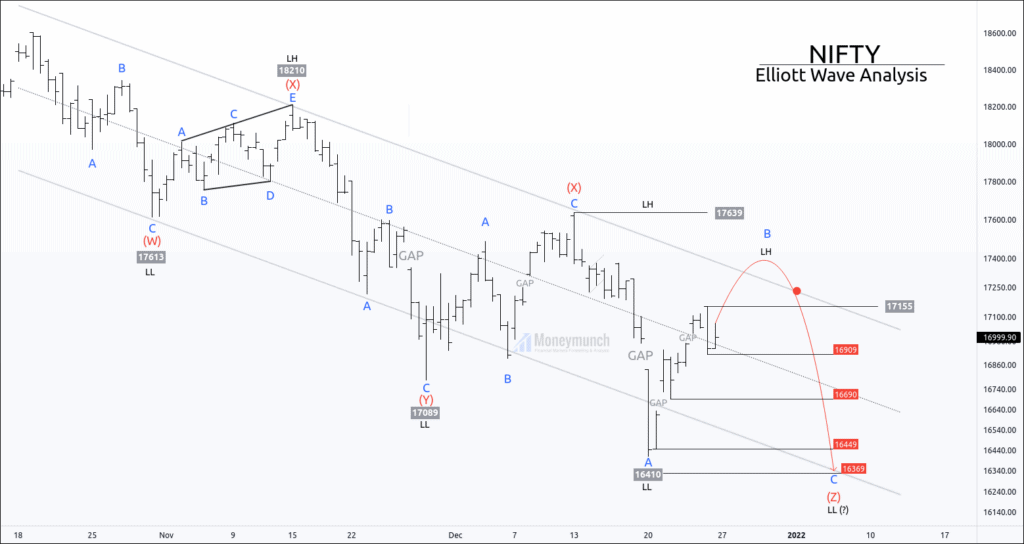

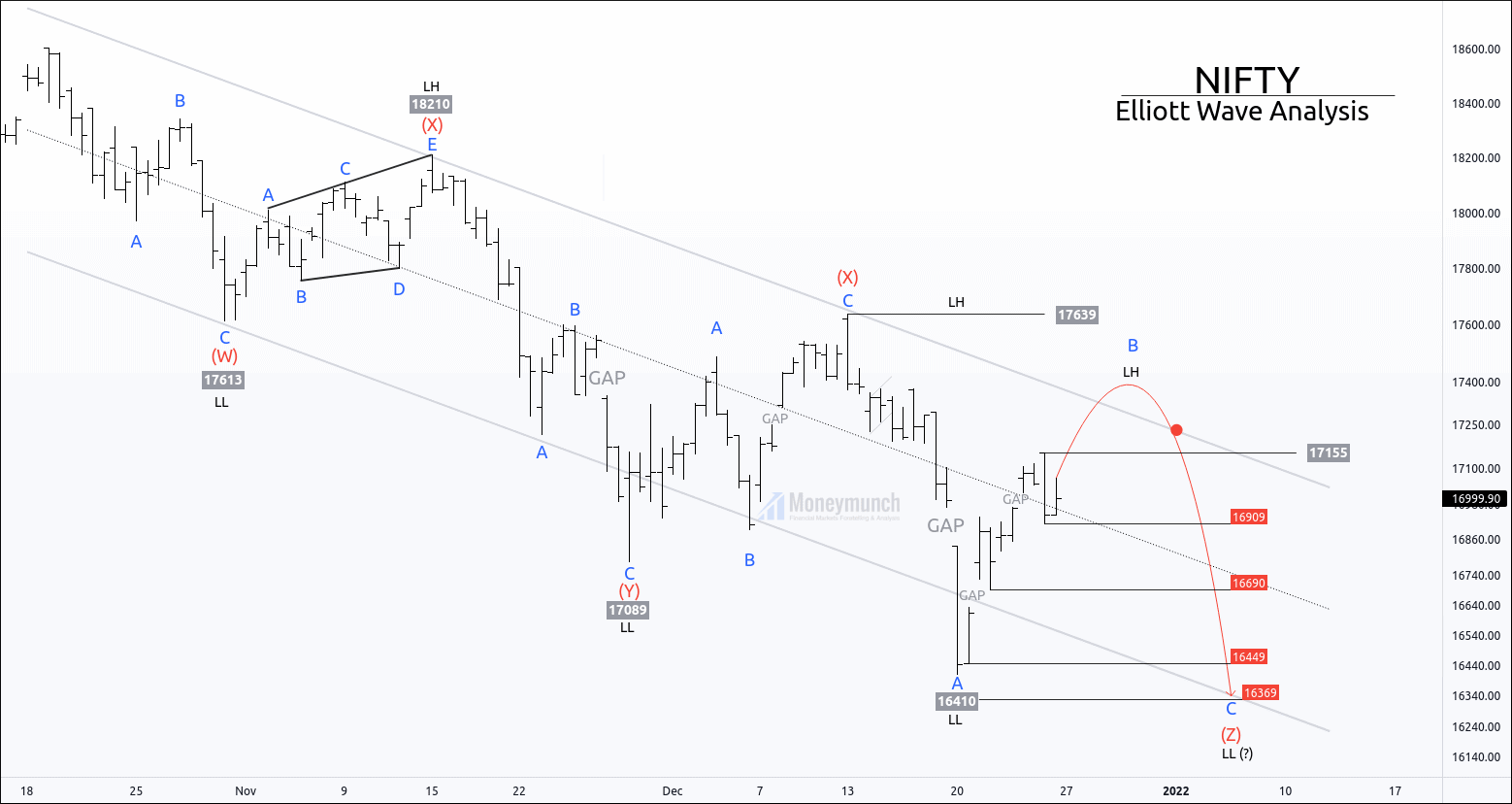

Nifty is constructing triple three (X,Y,Z) right now.

Price is about to accomplish sub-wave B of triple three.

Buyers should be ready to exit from their position before the price reaches the nearest lower high at 17639, which is wave (X) of the correction.

According to wave principle, if the price couldn’t sustain above wave X, then the current trend is about to resume.

Currently, nifty’s trend is bearish and, wave C can give a downward motion with the following targets:16909 – 16690 – 16449 – 16369.

Note that price can make an excess at the upper band of the channel.

Trade Setups (only for the safe traders):

Traders can enter when the price rejects the wave (X).

If the price breaks the (X) at 17639, it may be a fake-out. Traders can wait for the price to enter into the parallel channel.

Stop can be the nearest high of the excess which will be out of the channel.

Trade Setups (only for the Lionheart traders):

Lionheart traders can enter in sell position when the price makes rejection of wave (X).

After the price rejection, they can initiate a short position below 17600.

Stop can be high of the new lower high.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you sir,

Omicron will impect on the stocks all well as commodities.

But rebound should be quick!

Nice chart

I am good money form the previous premium call.

Thank you for this chart.

I know I don’t need to worry about next call but I am very excited to see next call in our app.

Thank you for your premium service.

Just wow

Much obliged 👍🏻🙏🏻

how can i purchase 20 shares of reliance if my capital is 10k only? (new to trading and risk management)

Being only a beginner trader. I would want to do short term trades and this helped my understanding on how much I take for risk to try out success.