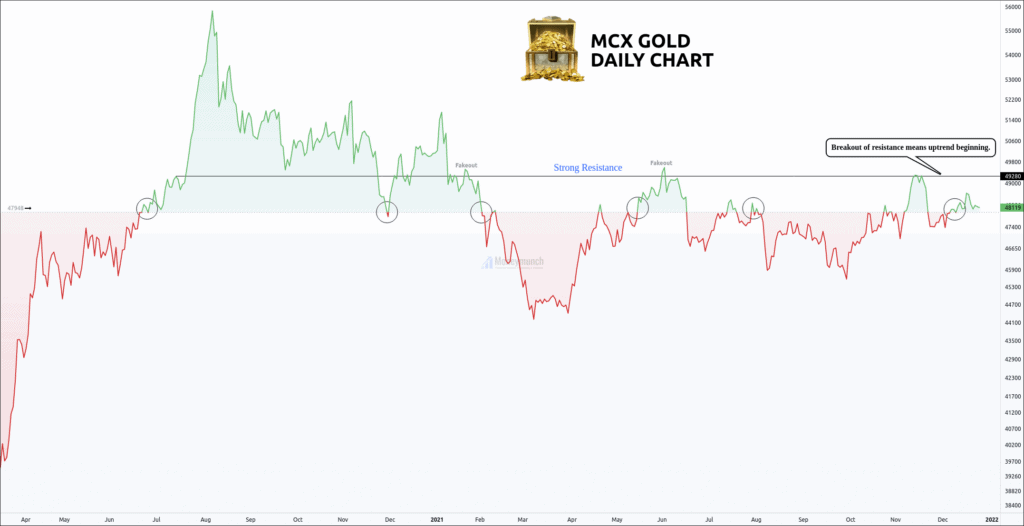

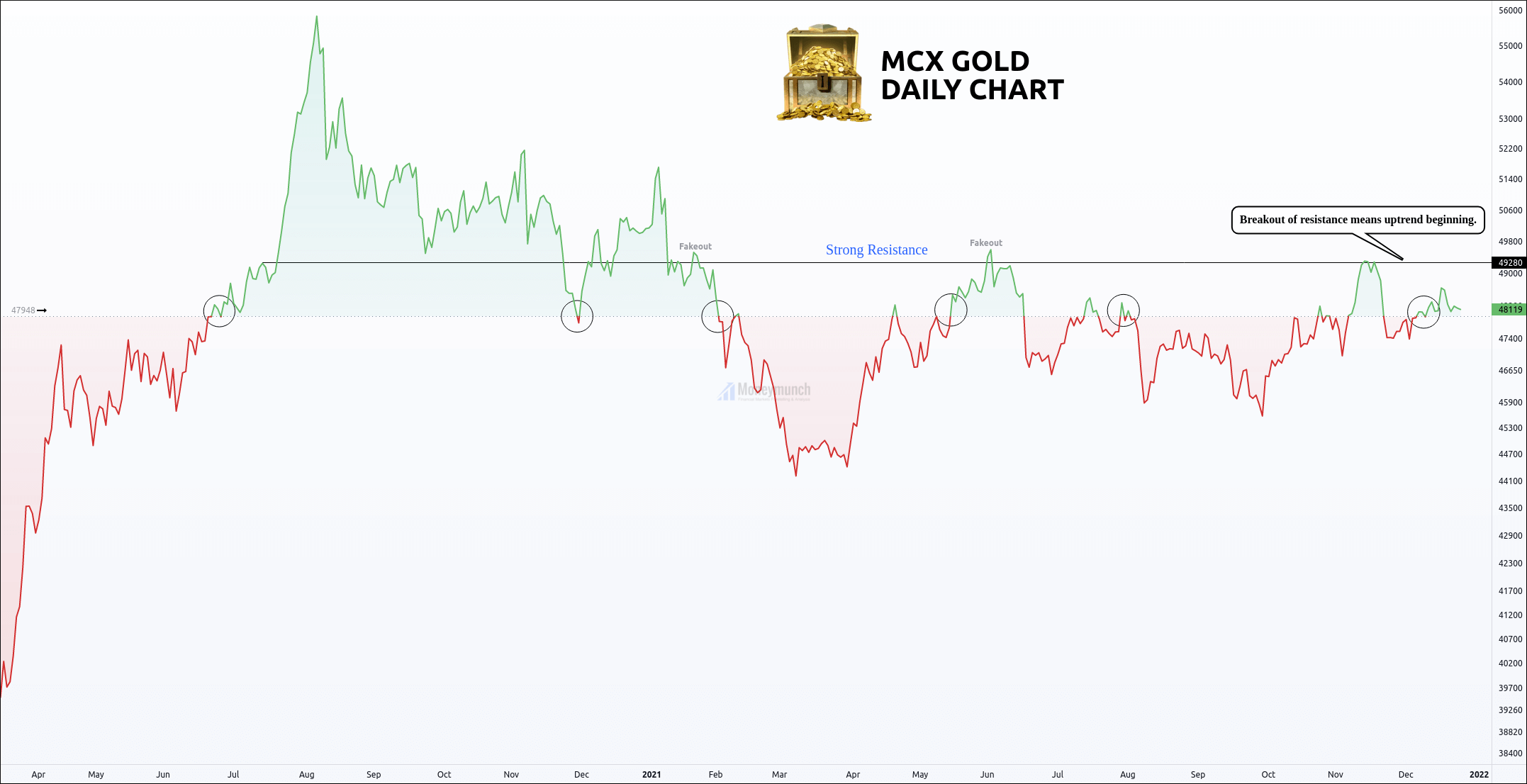

Key levels: 47948 – 49290

Gold is rejecting uptrend and downtrend at the level of 47948. And we don’t see a powerful movement in the 2021 year, wherein it throwout the level of 49280 successfully.

Here, you will have a strong support level, wherein we may decide about buying or selling. And it is the level of 47948. Intraday traders can keep buying the gold for targets of 48360 – 48640 – 48890 – 49280 until it remains above the level of 47948.

But, if you see a breakout of the first ‘key’ level, then sell it for the targets of 47480 – 47060 below.

Buyers must be aware these days. Why?

The gold prices may push down with power compared to an uptrend because of Coronavirus (Omicron).

For advance traders, watch significant releases or events that may affect the movement of gold, silver, crude oil & natural gas:

Tuesday, Dec 28, 2021

20:30 CB Consumer Confidence (Dec) – High Impact

Wednesday, Dec 29, 2021

03:00 API Weekly Crude Oil Stock – Medium Impact

21:00 Crude Oil Inventories – High Impact

Thursday, Dec 30, 2021

19:00 Initial Jobless Claims – High Impact

21:00 Natural Gas Storage – Low Impact

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you so much for fulfilling my request.

Gold is always a big deal for me. I am glad you saved my hard earned money by posting this article.

Wah sirji

Gold ki ye range par toh kabhi humne dhyan hi nahi diya.

Good chart👌🏻👍🏻

Perfect as usual.

Mr.dev is a master commodity analyst.

I love your ideas sir!

Please give regular update about commodity.

You are only analyst who analyses commodity perfectly.

It’s look like gold is very weird 😂. It’s very lazy.

By the way, thanks for this master piece.

Thank you, I’ve recently been looking for information approximately this subject for a long

time and yours is the greatest I’ve discovered till now. But, what about the bottom line?

Are you positive concerning the supply?