Understand The Cycle Of Doom To Make Winning Trades

Are you finding consistent profit in your trading? If yes, then you can skip this article, and congratulations!

Now, Let’s discuss talk about the rest of the traders.

Indeed, most traders don’t find profits consistently instead end up losing their money. It does not matter which market they trade.

There can be many reasons for not getting consistent profits.

Like, it can be risk management, trading system. It can also be trading psychology.

But the truth is, you are trapped! Ladies and gentlemen, I am showing you the numerous powerful psychological trap ever.

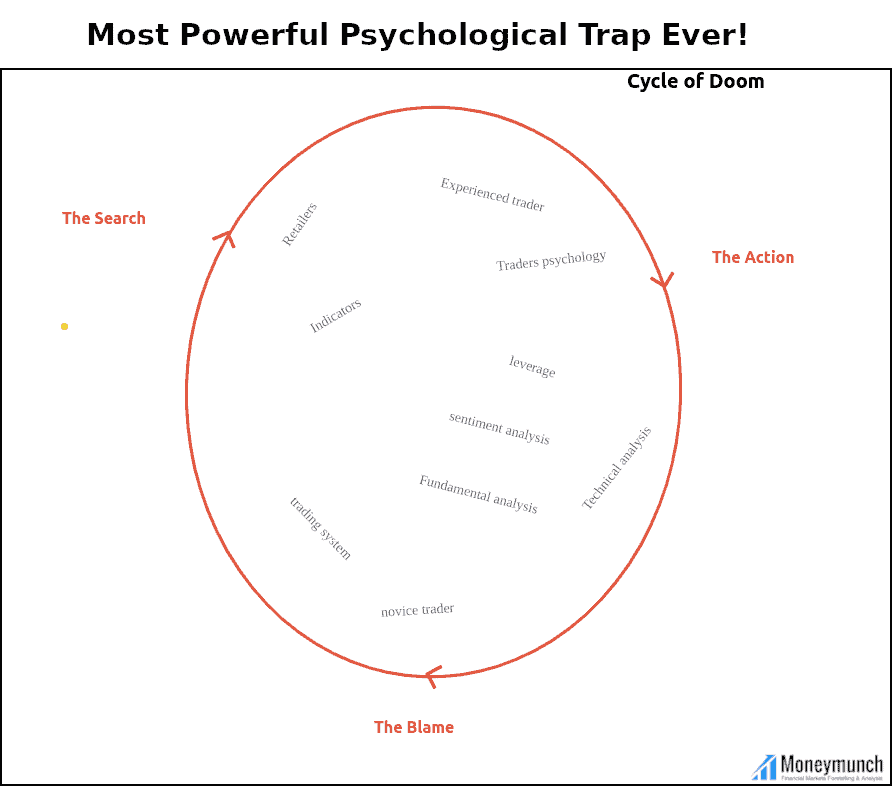

The Cycle of Doom

The cycle of doom involves three phases.

- Phase 1: The search

- Phase 2: The action

- Phase 3: The blame

To become a successful trader, however, you will have to get out of the cycle of doom.

How can you destroy the cycle of doom?

First of all, you have to understand the cycle.

You need to understand what is going on! So you can identify and move beyond the Cycle of Doom in the world of consistently profitable trading.

Phase 1: The search

In this phase, you are searching forContinue reading

Good Morning with World Markets

money is one of the ways we can turn the dreams we have into the reality we live. Without enough money, or a true scarcity of it, life can feel miserable. But when you have money in your pocket, does everything automatically get better? I think we all know the answer.

Money can’t change who we are. All it does is magnify our true natures. If you’re mean and selfish, you have more to be mean and selfish with. If you’re grateful and loving, you have more to appreciate and give.

Take a moment and think back to the financial meltdown of 2008. Trillions of dollars of stock and home values evaporated into thin air. Millions of jobs were lost in a matter of months. What did you experience? How did it hit you? How did it affect your family? How about your friends? Some of us reacted with fear, some with anger, some with resignation, some with resolve. All these responses were not about money, but about us. These events shined a light on what money really means to us. What power we give it. Whether we let money control us, or whether we take control of it.

WORLD MARKETS RATE :

- Gold trading at 1200 at 1196.

- Us dollar index trading around 88 at 87.

- Nymex crude trading below 70 at 69 and Crude Oil (Brent) at 75.5.

- Dow future trading with flat closing at 17,805.00 with -7.50 points negative.

- Green global trend seen.

- Indian Market can be move 6000 above very soon.

Qualities required to be successful trader

Many people take to trading in the mistaken belief that it is the simplest way of making money. Far from it, I believe it is the easiest way of losing money. There is an old Wall Street adage, that “the easiest way of making a small fortune in the markets is having a large fortune”. This game is by no means for the faint hearted. And, this battle is not won or lost during trading hours but before the markets open but through a disciplined approach to trading.

1. A successful trader has a trading plan and does his homework diligently

2. A successful trader avoids overtrading

3. A successful trader does not get unnerved by losses

4. A successful trader tries to capture the large market moves

5. A successful trader always keeps learning

6. A successful trader always tries to make some money with

less risky strategies as well

7. A successful trader treats trading as a business and keeps

a positive attitude

8. A successful trader never blames the market

9. A disciplined trader keeps a cushion

10. A successful trader knows there is no Holy Grail in the market

Rich Trader

Many new traders are taken out of the trading game through bad mental practices. Here are some things that top money managers have shared through interviews and books that may help traders who are making mental mistakes in their trading.

Ten Powerful Psychological Traits of the Rich Trader

- They have the ability to admit they were wrong and get out of a trade. They know the place where price proves them wrong.

- They have the ability to not only close a losing trade but reverse and go in the other direction when it is called for.

- The rich trader is not trying to prove anything about themselves they are focused on making money.

- They do not fall in love with an idea, currency, commodity, or stock they will make trades based on price action.

- Rich traders know that the market action is their ultimate boss regardless of their opinions.

- No matter how sure they are about a trade they still ALWAYS manage the risk.

- Rich traders get more aggressive when winning and trade smaller or take a break during a losing streak.

- A great trader is one that can admit to anyone that they were wrong.

- Rich traders do not believe their own hype, they know they can not really predict the future they can only react to current reality and the probabilities.

- Rich traders love what they do, win or lose.

When you are trading like that, it is hard to be beaten. Time is your friend.

Human Tendencies That Affect Trading

Successful trading is based mainly on trying to follow the right trading plan. But even the most disciplined can be affected sometimes by certain human tendencies that can turn that around. There are certain human quirks that seem to affect trading but most traders don’t seem to be aware of. Here are some of them.

Fear Of the Unknown

It is a human tendency to feel fear about something that one doesn’t know. This may limit traders on making those calculated risks. Some may just stay on a certain comfort zone, maintain a position where they have an idea of what the results may be. But this can also lead to missing out on valuable opportunities that may be present at one time or another. It can sometime be an unfounded fear that can seriously affect one’s trading success.

Information Bias

Some traders may not be aware of this, but information bias can also have a serious effect on trading. It is a tendency to accept only data and information that one likes to hear. Upon accepting this information, they seemed more biased to it, even though it may be more of an opinion than fact. In the process, some traders may rely more on information based on opinions rather than the facts itself. This may cause a certain trading strategy to fail because inputs used are not necessarily the real facts currently happening in the market.

The Thrill Of Anticipation

It may not be that easy to understand this common human tendency since most people go through it. Some may even call it daydreaming, but the thrill of anticipation of a future event can also affect trading. Anticipating something good that will happen is not always bad. But sometimes some people are more excited and relish the thrill of anticipation that they sometimes fail to act upon it and do something to make it a reality. In traders, anticipating too much rather than acting on it can certainly affect trading performance and success.