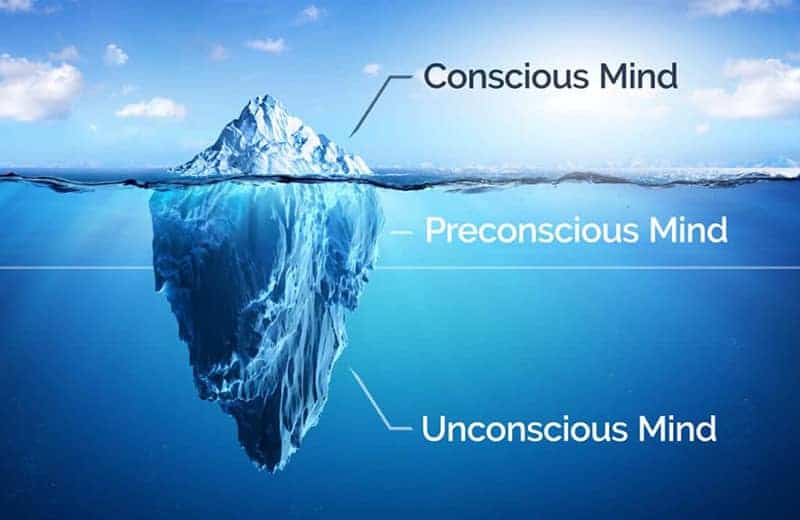

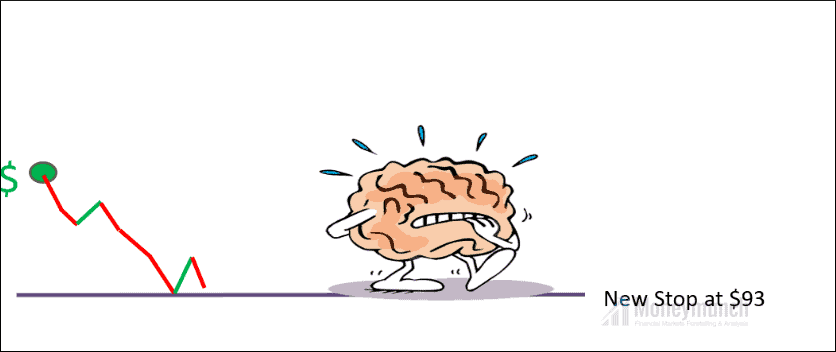

Definition: Instinctive feeling about something, detached from rationality and knowledge. In other words, experience feelings such asContinue reading

Part 6: Trading Psychology – Emotions

Definition: Instinctive feeling about something, detached from rationality and knowledge. In other words, experience feelings such asContinue reading