Did You Trade Adani Port’s Trade setup?

Click Here – RESEARCH REPORT: NSE ADANI PORTS MULTIPLE TIMEFRAME ANALYSIS

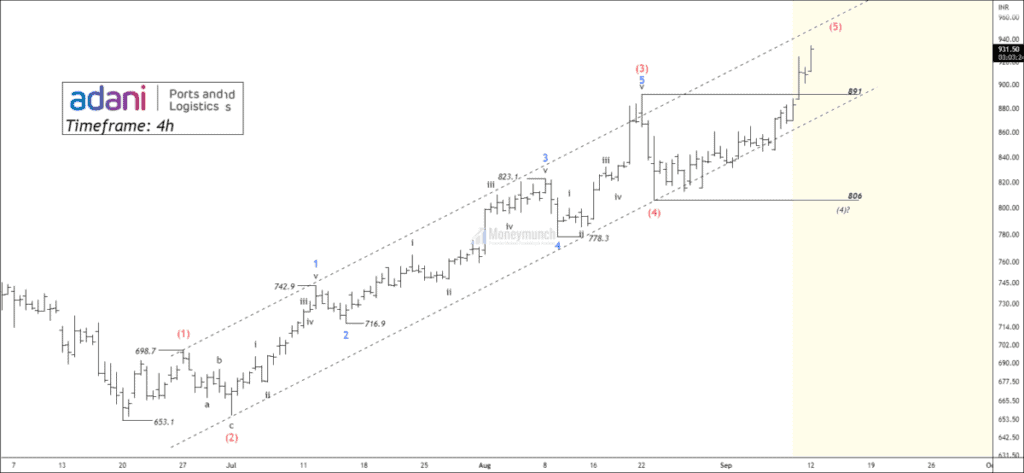

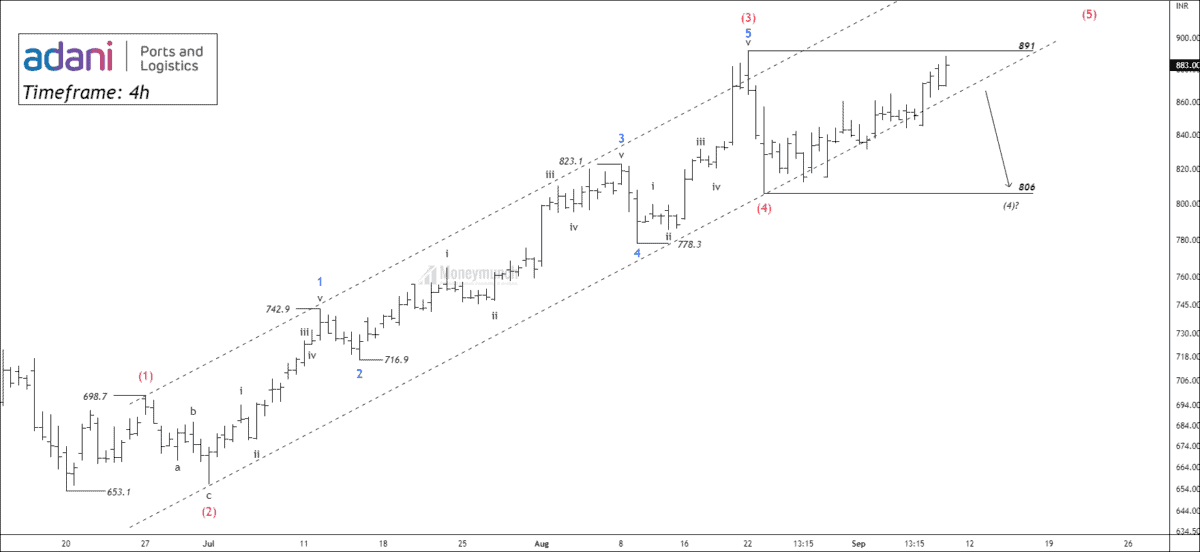

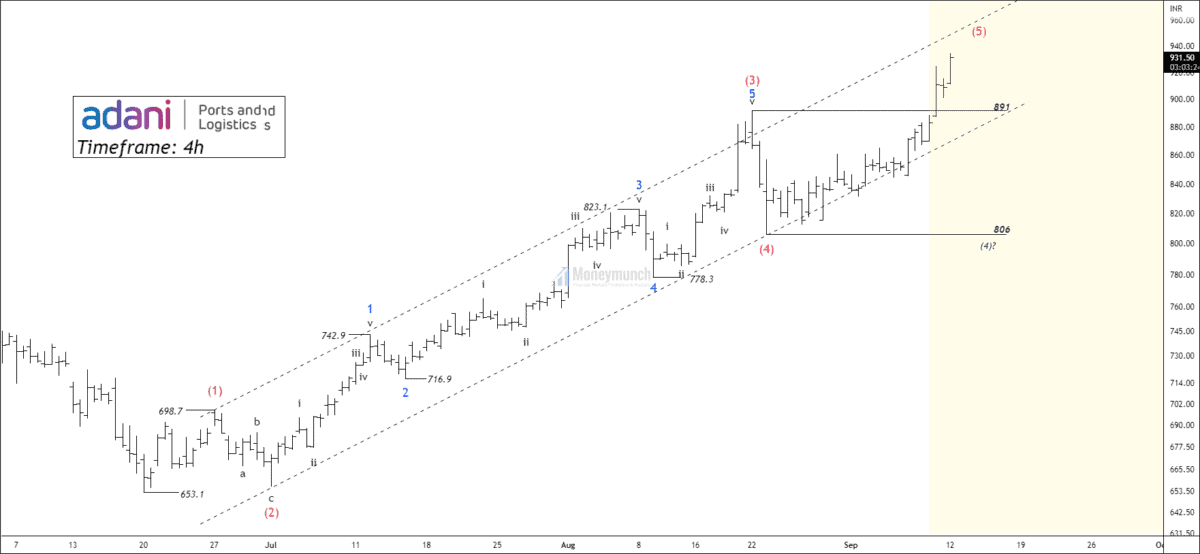

There was a critical level of 891 at which Adani Ports was stuck. Trade was only possible after either breakout of the breakdown of 891. Failure could drive the price for 806 as it was a strong support level.

To subscribers,

I have written clearly, “As per wave counting, it looks like the price has completed corrective wave 4, and started forming an impulsive wave (5). If the price breaks high at 891, traders can trade for the following targets: 932 – 964 – 1011.”

[12 September 2022]

- 09:40 AM – Adani Ports hit first target of 932.

In just two trading sessions, you could have made 38 points or more by trading this setup.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.