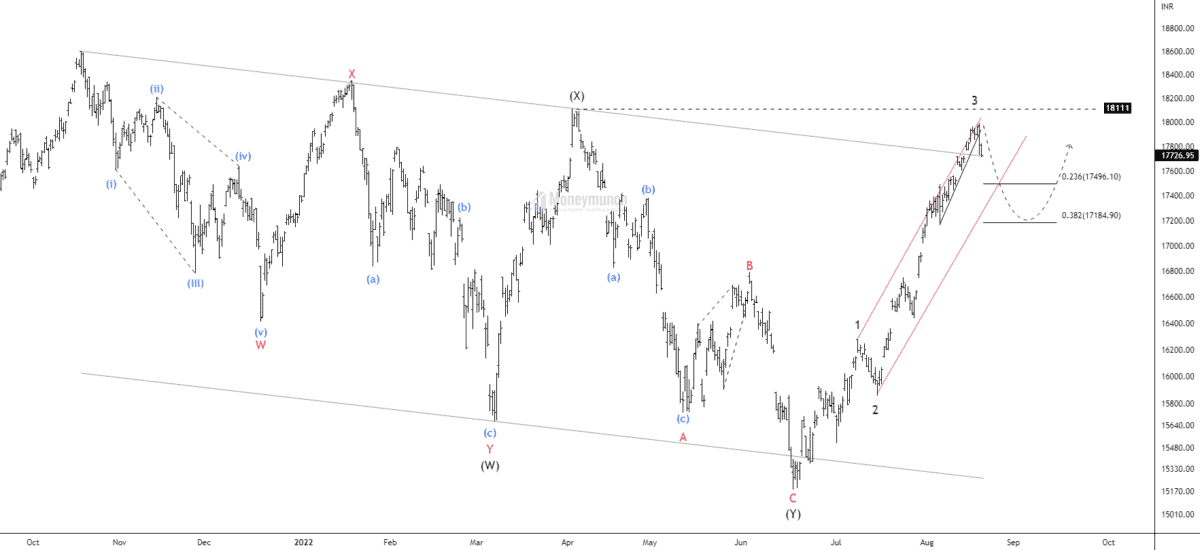

Is Nifty Preparing for An All-Time High?

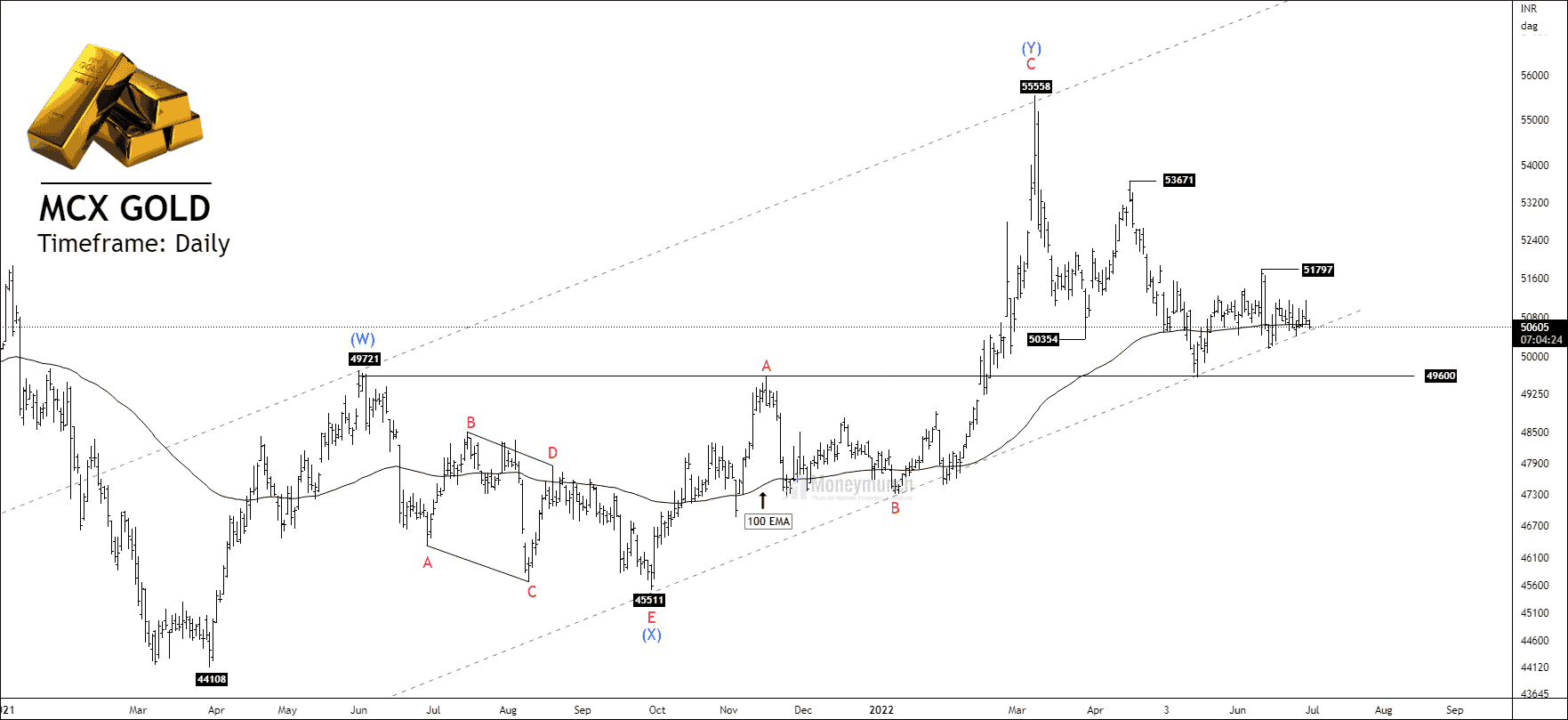

MCX Gold Elliott wave Projection For July 2022

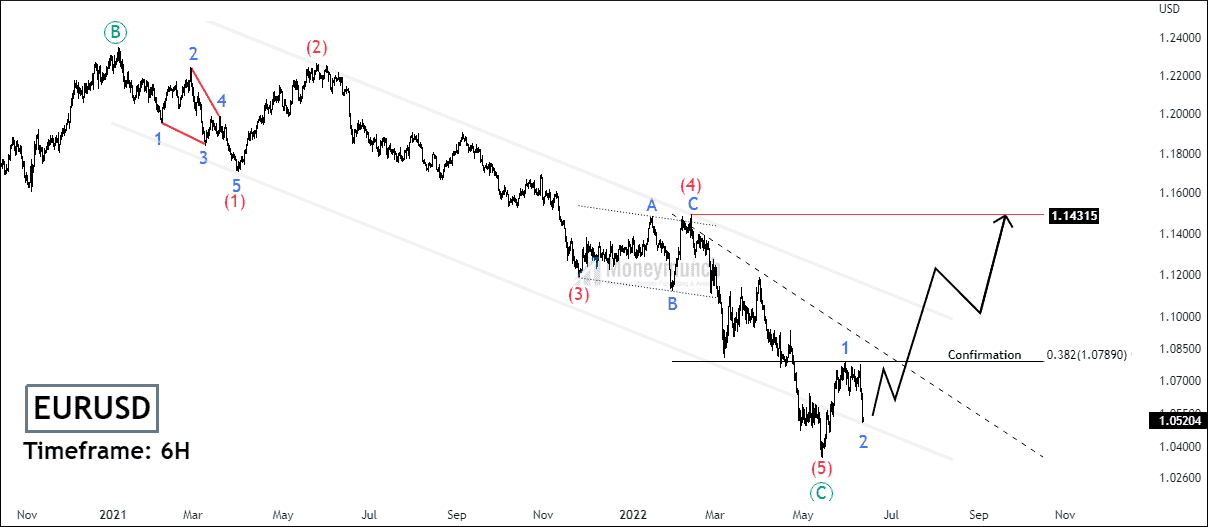

EURUSD Is Preparing For Skyrocket

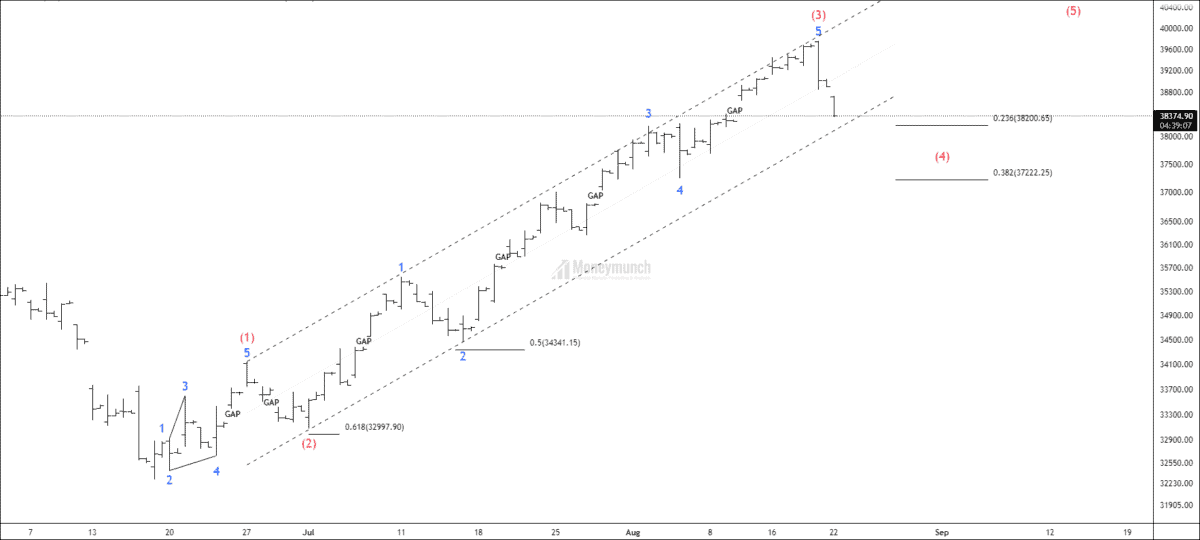

USDINR’s Trade Setup for Subscribers

Gold’s Next Bull Leg In Progress

Bull Gateway: 1852

Gold has created three consecutive positive bars in the last 25 trading sessions (36 days) for the first time. And it’s above 200 MA. That’s a good sign for buyers! If gold breaks the parallel channel, my upside targets Continue reading

Lock

Lock