This is the 47th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

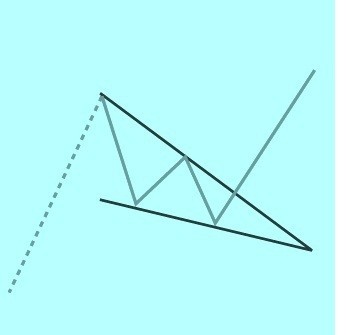

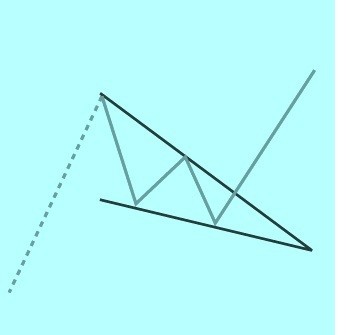

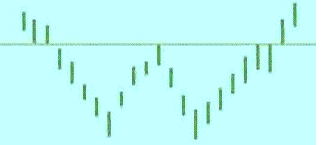

Head and Shoulders Bottom Chart Pattern

Implication

A Head and Shoulders Bottom is regarded as a bullish indication. It suggests a potential reversal of the existing downtrend into a new uptrend.

Description

The Head and Shoulders bottom is a famous pattern with traders. This pattern marks a reversal of a downward trend in a economic instrument’s cost.

Amount is completely important to a Head and Shoulders Bottom. An trader will be searching for improving amounts at the point of breakout. This enhanced amount definitively marks the end of the pattern and the reversal of a downward event in the amount of a inventory.

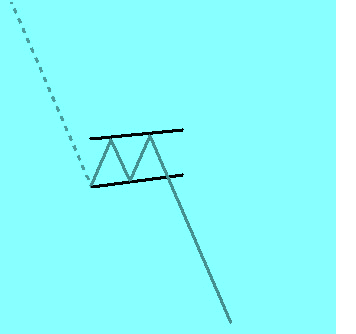

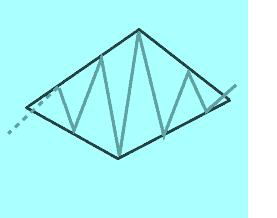

The neckline is a crucial factor of this pattern. The neckline is developed by attracting a line attaching the 2 large amount tips of the enhancement. The 1st high point happens at the end of the left shoulder and starting of the downtrend to the head. The second marks the end of the head and the starting of the downturn to the right shoulder. The neckline generally points down in a Head and Shoulders Bottom, but on unusual events can mountain up.

The pattern is accomplish when the opposition marked by the neckline is “broken”. This happens when the amount of the inventory, increasing from the low point of the right shoulder moves up through the neckline. Multiple specialized experts only consider the neckline “broken” if the stock closes above the neckline.

It is most important to observe amount at the detail where the neckline is broken. For a true reversal, specialists consent that significant amount is important.

Variations of the Head and Shoulders Bottom

There are a few notable variations for this pattern.

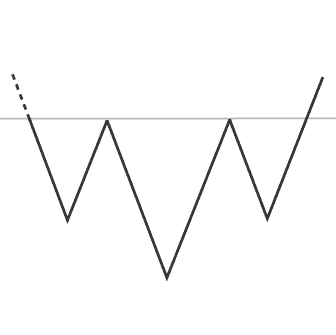

Multiple Head and Shoulders Patterns

Many valid Head and Shoulders patterns are not as well identified as the classical head with a shoulder on either side. It is not unusual to see more than two shoulders and more than one head. A popular variation of a multiple Head and Shoulders pattern contains two left shoulders of more or less equal size, one head, and then two right shoulders that imitate the range and structure of the left shoulders.

Important Characteristics

Following are important characteristics for this pattern.

In a classic Head and Shoulders Bottom, the left and right shoulders hit their relative low points at approximately the same price and level. In addition, the shoulders are usually about the same distance from the head. Experts like to see symmetry but variations are not lethal to the validity of the pattern.

Volume

In a well-formed pattern, the slope will not be too steep, but don’t certainly promotion a improvement with a steep neckline. Many experts think an upward sloping neckline is additional bullish than a downward sloping one. Others say slope has little to do with the stock’s degree of bullishness.

Duration of Pattern

Consider the length of the pattern and its relationship to your investing time horizons. The duration of the pattern is regarded to be an signal of the period of the impact of this pattern. The longer the pattern the longer it will take for the amount to achieve the desired amount. The shorter the pattern the sooner the price move. If you are considering a short-term trading possibility, look for a structure with a short length. If you are considering a longer-term trading possibility, look for a pattern with a longer length. The length of the pattern is sometimes called the “width” or “length” of the pattern.

Need for a Downtrend

This is a reversal pattern which marks the transition from a downtrend to an uptrend.

Slope of the Neckline

In a well-formed pattern, the slope will not be too steep, but don’t automatically discount a formation with a steep neckline. Some experts believe an upward sloping neckline is more bullish than a downward sloping one. Others say slope has little to do with the stock’s degree of bullishness.

Trading Considerations

Duration of the Pattern

Consider the duration of the pattern and its relationship to your trading time horizons. The duration of the pattern is considered to be an indicator of the duration of the influence of this pattern. The longer the pattern the longer it will take for the price to reach the Target Price. The shorter the pattern the sooner the price move. If you are considering a short-term trading opportunity, look for a pattern with a short duration. If you are considering a longer-term trading opportunity, look for a pattern with a longer duration. The duration of the pattern is sometimes called the “width” or “length” of the pattern.

Target Price

The target price provides an significant indicator about the possible cost move that this pattern indicates. Consider whether the desired price for this pattern is sufficient to provide adequate returns after your costs (such as commissions) have been taken into account. A good rule of thumb is that the target price must indicate a potential return of greater than 5% before a pattern should be considered useful. However you must consider the current price and the volume of shares you intend to trade. Also, check that the target price has not currently been obtained.

Inbound Trend

The inbound trend is an significant attribute of the pattern. A shallow inbound trend may suggest a period of combination before the cost move recommended by the pattern begins. Look for an inbound trend that is extended than the length of the pattern. A good rule of thumb is that the inbound trend should be at least two times the length of the pattern.

Criteria that Supports

Support and Resistance

Look for a location of support or opposition around the target cost. A region of cost combination or a powerful Support and Resistance Line at or around the desired price is a strong signal that the price will move to that point.

Location of Moving Average

The Head and Shoulders Bottom should be be below the Moving Average. Analyse the place of the pattern to a Moving Average of recommended duration. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Moving Average Trend

The Moving Average should change direction within the duration of the pattern and should head in the direction indicated by the pattern. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Volume

Volume will usually be highest on the left shoulder and lowest on the right.

A strong quantity spike on the day of the pattern verification is a intense indication in support of the possible for this pattern. The amount spike should be substantially above the typical of the volume for the period of the pattern.

Other Patterns

Other reversal patterns (such as Bullish and Bearish Engulfing Lines and Islands) that occur at the peaks and valleys indicate strong resistance at those points. The presence of these patterns inside a Head and Shoulders is a strong indication in support of this pattern.

No Volume Spike on Confirmation

The lack of a volume spike on the day of the pattern confirmation is an indication that this pattern may not be reliable. In addition, if the volume has remained constant, or was increasing, over the duration of the pattern, then this pattern should be considered less reliable.

Location of Moving Average

If the Head and Shoulders Bottom is above the Moving Average then this pattern should be considered less reliable. Compare the location of the pattern to a Moving Average of appropriate length. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Moving Average Trend

Look at the direction of the Moving Average Trend. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average. A Moving Average that is trending in the opposite direction to that indicated by the pattern is an indication that this pattern is less reliable.

Short Inbound Trend

An inbound trend that is significantly shorter than the pattern duration is an indication that this pattern should be considered less reliable.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

Trading Considerations

Trading Considerations