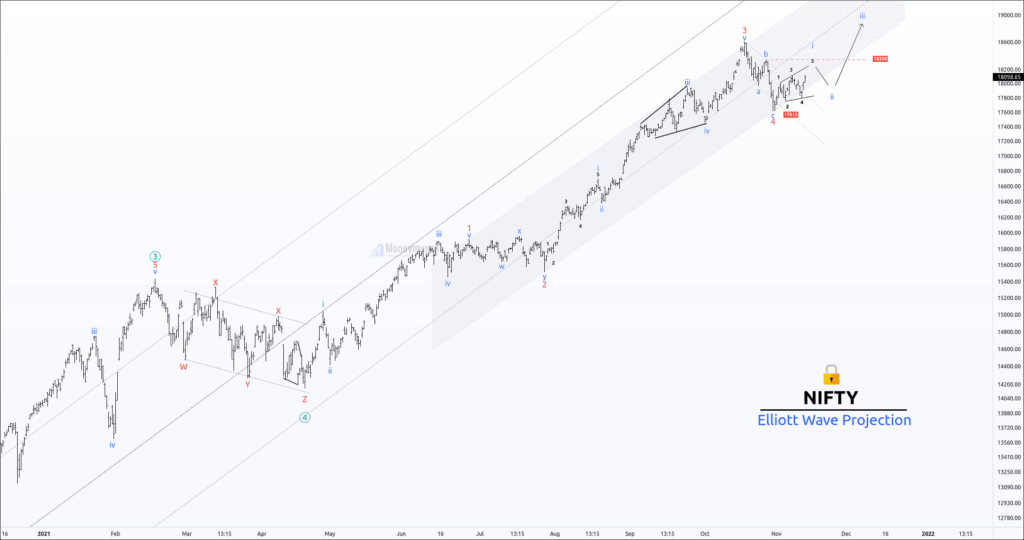

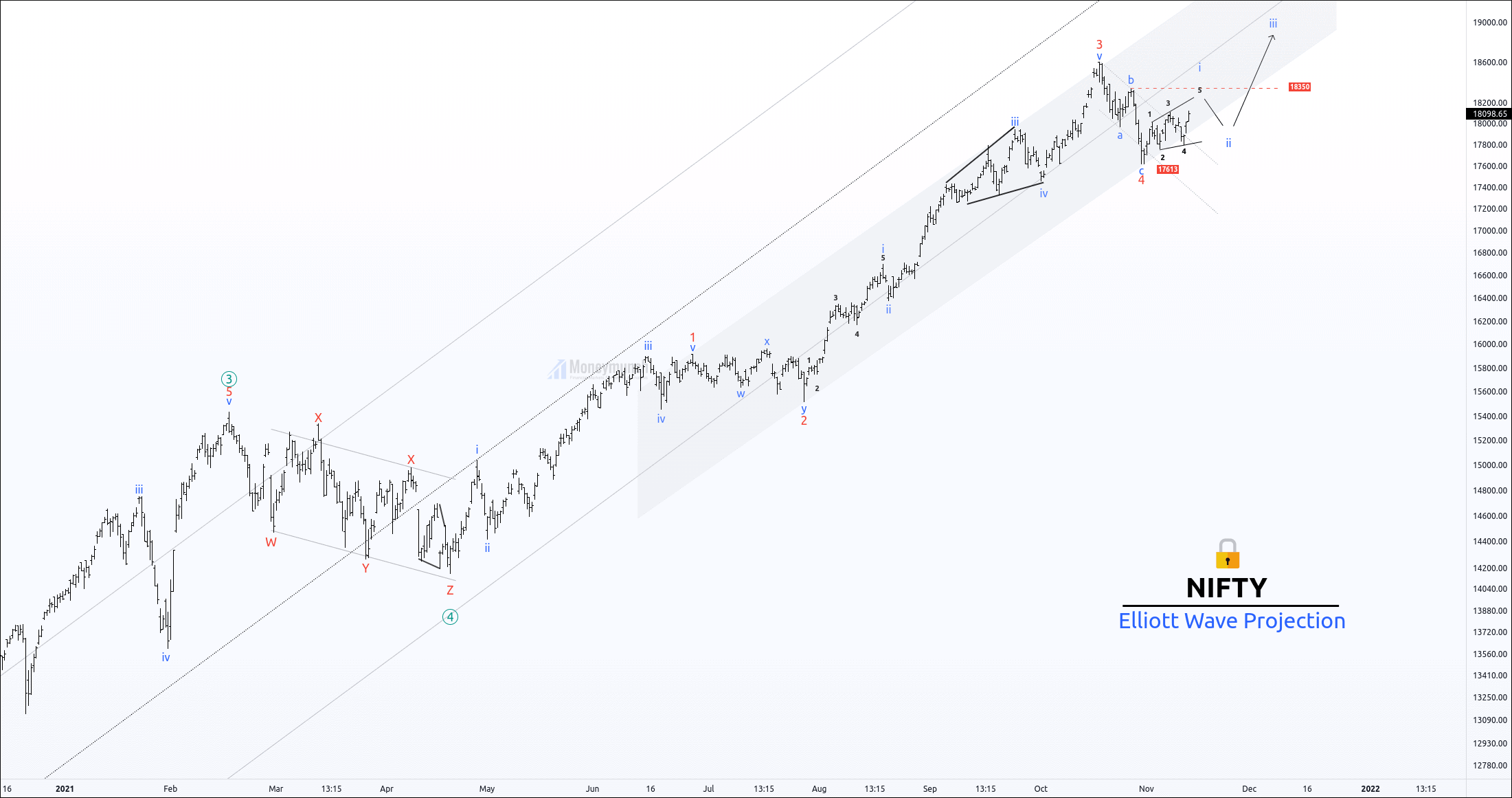

This week nifty may break 18350, and this level will increase high buying pressure.

The above chart shows that nifty seems price is forming a leading diagonal. Moreover, wave 5 is the ending point of the leading diagonal.

And completion of wave ‘i’ the wave ‘ii’ will take place. The wave ‘ii’ is corrective. So the day traders can initiate buy position there. It’s a golden opportunity because of moderated risk here.

Safe intraday traders can enter at the breakout of wave i. This point is also initiating an opportunity. If the acceleration phase is sturdy, then It can hit 19200.

Please note that wave ‘2’ can never overlap the starting point of wave ‘1’.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock