Type: Continuation

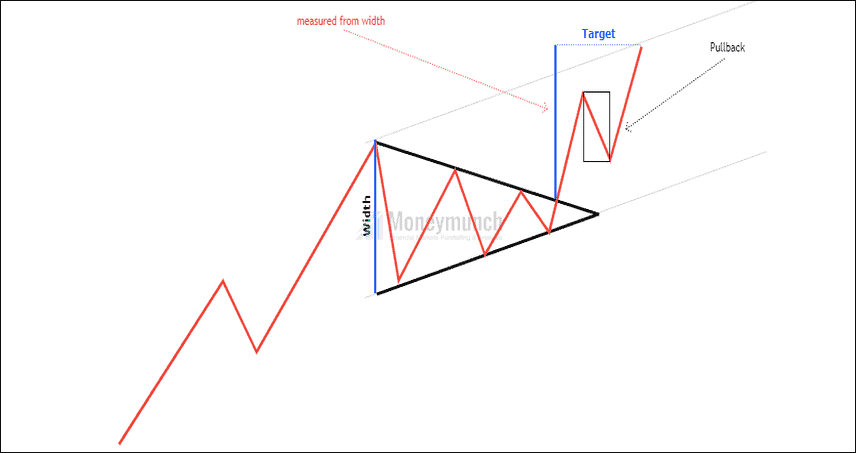

Prints when the market is indecisive. Price market higher lows & lower highs. It is the situation where supply and demand are near to equal. The trading range becomes smaller and smaller within the triangle. It represents a pause in the exhausting trend after which the original trend is resumed.

1) The minimum requirement for a triangle is four reversal points. Many have 6 point requirements but at least four points.

2) In a symmetrical triangle, we get apex where two converged trend line meets. Apex also works as a very important support & resistance . Sometimes a return move will occur back to the penetrated trend line after the breakout occurs.

3) Duration: A minimum duration of 3 weeks and it rarely exceeds 3 or 4 months long. (less than 3 weeks of duration likely to be a pennant formation, not a symmetrical triangle)

4) Volume: Narrow volume within the triangle. Very low before the breakout.

5) Breakout: Price closing below the lower rising trend line confirms the breakout or Price closing above the upper falling trend line confirms the breakout. The direction of the break in the pattern can only be confirmed after the break has happened. Either Up or Down.

6.A) Buy: Buy the Stock a day after Price closing above the upper falling Trend line .

6.B) Sell: Sell or short the stock day after Prices closing below the lower rising Trend line .

7) Target: – The technical price target is to measure the widest distance of the symmetrical triangle, Add the distance to the upper trend line breakout price for a buy target or Subtract the distance from a lower trend line breakout price for obtaining a covering price.

8) SL: usually, price closing above falling upper trend line is a Sell stop loss or price closing below rising bottom trend line is a buying stop loss. But very often, the gap between breakout price and trend lines is very wide.

Or

Stop: “Symmetric triangle” failures occur when price results in false breakouts. Stop below the first major “swing low” below the trend line for a long setup. Place a “stop” order above the first major swing high from the trend line for a short-setup.

9) Alert: To receive a valid signal, a closing price has to be above the resistance line or below the support line. The more the price moves to the very end of a triangle, the weaker will be the breakout in either direction.

10) Symmetrical triangle has two merging trend lines . For this formation, at least two peaks and two valleys are necessary. To reduce false breakouts, investors should wait until there are either three peaks and two valleys or three valleys and two peaks. With this approach, however, it is possible to completely miss a trend,

How to avoid fake outs?

1. 200 EMA confirmation

2. Use trail SL

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.