Within it Bar (Bullish) indicates a possibility reversal of the current downtrend to a new uptrend. The pattern is definitely an sign of the fiscal instrument’s SHORT-TERM outlook. Two-bar patterns mirror changes in investor psychology which have a very short-term impact upon future prices – usually less than 10 bars. Often the immediate influence is trend exhaustion and additionally oftentimes, a reversal. For investors looking for evident entry and exit aspects, our patterns provide well. These are normally not suitable because signals for long-term investors except if viewed as monthly taverns.

Story

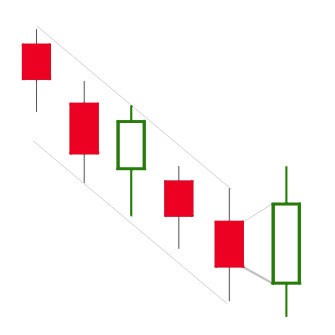

Any Inside Bar is a reversal formation characterized from a bar which forms totally in the trading array of the above bar. Inside Bars reflect a balance stuck between buyers and sellers following a sharp up or perhaps down move, and is at times later on solved from a change in trend.

Trading Factors

Inside Bars can feel either Bullish or perhaps Bearish hinging on the way of the inbound trend. If in case the inbound price trend is up, then upon identification of a Inside Bar, taking a short position or perhaps selling a long position is advised. Conversely, if the inbound price trend is down, then on recognition of a Inside Bar, taking a long position or perhaps closing a short positioning is recommended. Seek out verification wearing a trend-line break.

The degree that the price bars and volume qualities match this description could likely feature a bearing in the resilience of the post pattern price movement. Good trading training dictates which our signals cannot be utilized in isolation: fundamental information, area and marketplace evidences and various other technicals for example support/resistance and momentum tests must be utilized to support your trading decisions.

Factors that Supports

- The sharper the trend above the pattern, the more effective.

- The wider the 1st bar and additionally its immediate predecessors in relation to previous bars, so much the better. This is certainly evidence that the strong root momentum of the prevailing trend has got climaxed and additionally can dissipate.

- The smaller the 2nd bar relative to the broader range of the 1st bar, the more dramatic the change inside the buyer/seller balance and subsequently the stronger the signal.

- Volume on the inside bar must be noticeably lighter when compared to compared to the above bar because it indicates a more balanced situation.

Main Behavior

Some kind of Inside Bar indicates a weighing of sentiment between buyers and sellers soon after a sustained up or down move. In the Inside Bar’s second day, especially through a drop in volume, you are watching a drop off interesting in this instrument. The balancing usually causes a period of sideways price movement, however a reversal can be done.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Technical Analysis Training (60 Days – Comprehensive Course)

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?