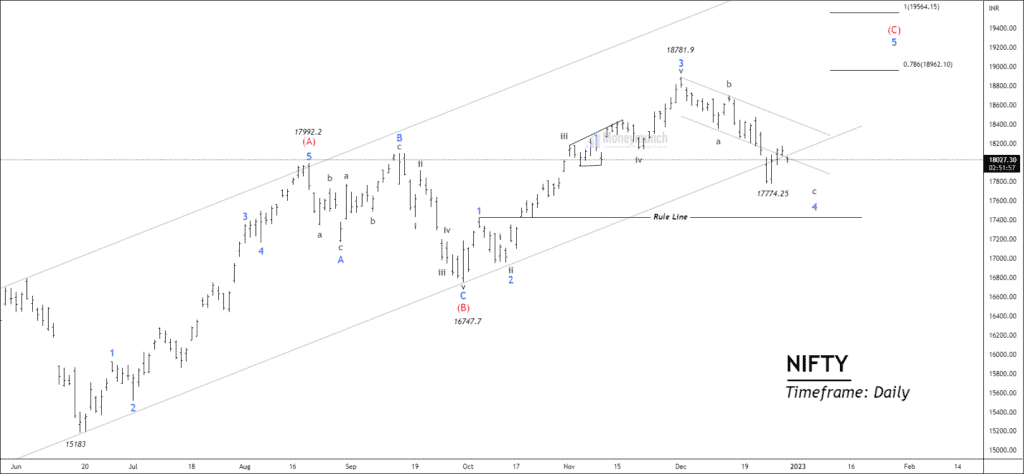

We already uploaded wave analysis & price action analysis where I talked about a bearish wave C. The level of 18100 was crucial support for the nifty 50, and the price made a low of 17774.25. We were able to grab the move.

This report will be a broad analysis with multiple timeframes and scenario analysis. So, here we are with the same question! Is correction deep enough? If we can find the ending point of corrective waves, we can ride on an impulse.

Timeframe: Daily

Don’t get confused with labels. Even if you have used an impulse label, you are in the same direction as I am. You can alter the labels with 1-2-3 instead of (A)-(B)-(C).

After making a low of 15183, the price started a new cycle to the upside. Prices have broken down a triple zigzag of the previous corrective wave structure. Surely, this makes it an impulsive cycle. 16747.7 is the end of wave B and the beginning of impulsive wave (C).

I have drawn a base channel to identify the reversal and wave behaviors. Currently, prices are out of the channel, and a reliable upward move is only possible above the lower band. No buyers are interested in encountering falling knives.

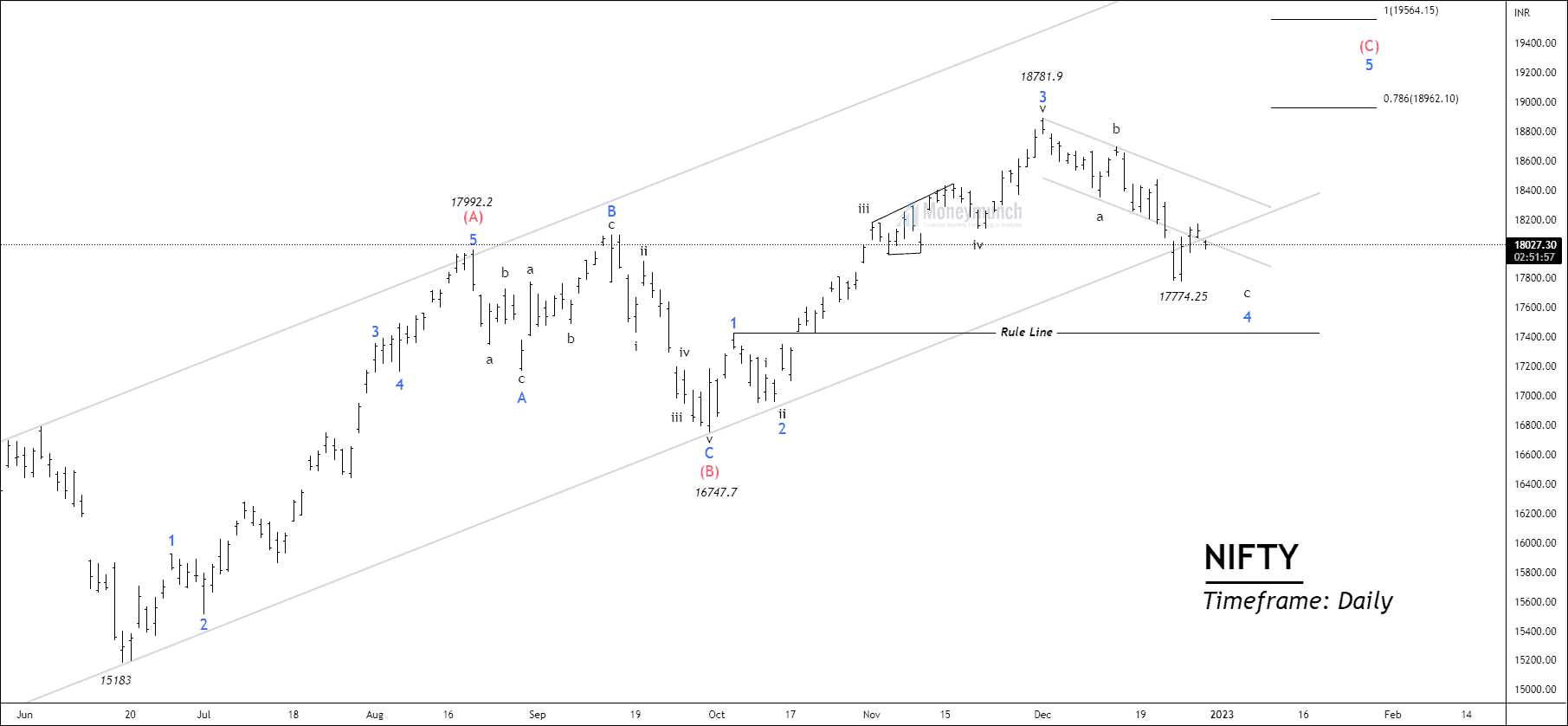

Let’s zoom in on wave (C).

Prices have accomplished sub-wave 3 of wave (C) and are constructing sub-wave c of sub-wave 4 of wave (C). The sub-waves of wave 4 are visible. If the price is trying to take support, it can’t fall more than 78.6% of wave 3. Otherwise, the impulse cycle will be invalid. According to Elliott wave, wave four can never enter the price territory of wave 1.

In this case, you may find seller supremacy.

Scenarios of the ending point of wave C:

There is a maximum distance wave c can travel within 61.8% of wave 3. Otherwise, prices will make the bullish scenario invalid. Wave 4 can never touch the high of wave 1.

Price has formed a dark cloud cover candle at a recent low. If the Nifty above the low sustains the low of 17774, traders can trade for the upcoming impulse. An entry into the channel is a bullish signal for traders and vice versa. Likewise, we may or may not get a downward move. It’s better to watch our levels.

What is the worst case for bulls?

A breakdown of the base channel and rule line indicates the worst scenarios, and the trend is about to change. As a result, it can cause a sharp decline and a late recovery.

Timeframe: 4h

We will update further information for subscribers soon. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Thank you for sharing this idea. I was clueless about nifty.

Expecting the same in nifty

Another great idea. Keep it coming

let us wait for the given levels. I appreciate your support.