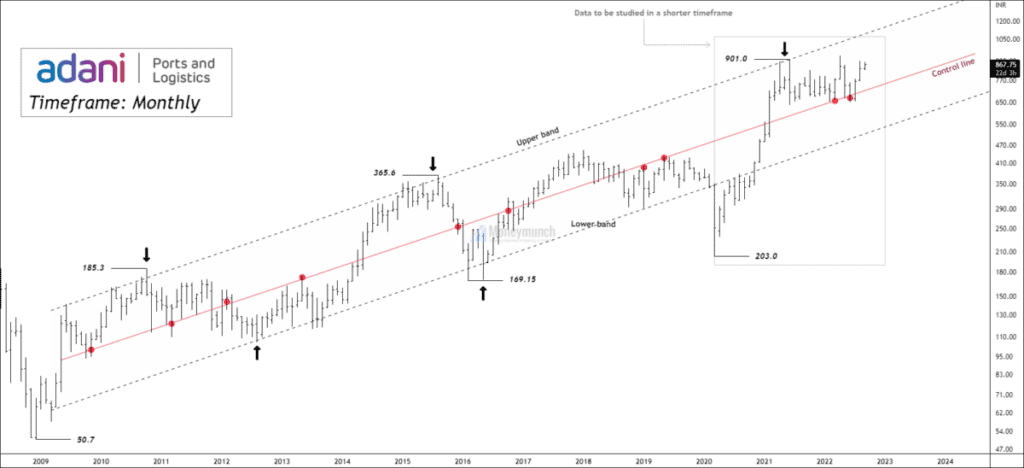

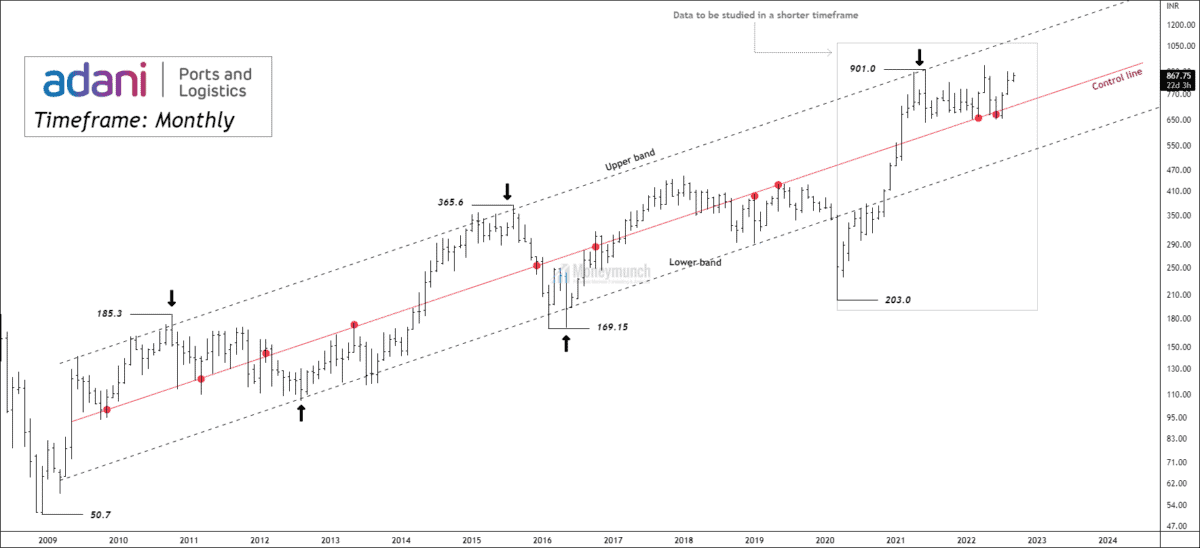

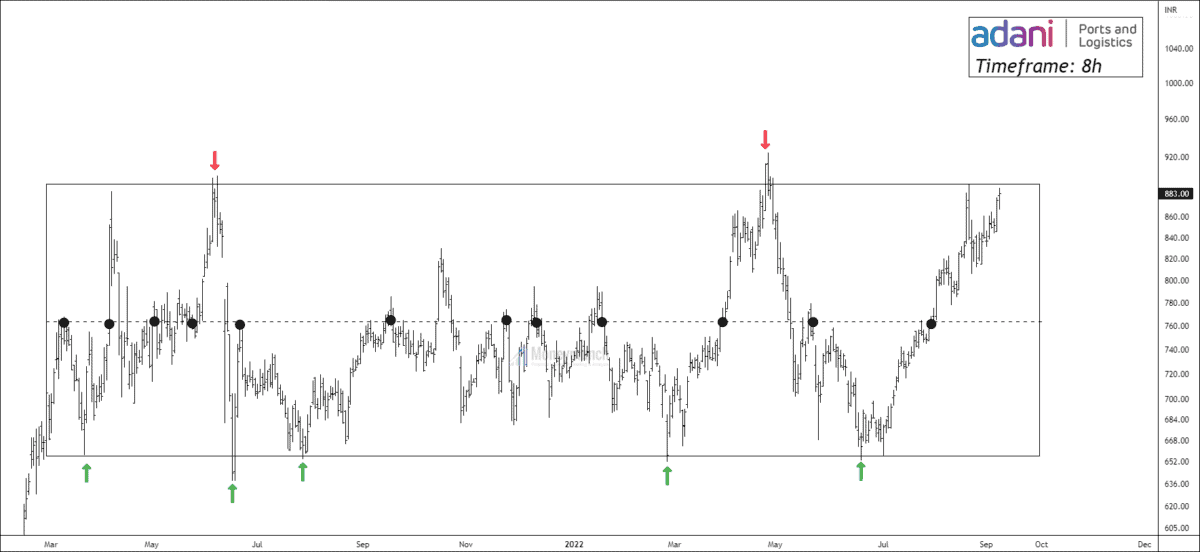

Adani port has been forming in the ascending channel for almost 14 years. A piece of evidence has validated this channel because the price has never broken the ascending channel except for big crises like Covid-19.

The Upper and lower bands are refusals to accept trend shifts. There have been three instances of resistance at the upper band and two occasions of support for the price at the lower band of the channel.

Price has also formed a control line that works as flip-flop levels. There are nine touches at the control line. Currently, Adani port has taken support on the control line of the parallel channel. Bear power can take down the skyrocket by supply pressure near 905 – 920.

If the price breakouts the supply zone, traders can expect an upward march up to the upper band of the parallel channel at 1056. Note that failure will lead to the control line.

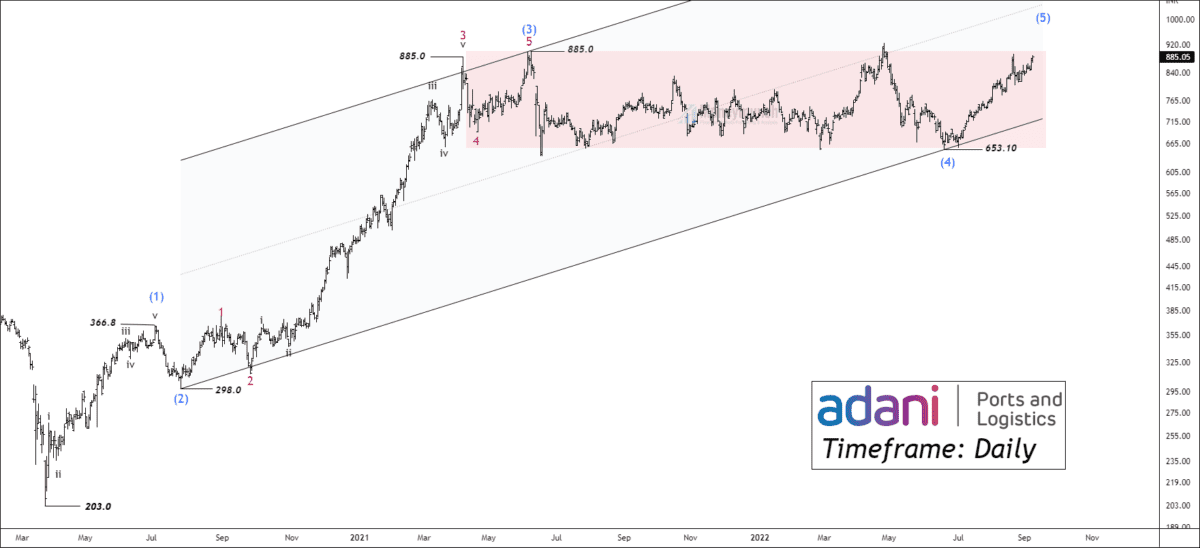

Adani port has been forming corrective patterns for more than 17 months. As far back as 2020, the Impulsive structure started at 203 in March 2020, and an all-time high of this cycle is 924.

Wave Formations:

- Wave (1) at 366.8 – Impulse Wave

- Wave (2) at 298.0 – Impulse Wave

- Wave (3) at 885.0 – Zigzag Correction

- Wave (4) at 653.10 – Complex correction Double Three (W – X – Y)

Wave Projection:

At present, Adani port has accomplished a corrective wave (4) and started creating impulsive waves (5). We can find the target of the impulsive wave (5) using reverse Fibonacci retracement.

If the price sustains above 920, traders can expect the following Fibonacci Extension ratios as targets:

- Reverse Fibonacci level of 1.618% at 1053.

- 0.5 fib. Retracement of waves 1 through 3 at 1001.

- 0.618 fib. Retracement of waves 1 through 3 at 1083.

As I mentioned previously, The range of 895 – 920 is considered a supply zone by the previous price history.

Of course, these are big targets, and the price has the right to pause for impending advance. We can approach a Lower degree time to get intraday targets. In contrast, scenario, the failure of sustaining signals that the price has no demand to touch another high.

Bears are capturing territories of bulls, and there is no way to escape from the falling knives from bears. Failure will lead the price to the lower band at 653.1, which is a strong support level.

Timeframe: 4H

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Impressive work!

Keep it up! love your wave counts…