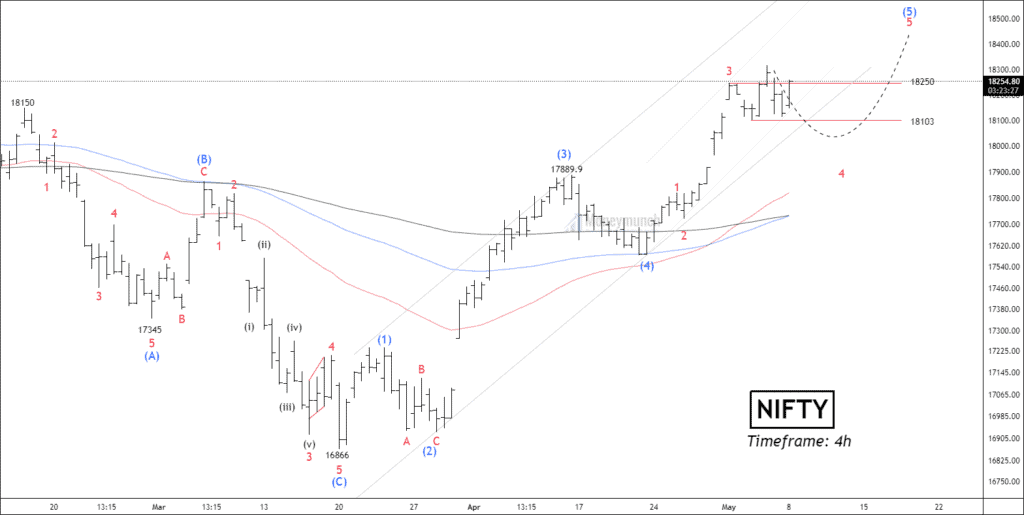

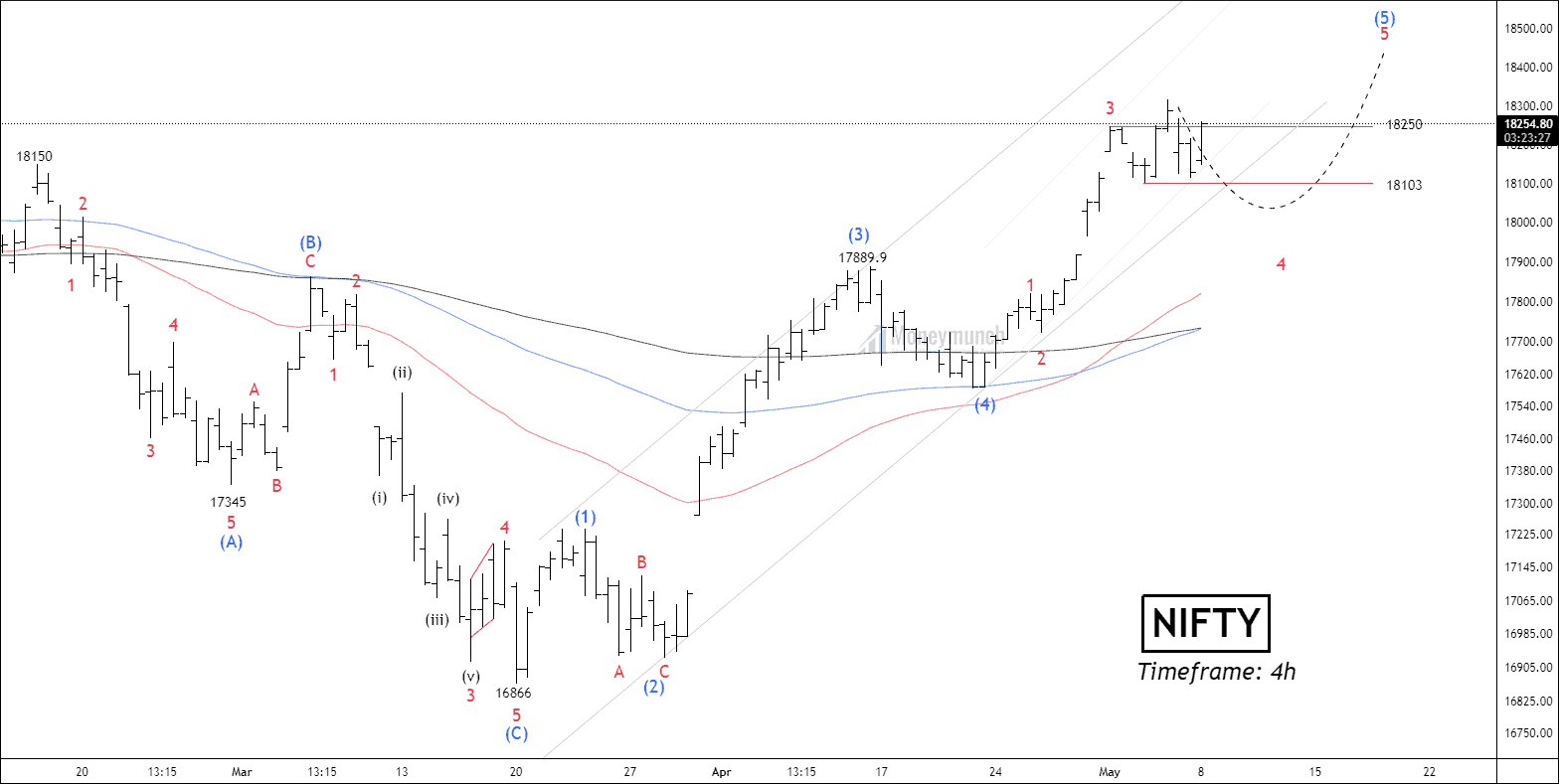

Timeframe: 4h

NSE NIFTY FUT has completed the corrective wave (4) and begun forming the impulsive (5) wave. In our previous article, we traded the impulsive wave (5), achieving all our targets. However, there is currently no evidence that wave (5) has been completed, according to price action.

Nonetheless, the price is currently trading above the 50/100/200 EMA, indicating a strong trend. Upon closer inspection, we can observe that the price has formed sub-wave 4 of wave (5) and is preparing for the launch of sub-wave 5 of the impulsive wave (5).

Traders should keep an eye on the range of 18103-18250, as a breakout on either side can lead to significant trading opportunities. The retracement of wave 2 is 50%, while wave 4 is retraced at 38.2%. The formation of sub-wave 4 appears to be a running flat.

If the price breaks out above 18250, even after retracement, traders can trade for the following targets: 18345 – 18465 – 18578+. Note that, wave 4 can never exceed the high of wave 1.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Amazing Chart, Looking forward to more wave analysis.

To be honest, I don’t know how you manage to do such a good job every single time. Very well done!

We are fortunate to have a wave analyst and market expert like you amongst us.

Keep working like this, and nothing will be able to stop you!

Thank you sir, You’ve been very helpful.