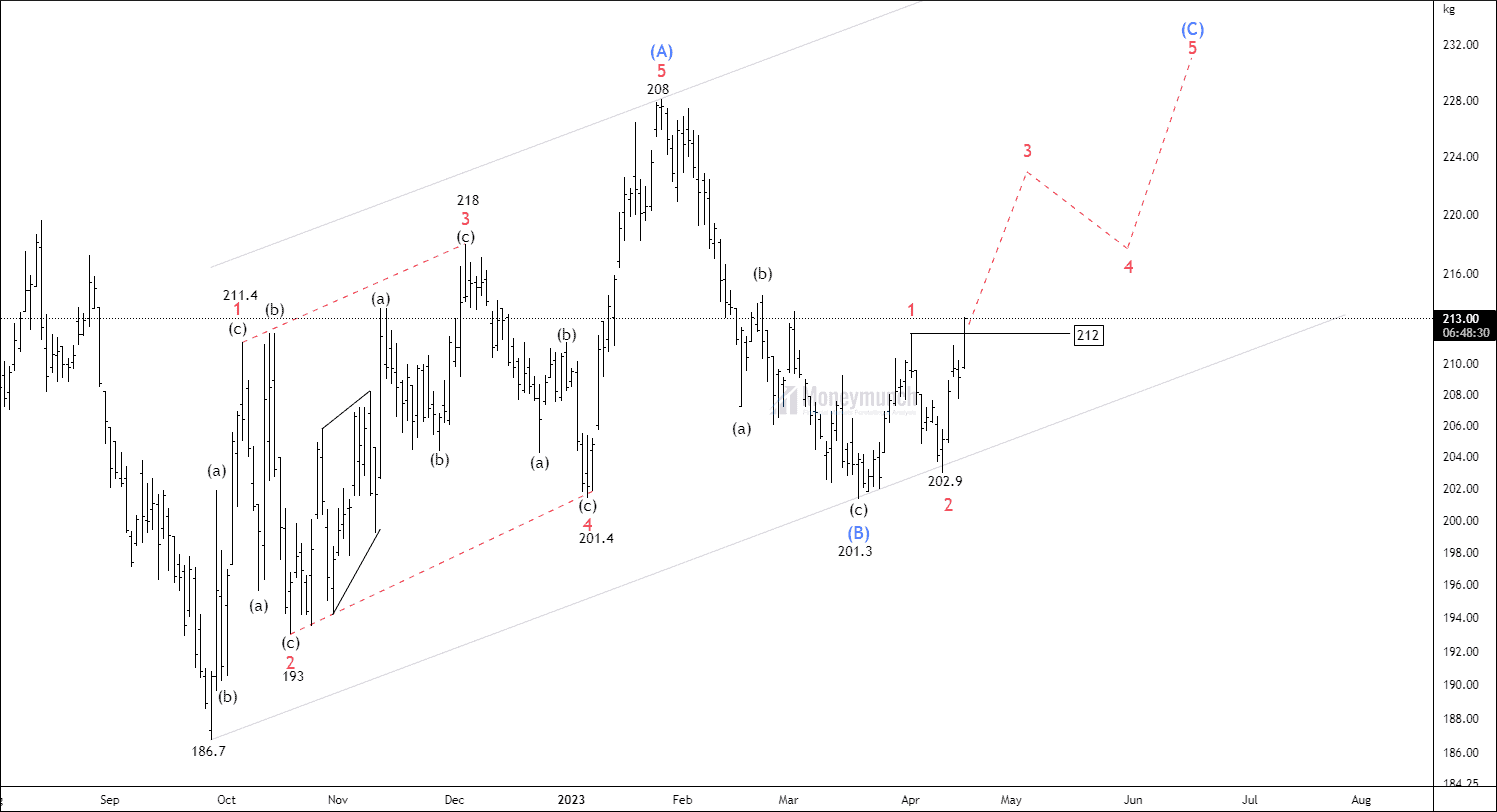

EWT – Identifying Bullish Trends in MCX Aluminium

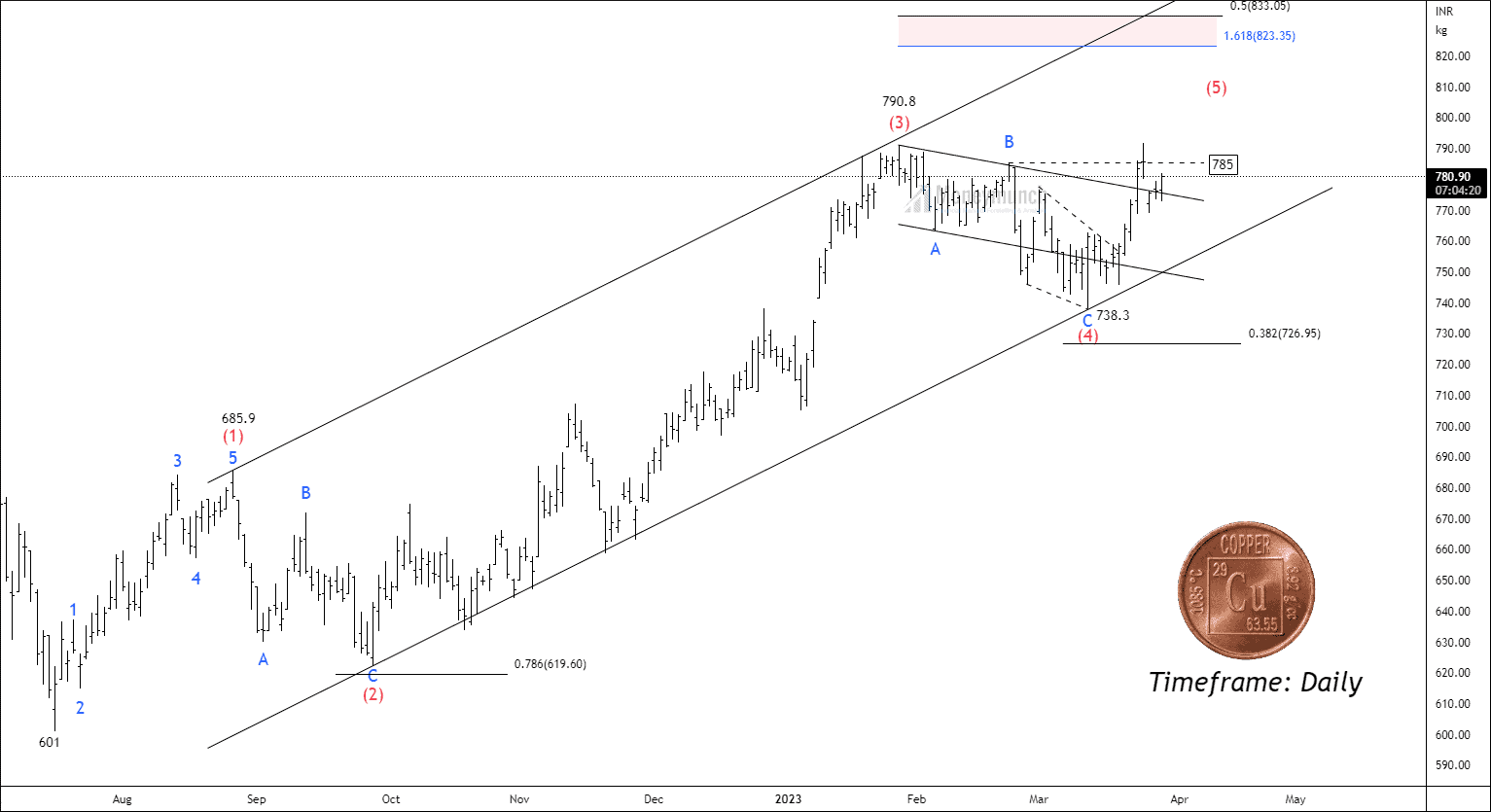

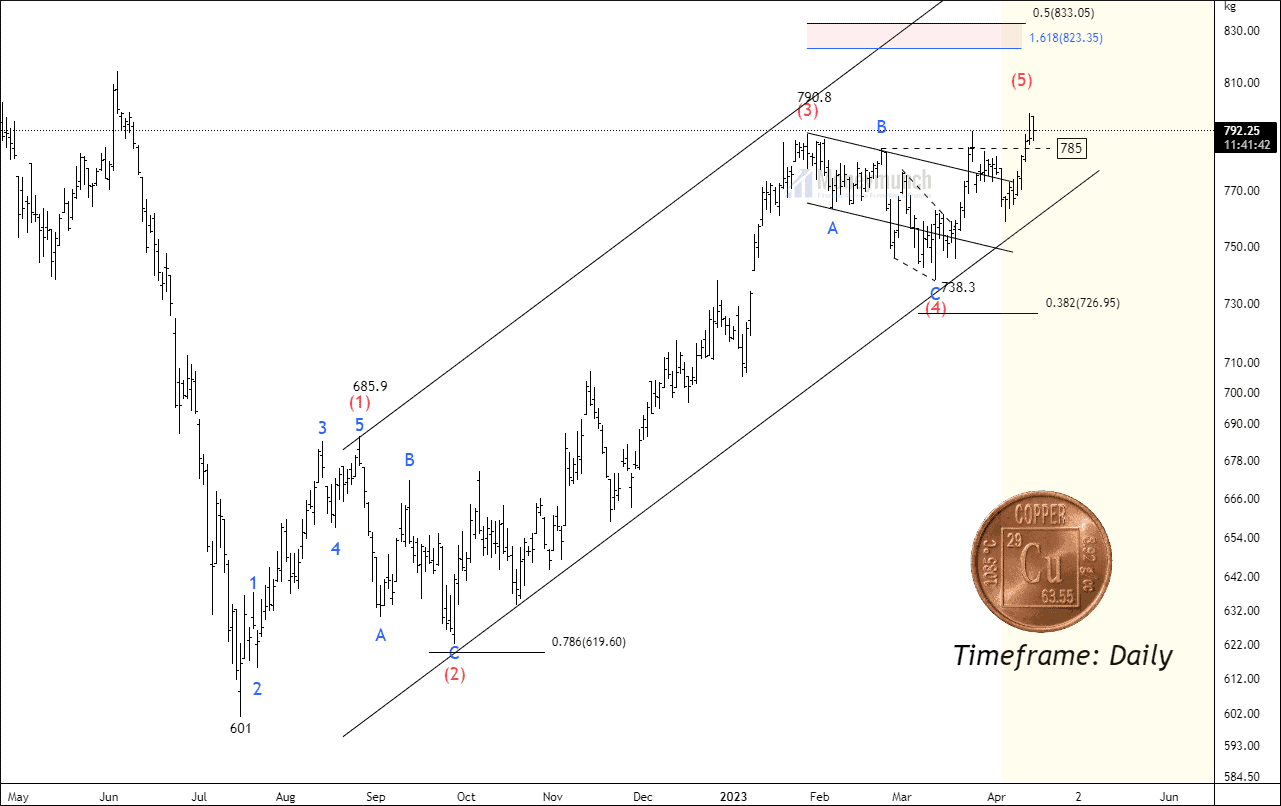

MCX COPPER – Trading Insights & Updates

Have you Traded our wave analysis on MCX COPPER?

Visit here: MCX Copper: Trend Forecasting Using Elliott Wave analysis

We have written clearly,”If the price remains above the B wave at 785, traders can consider trading towards the targets of 791- 809 – 821+.“

MCX Copper: Trend Forecasting Using Elliott Wave analysis

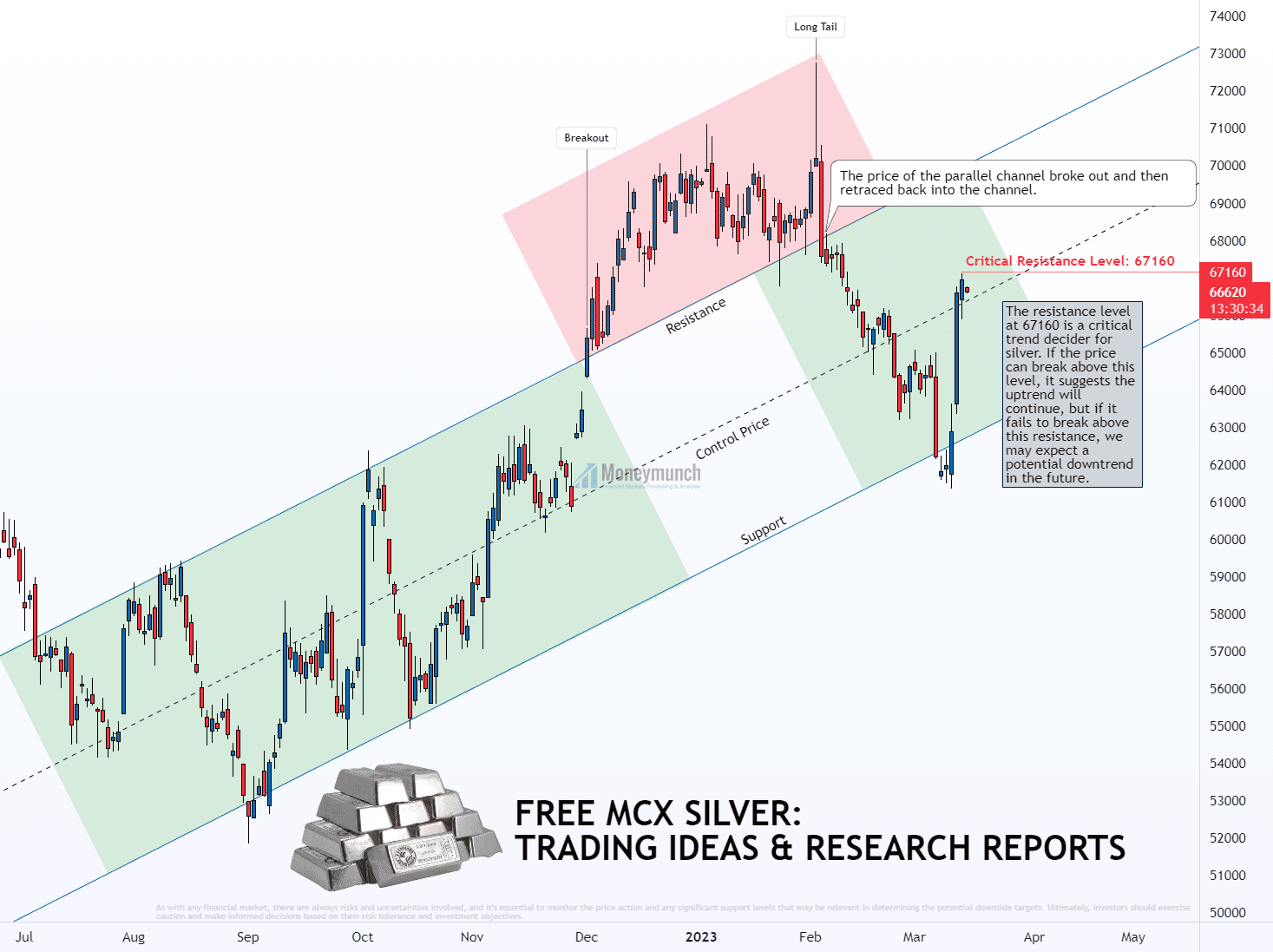

Silver Price Analysis: Critical Resistance Level and Potential Upside/Downside Targets

Part 10: Trading Psychology – Discipline

Discipline is nothing but self-control. Applied to trading, discipline is one of the most crucial factors on the road to profitability without discipline you will generally fail on the road to success! Because without discipline, you won’t stick to the rules, and you won’t continue to develop in the long run, you’ll do something productive here and there, but that’s not enough! If you want to develop discipline, you have to make your daily actions a habit.

Continue reading

Continue reading