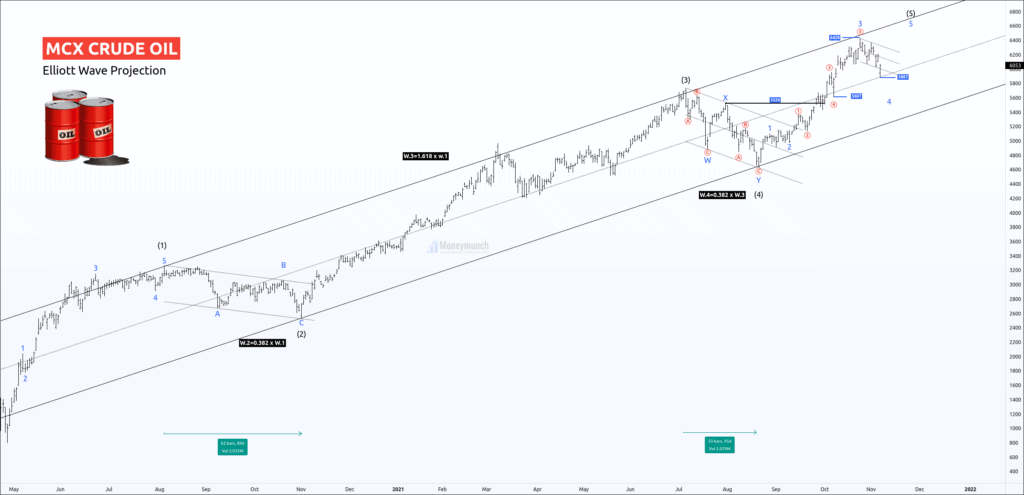

Price had made an extreme low at 795 on 20 Apr ’20.

It had started a quick recovery after an inviolable bottom-out. Due to bearish sentiments and no evidence of the verified bottom, it had constructed 2nd wave correction. The second wave retraced 38.2% of wave 1, which indicates a sturdy bull trend is ahead!

The acceleration phase lasted for 246 days and, the Fibonacci extension of wave 3 was 161.8% of the wave.

The public participation increased when the price had broken up the high of the first wave. It has the signal for bulls that crude was likely to make a new high.

After the acceleration phase, the price has corrected the bull phase with a double zigzag. It had retraced 38.2% of wave 3.

This correction was sharp in comparison with 2nd wave.

According to the above chart,

Wave 2 has taken 89 trading sessions to correct wave 1.

Wave 4 has taken 45 trading sessions to correct wave 3.

Wave 4 was a surprising disappointment for the bull traders.

Here, wave 3 is not a power extended because it hadn’t moved across wave 1.618% of wave 1.

According to the Elliott wave principle, commodities are more often extending at the 5th wave.

Currently, the price has made a new high of 6428.

Price has entered the corrective phase.

It is constructing the 4th sub-wave of the impulsive wave ((5)).

There are two possibilities,

1. If the price breaks the parallel channel, we can expect 50% to 61.8% retracement for wave 4. Be aware of the fake breakout!

Remember, entry is also not possible without an exact reversal signal.

Caution: Wave 4 can never overlap the starting point of wave 1.

2. Price is on the control line of the base channel.

The safe trader can enter the buying position when price breaks the wave B.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for Uploading this idea.

I was waiting for crude oil. I found that this article is informative.

Good post.

Sir, Please explain how we use stochastic and RSI indicators at that entry time?

Mr.Dev, You are the best.

Please keep up the good work! And also keep posting images of trades using this strategy.

Sir, Your analysis is awesome.

Is there a way I can learn from You?

Do you teach Sir?

Looks like a wonderful insight.

Thanks, bro