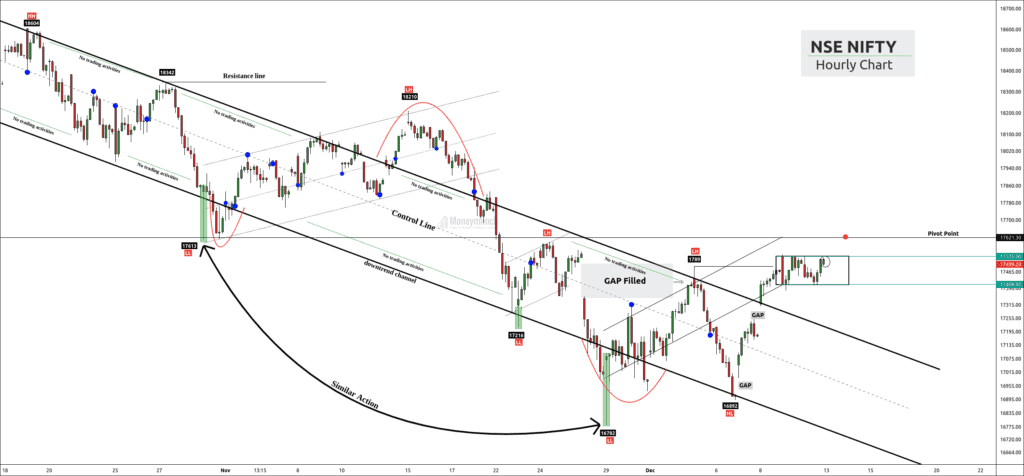

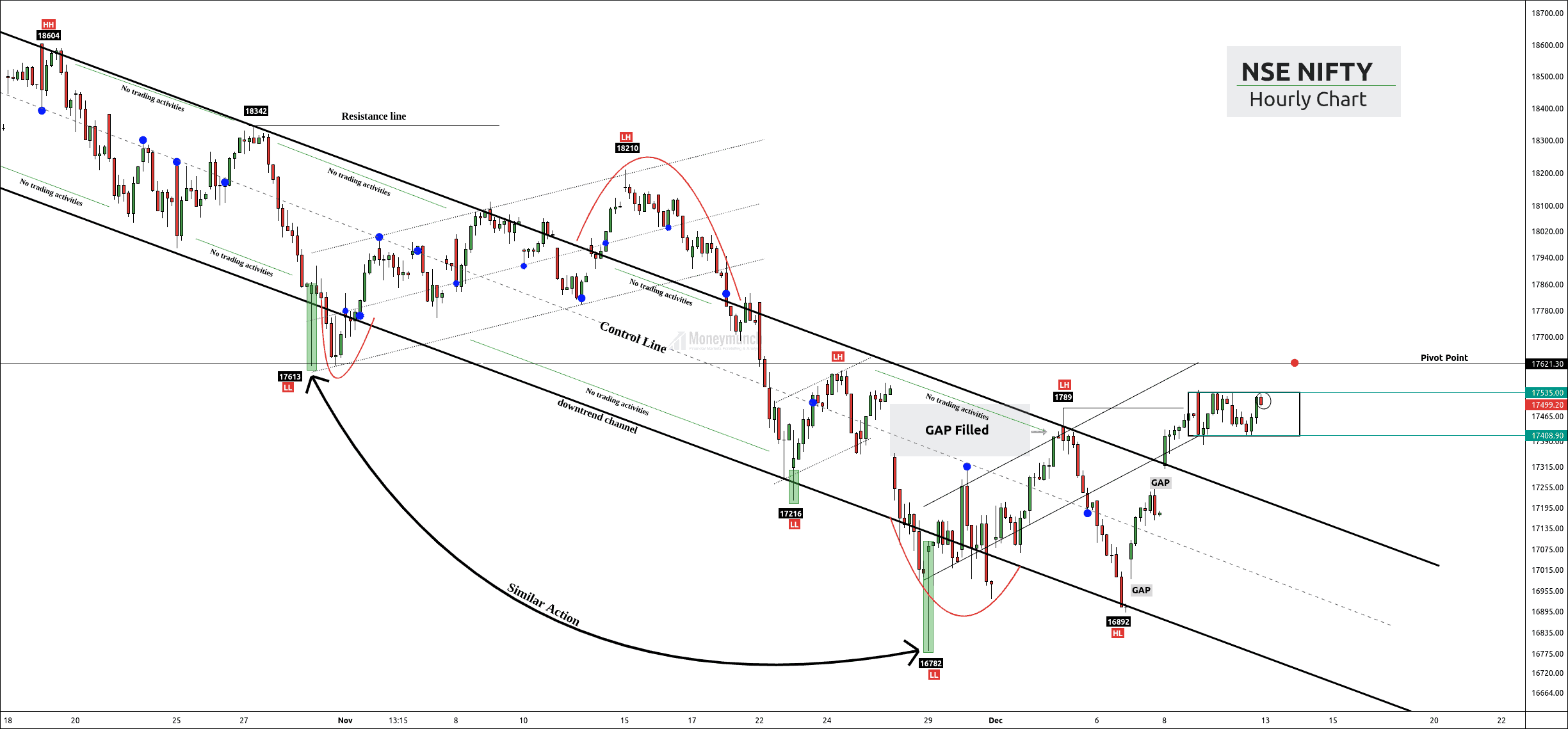

Nifty hasn’t given a continuous breakout of the lower high. If nifty couldn’t give consecutive closes above lower high, there can be a failed swing low and signals resumption of the trend.

In 30-minute timeframe, the price has made a value area box where supply equals demand. If nifty gives a continuous break to the upper band of the value area, traders can initiate a buy position for the target of 17554-17586-17618.

Strong closes above 17621 indicate a good time for bull traders.

Swing failure may drive the price lower. Bear traders can look for 17465-17408-17312.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Market open hote hi targets achieve hogaye.

maza aagaya sir.

Nifty looks strong but FII behavior is very important. We should examine the main factors of GDP as a new version of Covid is coming.

wah, kya baat he. gap up ke saath target milgaye.

BTST valo ko toh bahut fayda hua hoga.

GOOD CALL MR.DEV

NIFTY TOOK BULL TARGETS

Unbelievable predication Sir

You are the best.

Well rounded analysis!

Great work!

Thank you sir for the clear and concise analysis. Great job, keep up the good work!

it’s 😎 cool👍

You have extraordinary skills in analyzing the market.

very helpful.tanks

Love your videos. Very helpful. Please keep updating us with stocks and indexes. Would you be willing to review bank nifty? Thank you so much!