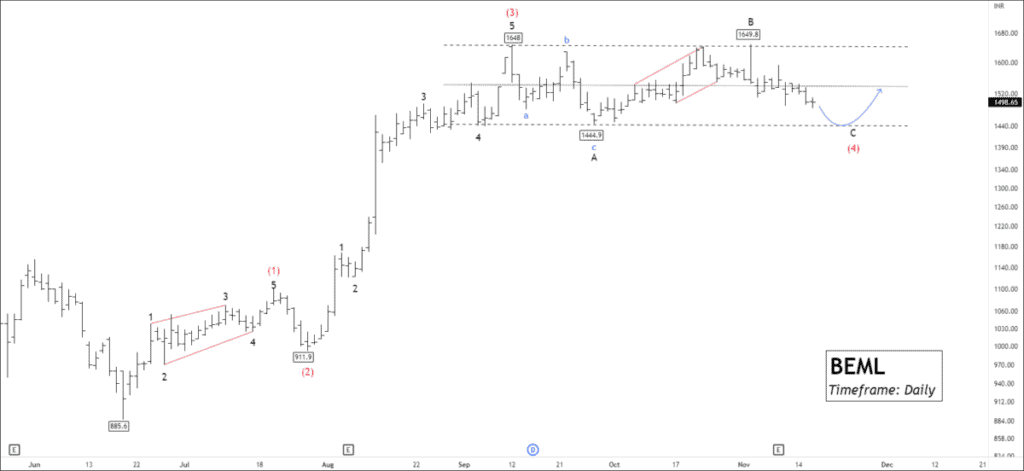

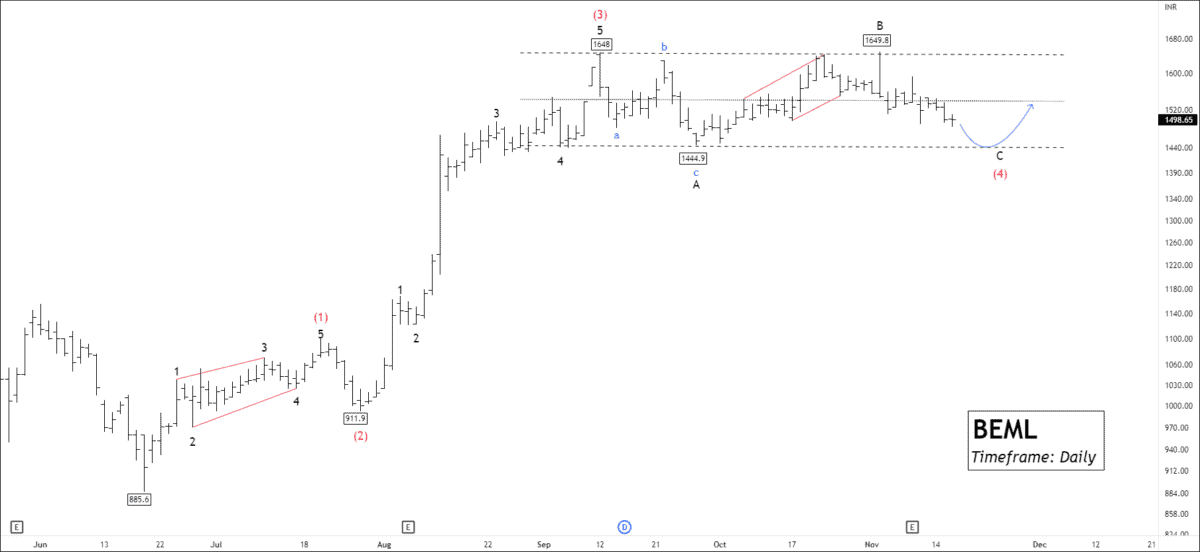

NSE BEML – Elliott Wave Projection

NSE HINDUNILVER – Intraday Setup

NSE HINDUNILVR has formed doji at the bottom followed by a hammer. The formation of the hammer is at 200 EMA, which makes it critical.

There are many ways to trade the Takuri (hammer), but traders can wait for the next day to confirm the hammer with retracement. After the next day, if NSE HINDUNILVR sustains above 200 EMA, traders can buy for the following targets: 2498 – 2527 – 2553. Note that, 2455 is a crucial support level for buyers.

The violation of the hammer’s low indicates dramatic supply pressure and can lead to a new low because it hammers out the downtrend by throwing demand pressure.

NSE HAL – Watch out Resistance breakout

HAL Has a broken-out All-Time high with a high volume at 2600. Traders can buy HAL for the following targets: 2743 – 2774 – 2821.

A good entry point can be found near 2600, which is a 61.8% Fibonacci retracement of a long candle. There is a possible target of 3000 in cases of extension of the move.

We will update further information soon.

NSE MINDACORP – Bulls Outnumbered Bears

MINDACORP looks good from a buying perspective. Price has broken out a cup and handles pattern at 210. It was the hammer that provided the force of demand at 196.

Currently, the price is standing on the 200 EMA at 210. If the price sustains above 210, traders can trade for the following targets: 216.5 – 223 – 231+.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Great work sir…learned a lot…thanks a lot!

God bless you for this work and analysis. This took time and I appreciate your sharing. It was a mindblowing recommendation.

Your detailed analysis is much appreciated.

Very detailed post, deserves way more attention, good work!