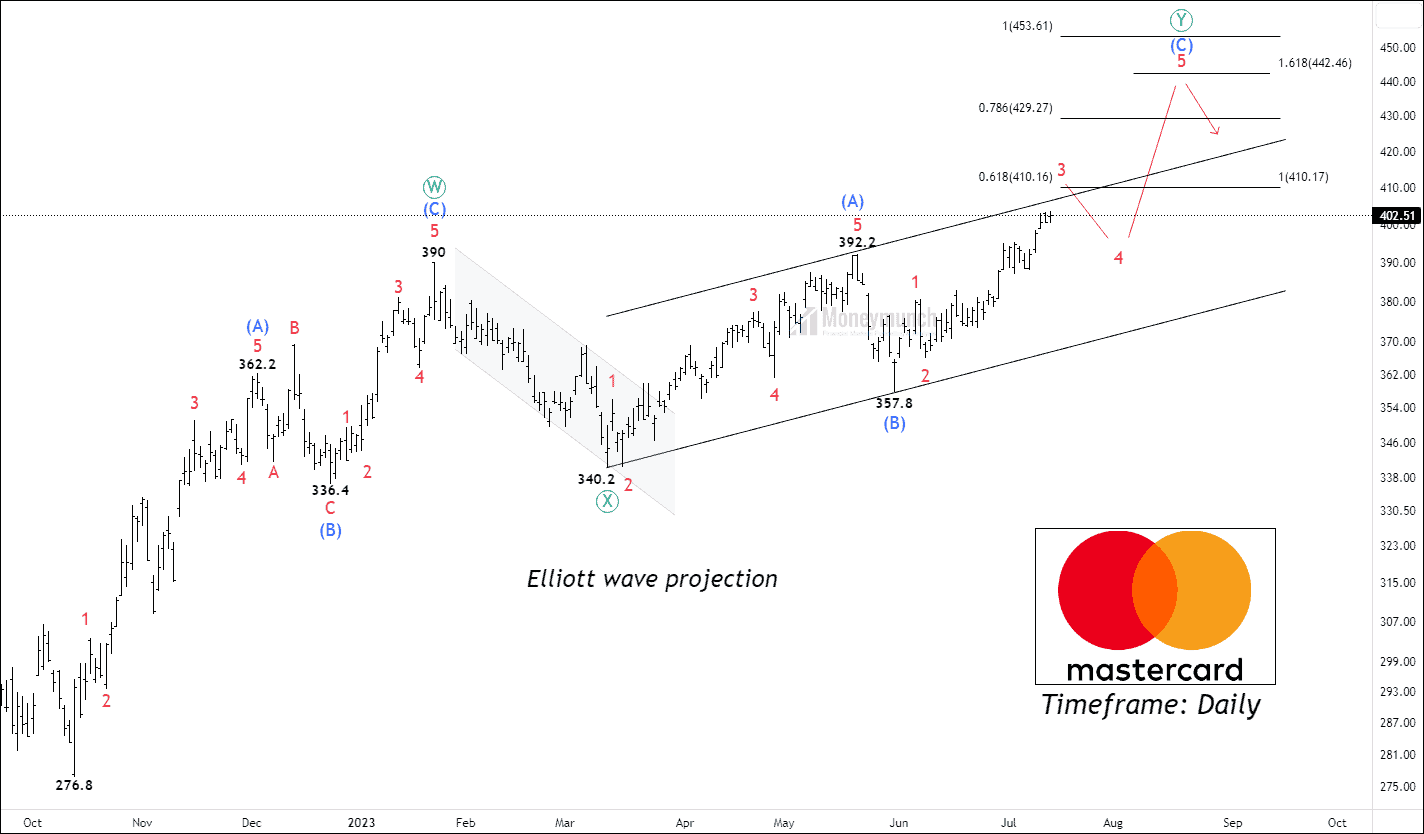

EWT – NYSE Mastercard Is Preparing Skyrocket

NYSE MA has started a double zigzag at the low of $26.8. Price has accomplished wave w at $390 and wave ((X)) at $340.2. The security price is moving above the 20/50/100/200 moving average with falling ATR signals sellers can come to provide a correction before the price surge.Continue reading

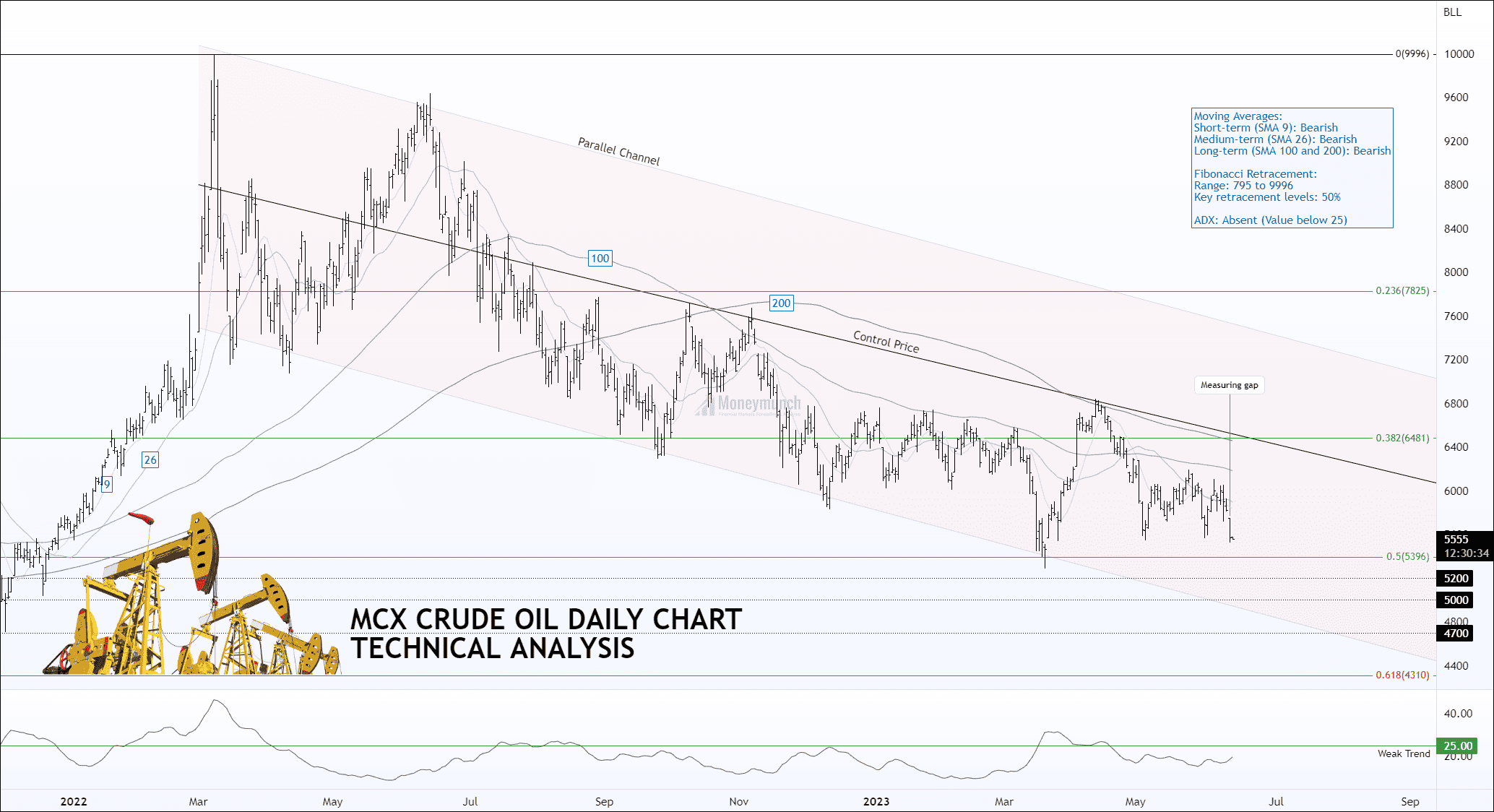

MCX Crude Oil: Retracement Analysis and Downside Targets

MCX Crude Oil: Will it Drop Below 5000 Before the Weekend?

In the wake of the COVID-19 pandemic, crude oil prices experienced significant volatility, hitting a low of 795 and reaching a peak of 9996 on March 8, 2022. Currently, the price is undergoing a retracement, approaching the key level of 50%.Continue reading

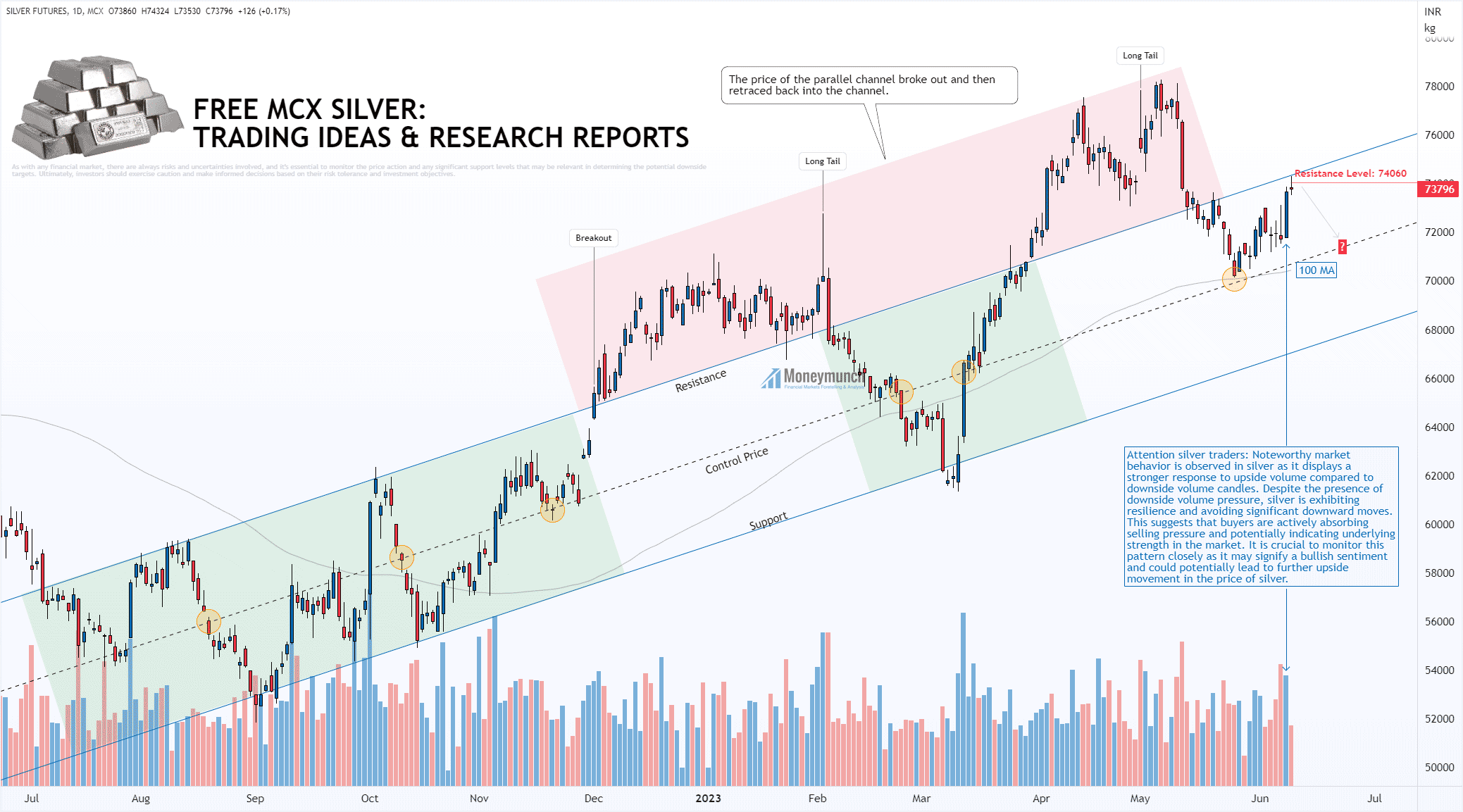

Silver Price Analysis: Exploring Resistance, Control Price, & Volume Dynamics

Examining the Parallel Channel and Resistance Levels for Short-Term Traders

Upon analyzing the chart, it is evident that silver has been trading within a parallel channel for almost a year, indicating a well-defined price range. In the previous trading session, the price of silver reached the resistance line of this channel. For short-term traders, a critical resistance level to watch is 74060. If this level is not surpassed convincingly, it could lead to a potential downturn towards the control price (CP) line. It is worth noting that silver has yet to test the CP line and the 100-day moving average (MA) successfully.Continue reading

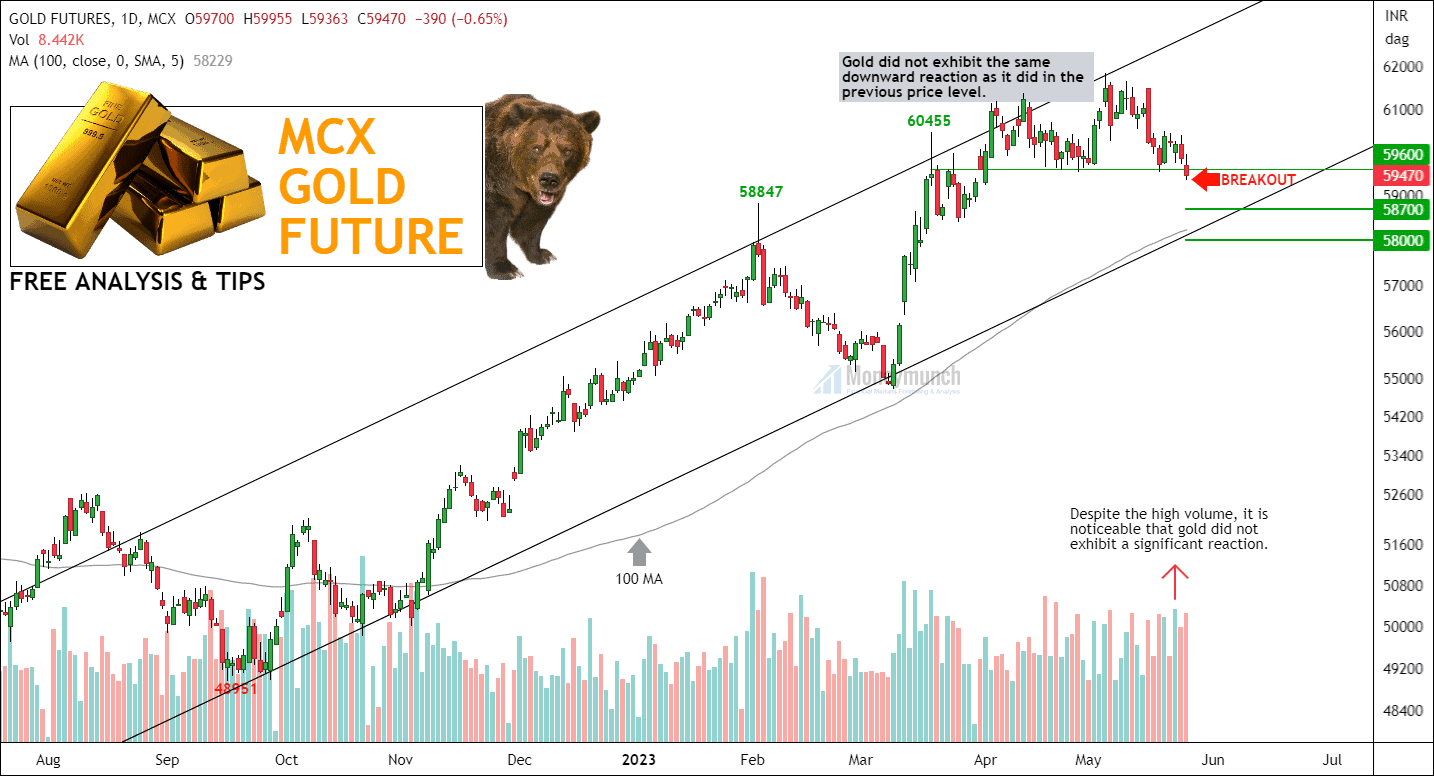

Analyzing Gold’s Chart: Levels to Monitor & Potential Reversal Point

Delta Hedging: Mitigating Risk in Financial Markets

In the fast-paced and unpredictable world of financial markets, investors and traders are constantly seeking strategies to minimize risk and maximize returns. One such technique that has gained popularity is delta hedging. Delta hedging is a risk management strategy employed by market participants to reduce or eliminate the exposure to price movements in an underlying asset. In this article, we will delve into the definition of delta hedging, explore different strategies, discuss its pros and cons, and conclude with its overall effectiveness as a risk management tool.

In the fast-paced and unpredictable world of financial markets, investors and traders are constantly seeking strategies to minimize risk and maximize returns. One such technique that has gained popularity is delta hedging. Delta hedging is a risk management strategy employed by market participants to reduce or eliminate the exposure to price movements in an underlying asset. In this article, we will delve into the definition of delta hedging, explore different strategies, discuss its pros and cons, and conclude with its overall effectiveness as a risk management tool.Definition:

Delta hedging is a method used to neutralize or offset the risk associated with the price fluctuations of an underlying asset. The “delta” represents the rate of change in the price of an option relative to changes in the price of the underlying asset. By dynamically adjusting the position in the underlying asset, investors can minimize or eliminate the impact of price movements on the value of their overall portfolio.

Strategies:

There are various strategies employed in delta hedging, depending on the specific needs and goals of the investor or trader. Some common strategies include:

- Delta-Neutral Strategy: This approach involves adjusting the position in the underlying asset to maintain a delta-neutral portfolio. It requires continuously monitoring and re balancing the portfolio to ensure the overall delta remains close to zero. By doing so, the investor aims to eliminate the risk of price movements in the underlying asset.