A neural network (also called an artificial neural network) is a system that works using interconnected neurons in the brain. It learns with data, numbers, and facts so that it can be trained to finally recognize patterns in the brain. In other words, it is the control center of our brain. Each nerve cell (neuron) has about 10,000 connections to other neurons and often sends hundreds of electrical impulses per second via the synapses.

Neurons:

Experiences and skills have been stored in our brains over the years. Everything we actively think and feel has a connection with each other. Every experience finds the right neuron and then forms a huge network with other neurons. All of our thoughts, emotions, and memories are linked together in this way. The more numerous these connections are, the more we control a certain action and feel the associated emotions.

A neural connection is more stable the more often we repeat an action!

With constant repetition of an activity, a stable neural network develops, which becomes a distinct habit with increasing repetition.

How does a neural network work?

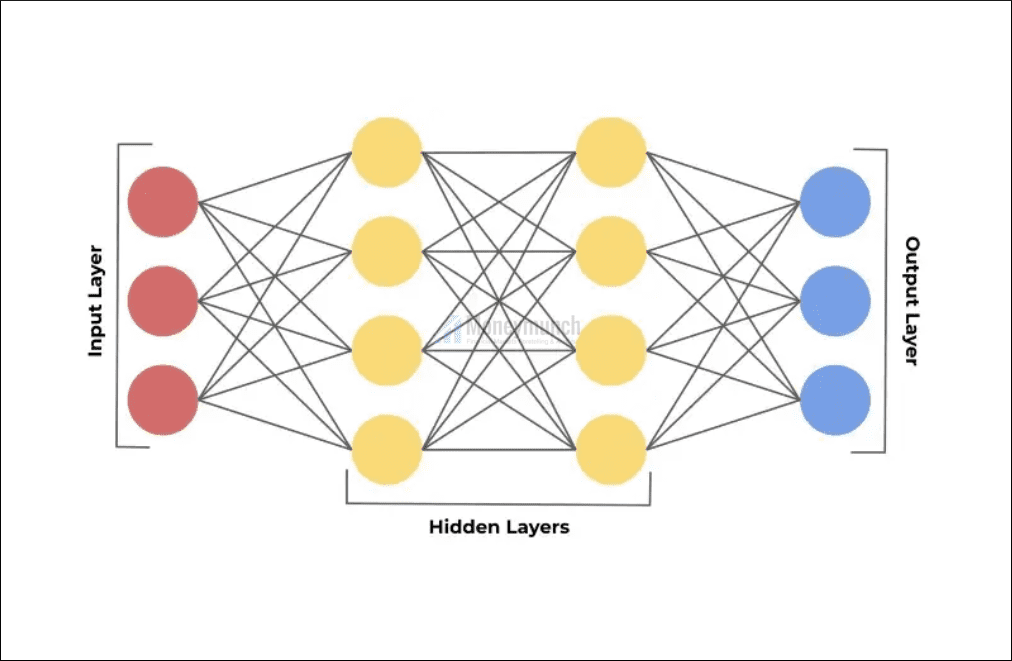

A neural network consists of an input layer, one or more hidden layers, and an output layer. The layers are connected via neurons. Each layer uses the output of the previous layer as its input. The neurons connect the different layers. Each neuron typically has weighting factors that are adjusted during the learning process. If the weight decreases or increases, the signal strength of this neuron changes.

But what does that have to do with trading?

Many people believe that the mere will to change would be enough to achieve the set goal, but if it were that easy, then everyone would have achieved what they only dream of – but that’s not the case. Man is a creature of habit, he hates change because change always means one thing and that is the first step out of the comfort zone. Getting rid of habits is very difficult! As the saying goes, “Men would rather perish than change their ways – Leo Tolstoy“

But, coming back to trading, if you keep repeating the same mishaps while trading, you will create a tight neural network in your brain that will work on its own over time. In the worst case, these bad behaviors can lead to an automatism that is unconsciously triggered in a certain situation. Then you no longer trade as a trader

your Subconscious trades for you.

Of course, the neural network has many advantages. Through routine trading processes, trading can be simplified and facilitated. Important: To create a routine habit from a conscious behavior, this behavior must be repeated constantly and regularly. The longer and more routinely we implement a behavior, the more likely it will become a strong neural network and the easier it will be for us to make a habit out of it. As mentioned above, neurons are connected to our emotions, so if we want to turn a behavior into a habit, then we should enjoy it because emotions speed up the development of neurons.

Example:

If we want to get into the habit of reading 10 pages of a book in the evening and make this behavior a habit, then it should be a book that we like and feel like reading, otherwise, our brain will block, and it will be very difficult for you to form a habit to make of it.

Trade + Continuity + Emotions = “Faster” stronger Neural Connection.

What trading beginners often do wrong is to set wrong neural connections and that happens e.g. does not practice money/risk management, do not set an SL, or impulsively expand the SL – this is how fear triggers automatically arises concerning these behaviors. If this behavior is repeated, a false neural network is created with the associated emotion, FEAR. If this becomes an automatism, it will

your Brain ALWAYS react fearfully in situations in which you have used this behavior and do the same thing again!

It takes a certain amount of time for this neural network to be overwritten. As the saying goes

“hold the vision, trust the process”

Target:

From fear and panic to discipline, patience, perseverance, and consistency.

->You can only make this switch if you exceed the current neural connections and stick to your trading plan and do it continuously habit->automatism->emotion->new neural connection).

We are what we repeatedly do. Excellence, therefore, is not an act but a habit. – Aristotle

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.