Four phases of security price movement:

1. Accumulation

2. Advancing

3. Distribution

4. Declining

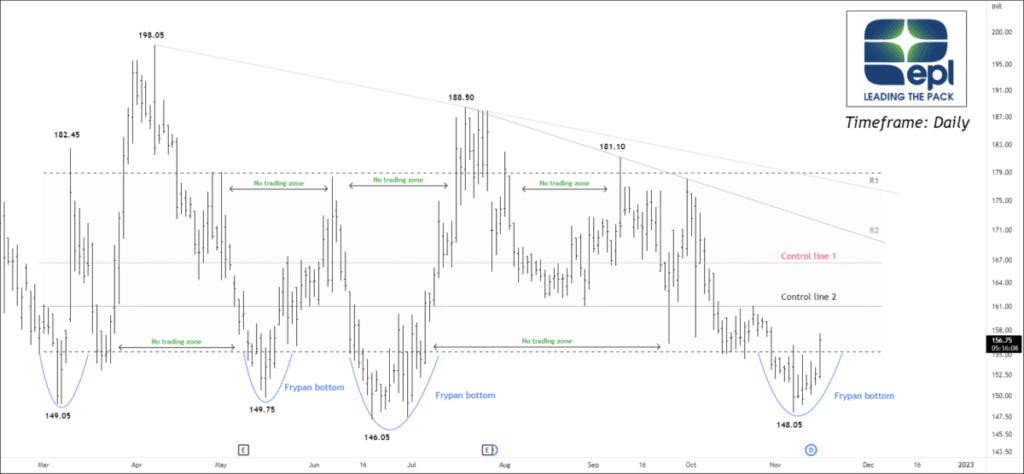

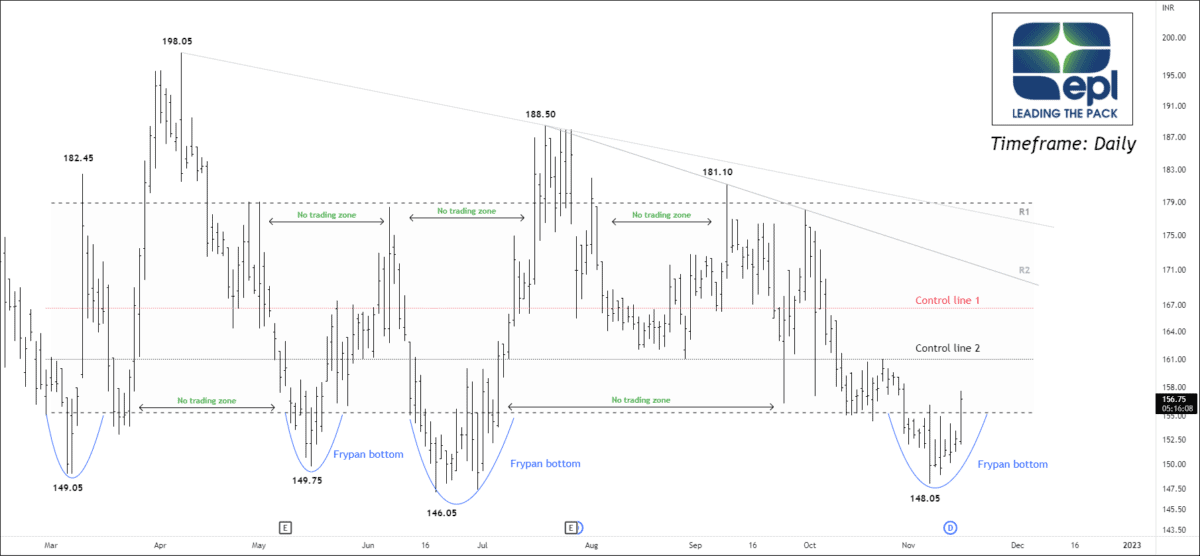

EPL had been forming a declining phase for more than 13 months. Prices were facing huge supply after making a high of 308.75. We have many reasons to consider the previous trend as a declining phase. For example, security has made a distribution range at an all-time high, and traders became long-term investors as the price dropped below 200 EMA.

The current formation is similar to the accumulation phase because the prior trend is mark-down. Price has been moving in this value area for more than 36 weeks. There is two control line which is continuously attracting and distract the prices. Currently, the price has formed the frypan bottom at the lower band of the channel.

If the price sustains above the lower band, traders can buy for the following targets: 162 – 176 – 183+. Breakout of the value area will lead to a classic markup but do remember bottom takes time to form.

I will update further information soon. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Appreciated!!!!

It makes sense mate!