One question first, what do you think, how much (as a percentage) is controlled by the subconscious or the conscious in our lives? Who controls us?

Answer: 80-90% is controlled by our subconscious and 10-20% by our conscious mind. However, we think that we make conscious decisions, even if these “conscious decisions” are simply an output of our experiences or knowledge, emotions, or simply hereditary deposits from our consciousness.

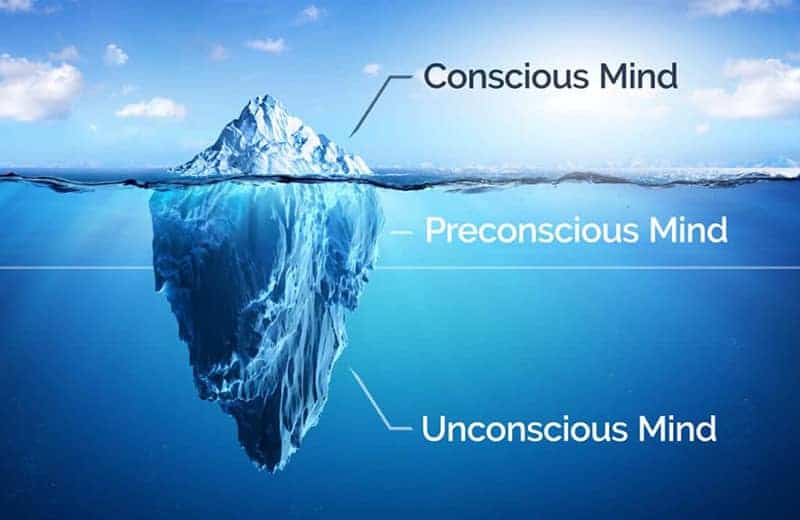

Here is a schematic example. we can remember things better if we link an image to what we have read.

The 80/20 rule (Pareto principle) can also be illustrated using an iceberg. The so-called communication model states that, as mentioned above, we are controlled approximately 80-90% subconsciously (below the water surface) and 10-20% consciously (above the water surface). The 10-20% are e.g. expressed thoughts and feelings, numbers, dates or facts, desires, and/or goals. The 80-90% are deeper things like fears, feelings, personality traits, trust, genetics, instincts, and/or traumatic experiences.

You can also say that the tip of the iceberg is the rational level and the body is the emotional level (input output). In other words, find a change in our emotional level instead of, so it also changes the rational level, the subconscious has a direct and powerful impact on our consciousness.

It is important to note that consciousness is visible to everyone, but it does not mean that it reflects the subconscious. Each of us has already lied at least 1x in our lives, which means, conversely, that because a person appears happy, for example, he doesn’t have to be happy.

The subconscious can also be seen as a large archive where all the information that one has ever experienced has been stored. Just imagine that the subconscious is a hardware store and every single shelf stands for information and experiences that you have lived through. The path from the conscious to the subconscious runs relatively smoothly (right now you read the text with your conscious mind, but with your subconscious, you register, for example, moving cars, wind, rain or, to put it simply, the surrounding noises. If one of these things currently happening to you, then you switch from the unconscious to the conscious, because then you become aware of the matter.

Example:

You sit with friends in the room and watch a film, then someone draws your attention to the noises from the construction site across the street and suddenly you listen consciously and suddenly it bothers you when you continue watching. Before, the sounds of the construction site were there too, but they were in your subconscious and not in your conscious mind.

Consciousness can absorb about 20-40 bits, which is equivalent to a sentence such as “Tom is going to ride a bike today”.

The subconscious, on the other hand, can absorb around 5-10 million bits (information unit).

It is not possible to bring something into the subconscious that has not previously passed through the 5 senses. Getting something from the subconscious to the conscious is relatively difficult, but possible.

You can imagine it like a garbage can, with the flap of the garbage can being the opening from the conscious to ⇉ subconscious.

When you open the flap, you throw the rubbish in, but the rubbish can’t get out again, since the flap closes, of course, unless you lift the flap and turn the rubbish bin 180 degrees, then it falls Garbage out. That’s also the reason if you’ve been on vacation, for example, and then go back to work, you have the feeling that you can’t do the simplest things anymore because every time you don’t talk to someone for 1-3 days deal with the topic (no matter how long you’ve been doing it) the trash can (subconscious) closes the flap again because you no longer actively did the activity.

So, and how do you manage to leave the flap open permanently?

Answer -You have to be able to control your subconscious, and you can do that with questions! Speak with questions, one achieves that the complete knowledge and the complete experiences that are anchored in the subconscious (in the garbage can) come to the surface (out of the flap) ⇉ consciousness.

But what does all this have to do with trading?

If the trading knowledge is not stored in the subconscious, then it will be difficult to access it in the long term, so after a short time, we lose the knowledge in the conscious mind. The aim is to consciously access the knowledge in the subconscious directly, which we create through constant repetition and experience in this area. A beginner trader looks at a learning video and thinks he has understood everything and does not need to be repeated (usually this is due to the lack of discipline), an experienced trader looks at the learning video again, makes marginal notes if necessary, and applies the knowledge, because As we know, our brain first has to unlock certain connections so that with further knowledge of this kind we have a folder in our memory where we can save any knowledge of this kind, the folder becomes more and more meaningful and anchors itself more and more, the more often we use it open the saved files in the folder and go through them repeatedly.

The selective perception

Definition: With selective perception, we describe the psychological phenomenon that only certain aspects of the environment are recorded and others are suppressed.

- You buy a new car – suddenly you see the car everywhere.

- You have a new hairstyle – suddenly you see it everywhere

- You have new shoes – suddenly you see them everywhere

- You have a new tattoo – suddenly you only see people with tattoos

- You know what I’m getting at :D

But why is that so?

Hiding and highlighting are two important terms here. You set a filter based on your current needs and hide everything else, for example, if you are hungry, so you look for groceries and restaurants and not for shopping malls, you focus on the one thing with which you meet your own needs and can breastfeed. (In this case the feeling of hunger). And in trading?

A common mistake in trading is to wear bull or bear glasses and focus on just one scenario. That is, if the market has, for example, a bearish, affirmative structure, one only focuses on bearish entries and neglects any opposing bullish alternative scenarios (which are also important to consider). So you act what you want and not what you see!

Important questions:

- What must the bears/bulls do to continue to follow their structure?

- Where are crucial bullish/bearish key levels?

- What area does the market need to break for it to be bullish/bearish affirmative?

If necessary, you can also make a table in which you look at the market from both a bull’s and a bear’s point of view and note down the points. In the end, you look at the bull/bear ratio and then decide whether to enter the market or whether there are too many points in favor of the alternative scenario and therefore no trade.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.