What are emotions?

Definition: Instinctive feeling about something, detached from rationality and knowledge. In other words, experience feelings such as joy, sadness, fear, hate, and love in combination with their reactions.

E.g . Sadness -> crying (reaction), hate -> insults, violence (reactions).

General

Emotions not only relate to the subjective experience but also include physical reactions to certain triggers that prepare people for behavior and are intended to motivate them to act. Emotions are very comprehensive. They influence our attention, our ability to think, and our self-assessment. Individual emotionality is a crucial part of our personality, it is precisely the episodes in our past associated with strong emotions that have shaped us and make up our personality. Emotional events dig deep into the memory.

How do emotions affect trading?

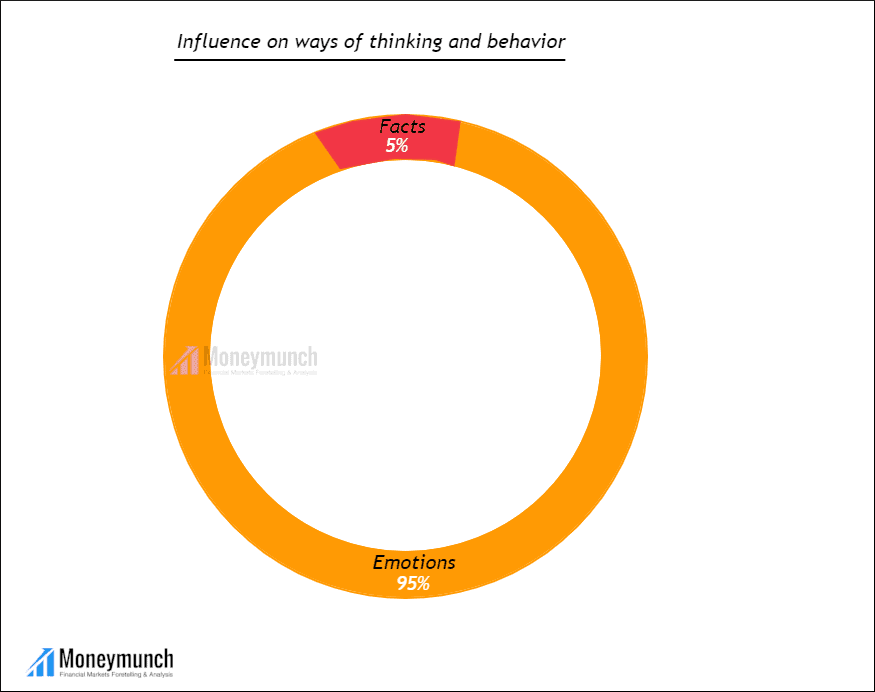

As you can easily see from the graphic, emotions determine our behavior. Biologically, we humans act emotionally rather than rationally, this is also the reason why most people stop trading after the first 3 months, the biggest reason is because of emotions. Our emotions act and make decisions for us, we are only there to consciously show our reactions to them. But emotions have no place in the stock market! The goal is to master a rational system without any discretion. At first glance it sounds easier than it is, we have to have our emotions under control to rationally follow the rules.

A big superstition in the stock market world is that you have to trade without emotion! But that’s not possible, you can only have your emotions under control.

Two well-known emotions on the stock exchange are fear and greed, although I see this as one emotion with the umbrella term FEAR. Greed is part of FEAR.

I believe there are two emotions in the stock market, one negative and one positive, FEAR and JOY.

Let me explain briefly why I find that greed is part of the fear “Anyone who wants too much is usually afraid of not getting enough, or whoever wants something too quickly may be afraid of not being there at some point”.

- Fear to fail from losses

- miss the trade

- not complying with the rules

- to have to do something wrong

- to have not mastered the trading system before the future to embarrass yourself

- not to be right

- not being “smart enough”.

Fear resides in the limbic system, specifically in the amygdala (the brain region that regulates emotional expression). If you can’t get your anxiety under control while trading, then this will be the reason for an unsuccessful trading career. The emotions are located in the subconscious, which, as we know, works with its mechanisms.

Can you now follow me why so few are profitable in the long run?

Profitable traders know what they have to deal with, with themselves, with their subconscious, and their habits (basically with all the topics that I have discussed and that will follow). It’s not a popular topic, nor is it easy, but no one said trading would be easy!

Trader career = strong emotional strain, are you up to it?

Profitable traders approach the matter in a self-reflective manner. The topic of self-reflection is also not a popular topic, because basically (but not exclusively) you look at losses and think about whether the trade was valid but didn’t work out or whether you overlooked something.

Always remember that fear is deeper than you think, for example, if you are afraid of loss, then there may be a deeper reason for it. Ask yourself questions, the answer to your emotional mistakes is within you, it is only a matter of time before you get them from the subconscious to the conscious. The trader ALWAYS acts as he thinks, so pay attention to your thoughts and your beliefs, because they influence your life.

Why are we afraid of loss?

Person A knows that losses are part of daily business, but every time a loss gets upset, isn’t that paradoxical? Profitable traders see the sum of all trades, amateurs only see one trade.

Joy realize a winning trade be being stopped out (Be -winning trade since you start with risk and then are at +-0)

- to see how to reach your goal step by step

- that you always own the markets see can interpret

- to trade disciplined

- on trusting the system and then seeing that it’s worth it.

I can’t write much about the emotion of joy compared to fear, because it doesn’t hinder us in our careers. An important point is also to question winning trades. Was the take profit based on luck? Or has it been replicable? Just because a trade works doesn’t mean you’re allowed to trade it.

Lucky Trades and Replicable Trades are different.

If your trades are based on luck, you do something different every day, and don’t worry about your inner trading calm, because you trade differently every time. The goal with active trading is to approach things calmly, and you can only do that if you do the same thing every day ⇉ automatism ⇉ habit.

You don’t just want to be happier, you want to be happier than others, and that’s so difficult because we think others are happier than they are. – Charles-Louis de Montesquieu.

Always remember, trading will and will remain an individual process. Everyone will learn at different speeds and gain different experiences, comparing will only prevent you from progressing. Dissatisfaction leads to frustration and frustration is an emotion that robs enormous energy, focus on the positive energy that is within you!

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thanks for sharing, amazing!

Loved reading this! Thank you for your knowledge 🤝