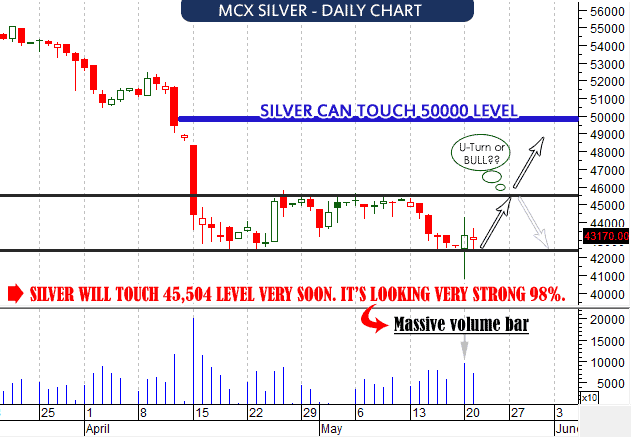

The daily charts of both gold and silver are beginning to show some bullish signs. On Sunday night, silver plunged about two dollar an ounce, but there wasn’t much volume, which is bullish huh. And on Monday, silver move like “Skyrocket” because action is not taken to reduce government debt. Oh yes, Monday’s trading volume was truly massive and there is now a “key reversal” day visible on the silver chart. See below MCX Silver chart.

You can see on above chart, silver is looking bullish for one-two weeks. If silver cross and close above 45,504 level then it will kiss 50000 level in few trading session. Let’s talk about this week, silver is looking strong and will kiss step by step 43751-44337-44997-45504. Where should I take position on silver? Sorry, I will say to subscribers with stoploss.

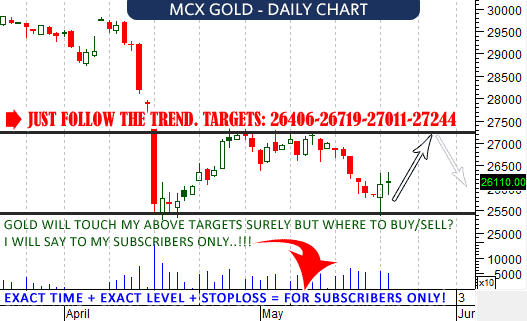

See above the gold chart and it is beginning to display a bullish hook. As I mentioned on above chart, just follow the trend. More information about Gold for subscribers.

For smart traders beck is enough: since late 2012 the S&P 500 has been on a nonstop rise, while gold has gone the other way…

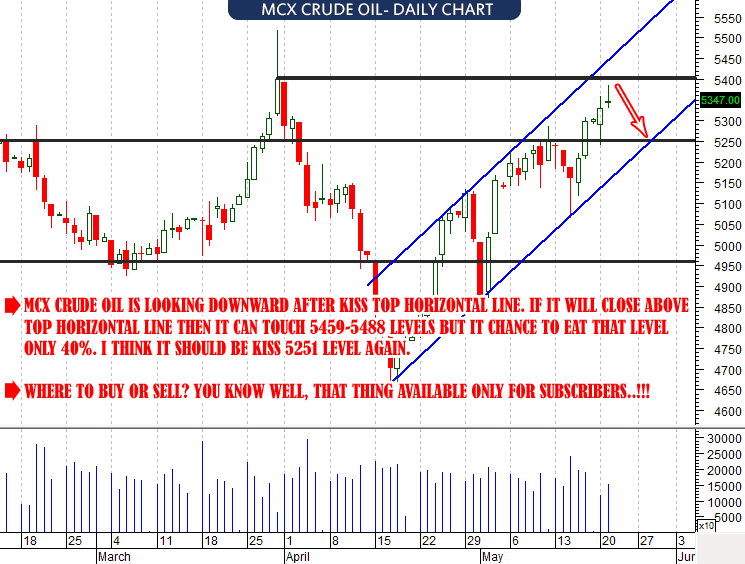

See below MCX Crude oil chart and get the future!

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

i want to say you again ..sir your last gold call was excellent..you update today, gold silver is good and see it is moving upper side. are you god of commodity market? you’re great! thank you!!!

Is there any monthly package please