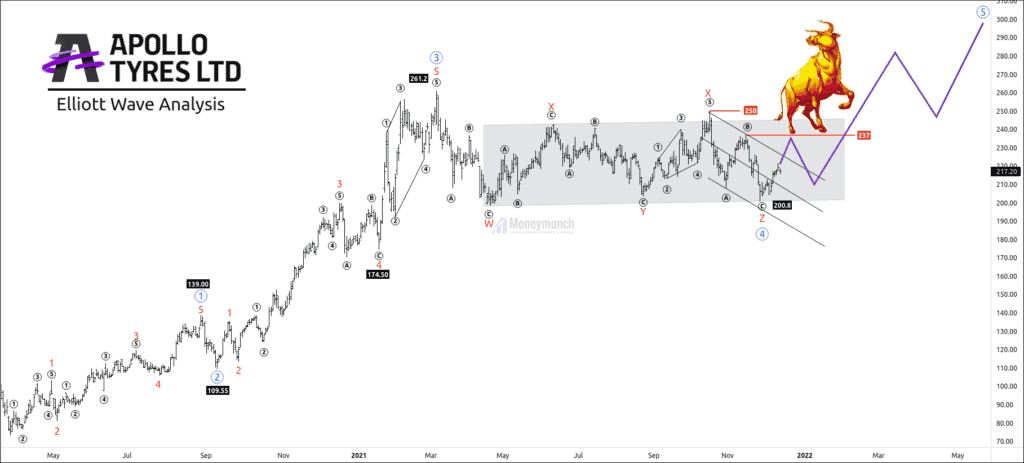

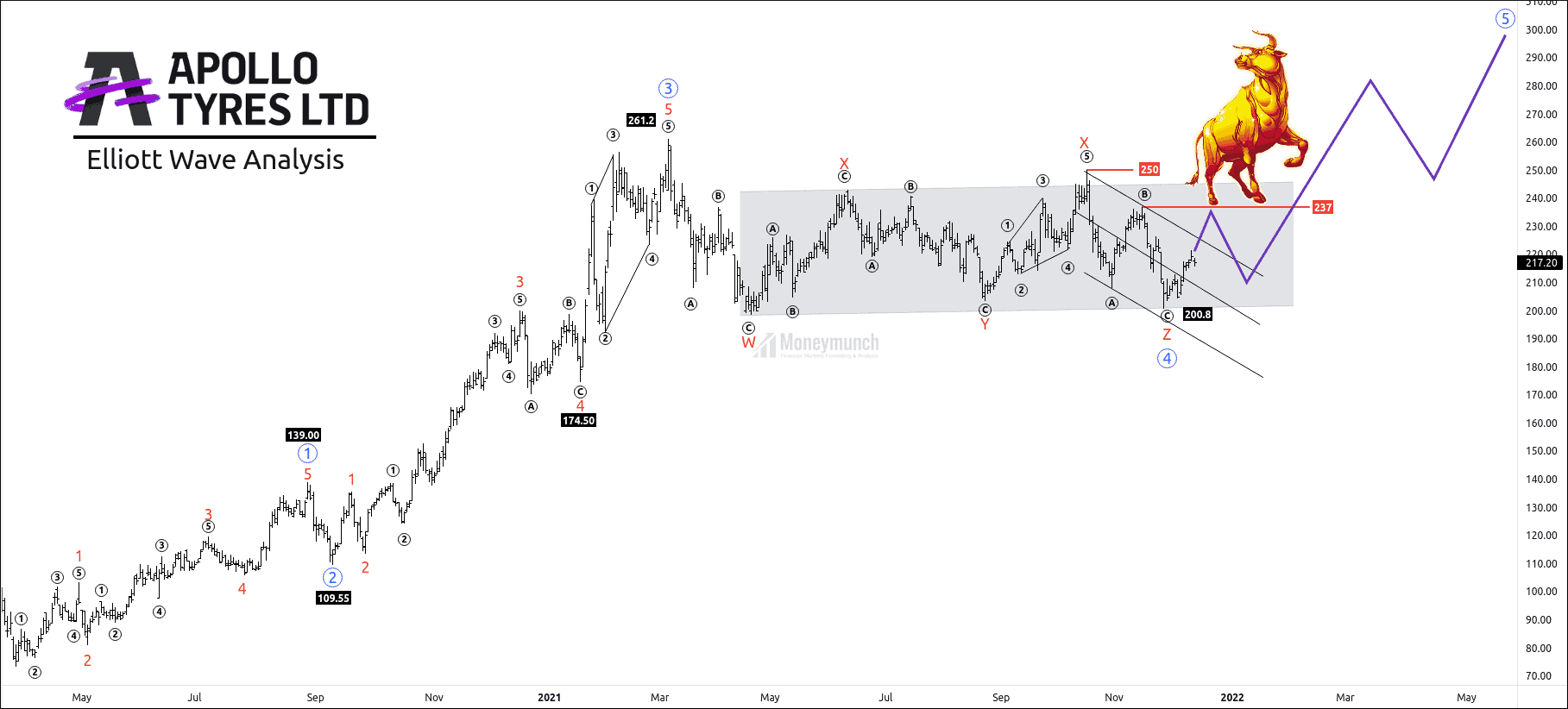

Will bull traders drive Apollotyer above Rs.300?

APOLLOTYER is preparing for a bull run. After completion of the 3rd wave at 261.2. Price had started a corrective wave ((4)) and took 38 weeks to finish this structure.

A trader can trade impulsive wave ((5)) to make a high confidence trade setup.

Wave Formations and Fibonacci relationships:

Wave ((1))is an impulse with a 5-3-5-3-5 wave structure.

Wave ((2)) is a zigzag move. Fibonacci retracement of wave 2 is 50% of 1st impulsive wave at 109.55. Sub-wave of wave 2 fulfilled the rule of equality (wave A= wave C)

Wave ((2)) is not exceeding the starting point of wave 1.

Wave ((3)) is an extensive impulse. 3rd wave has 261.8% retracement of 1st impulsive at 261.

Wave ((4)) is a triple three with a 3-3-3-3-3 wave structure.

It retraced 38.2% of the 3rd wave and did not overlap the starting point of wave 1.

What will happen next?

Completion of sub-wave z indicates that the corrective wave has ended. Price has started forming sub-waves of wave 5.

The sub-wave z of wave ((4)) has formed a descending channel.

If the price breaks descending channel and close above sub-wave ((b)) at 237, it will confirm the impulsive behavior.

(Note that the ending point of the corrective wave is the starting point of an impulsive wave.)

A trader can expect the following targets: 237 – 250 – 279 – 297+

Target 1: 237

[Clusters: high of wave B, the breaking point of the channel, 61.8% of reverse Fibonacci retracement of wave 4]

Target 2: 250

[Clusters: 78.6% reverse Fibonacci retracement of wave 4, high of wave X]

Target 3: 279

[Clusters: 38.2% of reverse Fibonacci retracement of wave 4, 50% Fibonacci extension of wave 1 through 3]

Target 4: 297+

[Clusters:161.8% of reverse Fibonacci retracement of wave 4, 50% Fibonacci extension of wave 1 through 3]

The safe traders can wait for the breakout of wave X.

If the price fails to break the wave X, correction is about to make a new leg down.

They can enter on the pullback to enter where they can manage risk with tight stop loss.

Invalidation: pullback can’t break the low of wave ((4))

NIFTY UPDATE

Nifty has exactly performed as I described on the 13 Dec hourly chart. First, click the below link to read that Nifty Tips again:

Nifty is technically short-term bullish, but

First, nifty has touched the first three upside targets on the same day. And It has started collapsing to break downward targets of 17465-17408-17312.

Today nifty has made a low of 17225.8 and completed all targets. What’s next? I will update you soon.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Another master piece made by Mr dev.

Your ideas are very fabulous.

I daily wait for your idea. I am also learning the wave principal and it helps me to learn and count waves.

I am very thankful to you

Wave master is back with his new chat.🔥🔥🔥🔥

I think, this setup is accurate.

Saras

Sir mera seat kahi chala na jaye. Me aajke aajhi pro Plus leraha hu because isbaar me miss nai karna chahta.