Publish Date: 26/08/2021

UPDATE 2.0

We get a lot of questions about Elliott Wave, but a set of questions often received from the followers:

- Where to start wave counting on the chart?

- How do I begin/start wave counting on the chart?

- How do you do Wave Counting?

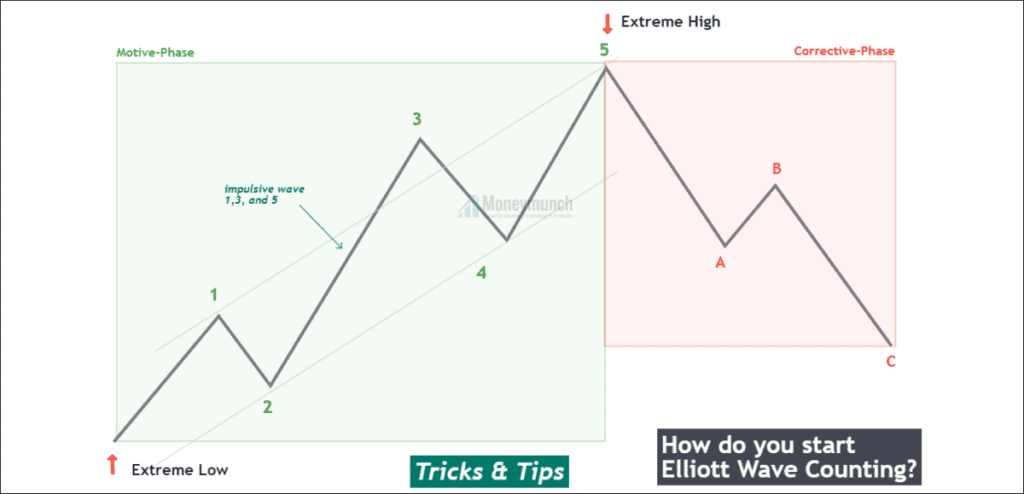

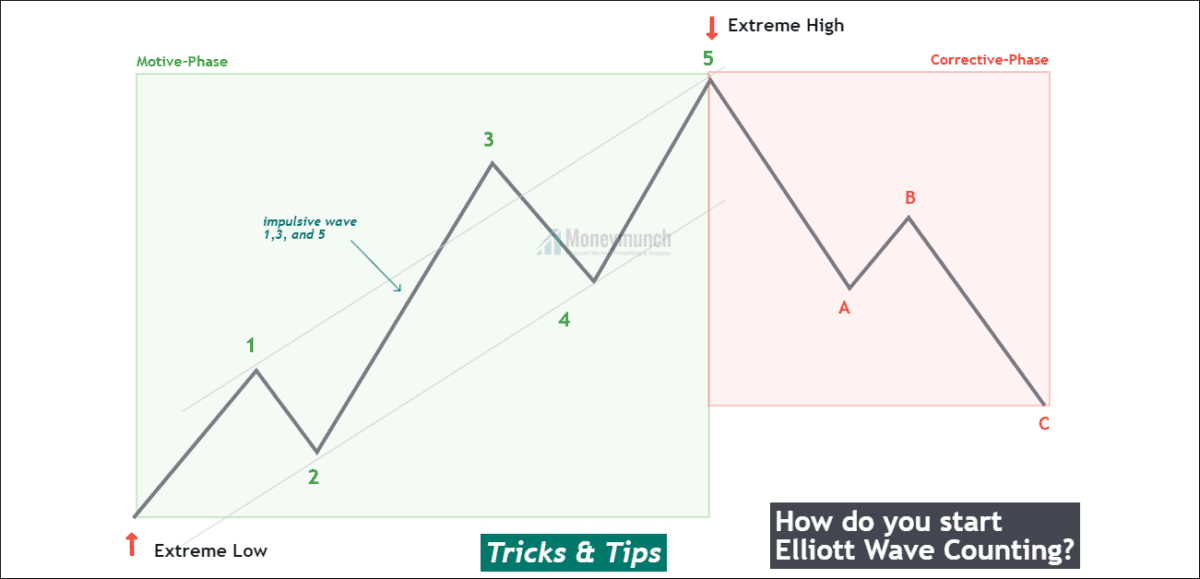

As a part of establishing Elliott Wave Counting on a chart, we use three working tricks. These are my steps/processes or tricks that can help you to start counting waves.

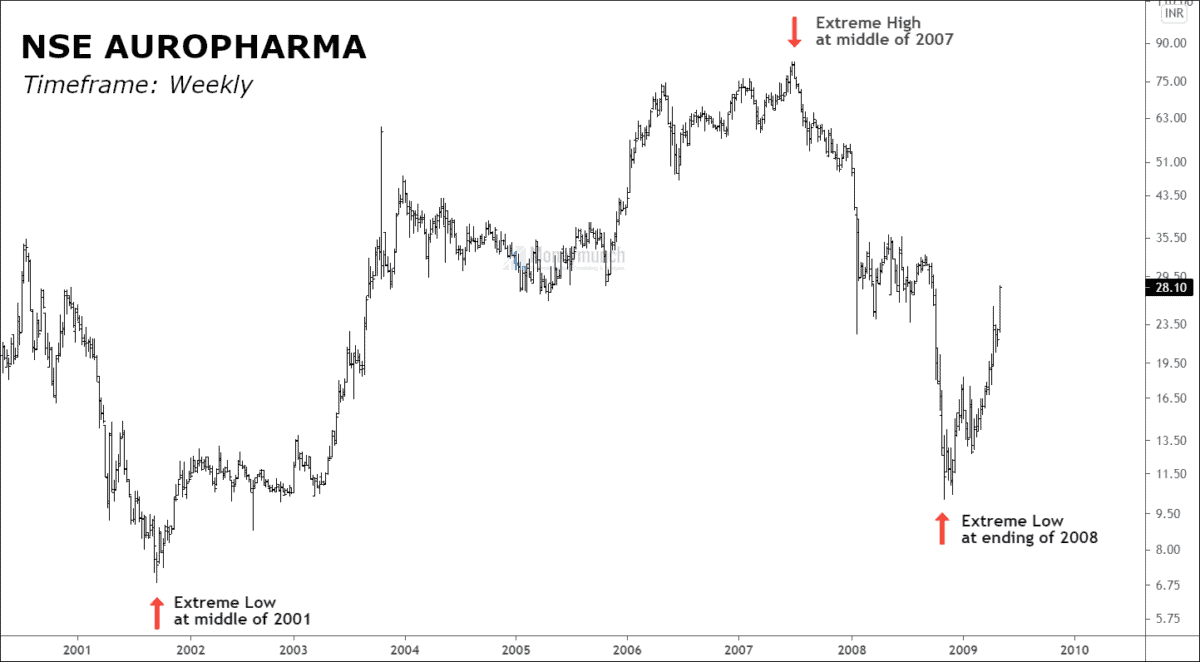

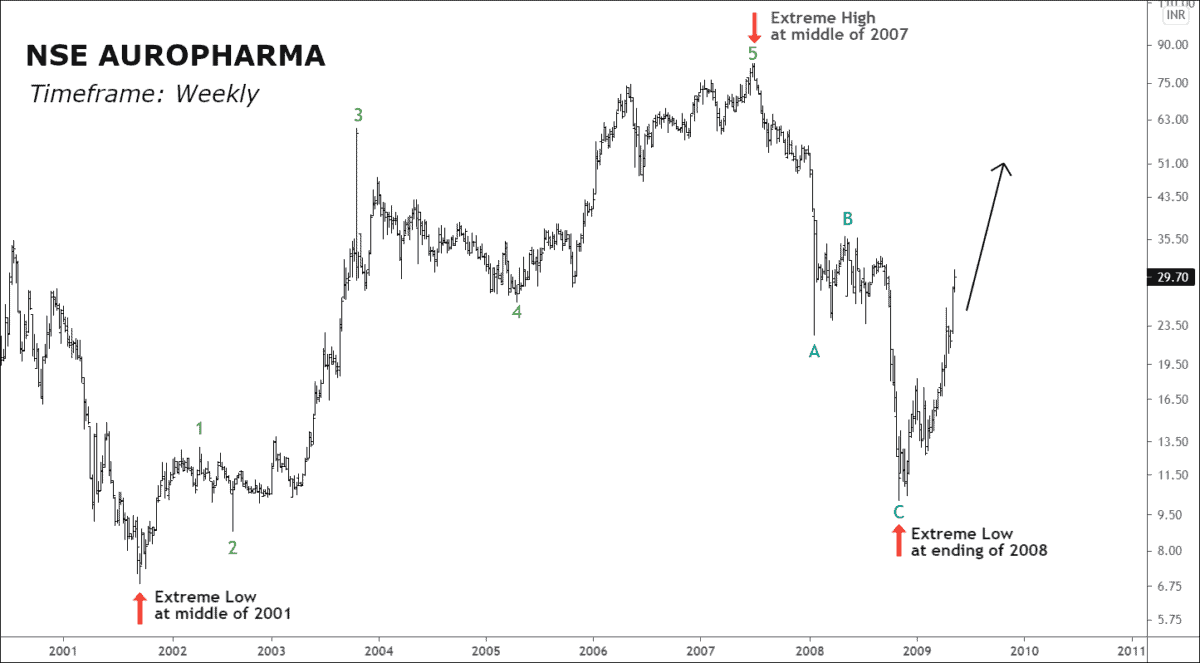

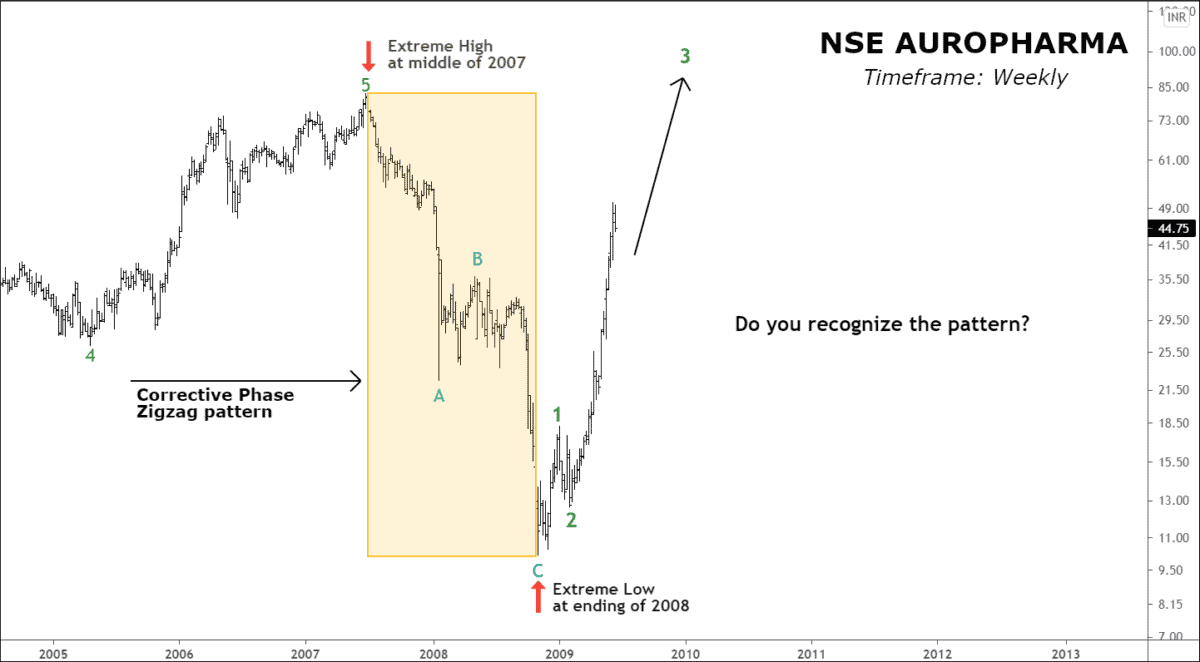

Key Point: you can begin the wave counting over the Extreme Low or Extreme High. It doesn’t matter if you start from extremely low or high. I am going to start Impulsive Wave Counting from Extreme Low in the middle of 2001.

The Wave Counting is quite simple on this chart with Wave 1,2 and nice acceleration in wave 3 that moves more confidently, wave 4 pullback and five-wave advance impulsive again. Now corrective phase, flat A, B, and C correction. This is a very easy and clear chart to identify wave counting.

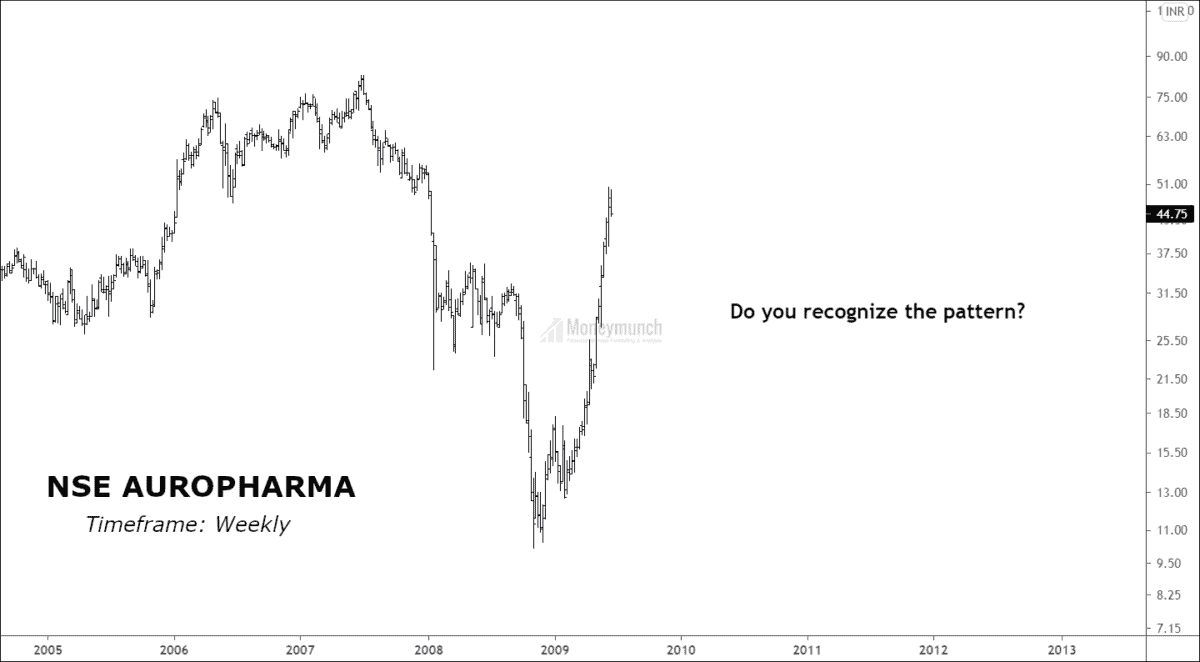

Just simply ask yourself “Do I recognize the Pattern?”

The answer is NO, then Okay

Next, ask yourself, Do I see a motive or corrective wave?

Elliott Wave classification in two phases, Motive, and Corrective phases. If it’s a motive-phase(wave 1,2,3,4 and 5) then, you have two patterns to work with:

- 1. Diagonal and,

- 2. Impulsive waves.

Suppose to, its Corrective-Phase(A,B, and C) then, you have 3 patterns,

- 3. Flat,

- 4. Zigzag and,

- 5. Triangle.

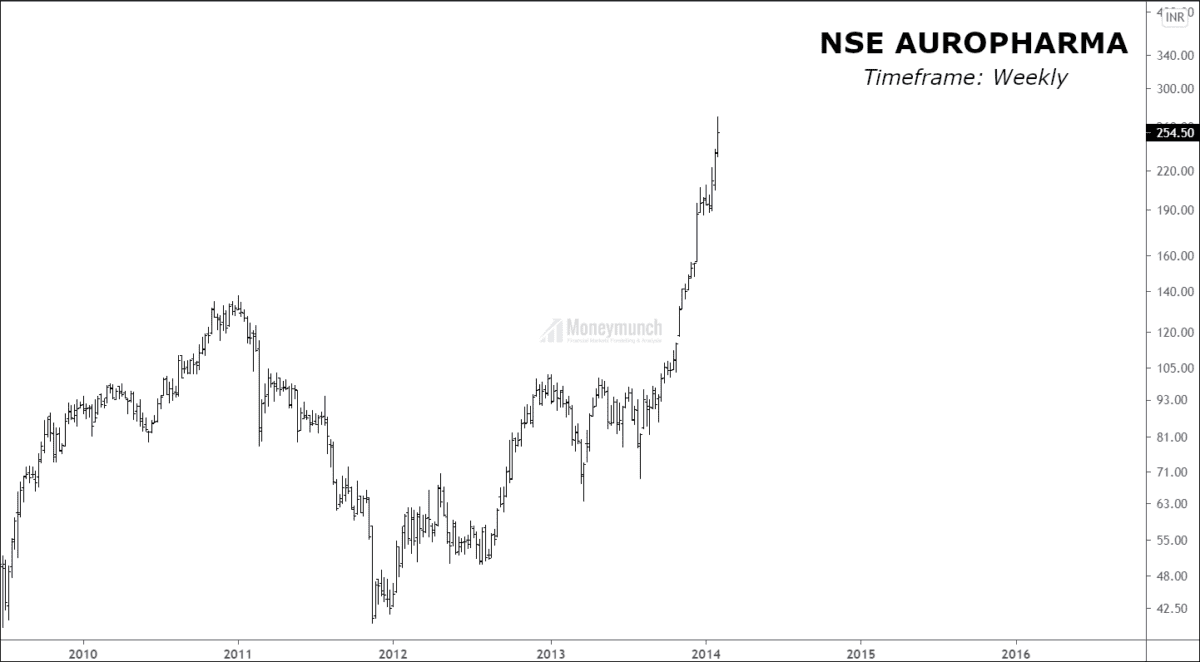

Trick 3: Start in the middle and move forward

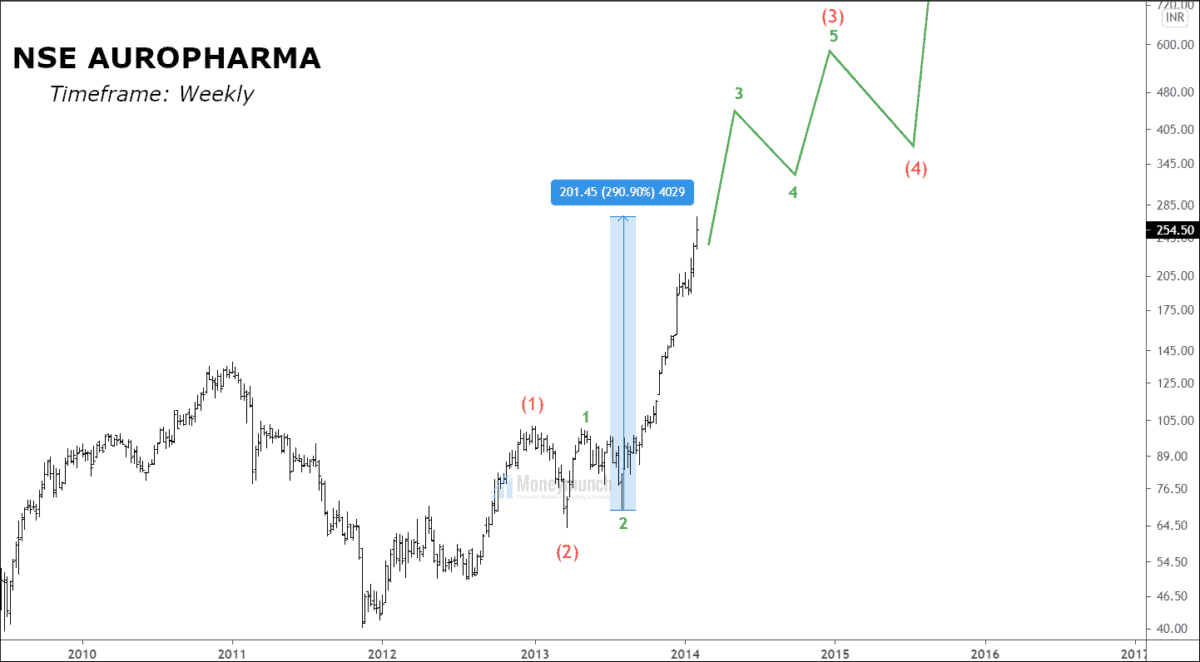

I don’t know what is going on but, in Aug 2013, the price moved 201 points from 69 to 271 which is a very strong upward move in a short period of time. This is a clean and clear sign of the 3rd wave.

If this move is Impulsive wave 3 then prior swing low can be labeled as wave (2) and prior swing high can be labeled as wave (1). Basically, it is Wave (1), (2), 1,2,3,4, and 5, (3), (4), and (5) motive phases. More often, we may see gaps and price surges in a short period of time in Wave 3.

We will upload more articles on Elliott wave analysis. (To become a subscriber, subscribe to our free newsletter services. Our service is free for all.)

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

great work thanks 🙏

Good stuff

excellent Work My Friend Nailed it… Many Traders need to READ this and learn… IF only!

your idea is good 👍👍👍👍👍👍👍

You made me reconsider to wave analysis

Thank you. Great job. Two thumbs up!

As always, great explanation!

I really like the structure you pointed out. It looks very solid. Thanks

Cheers!

Great as always! Please update more ideas on Elliott wave analysis.

Good insight. Thanks for sharing. These articles will help beginners for sure.

Please teach me Elliott waves🙏🏾🙏🏾