The first week of the month is always the most interesting, with global purchasing managers indexes, U.S. ISM’s, and employment data released. Overnight we see continued weakness in Europe’s economic data and perhaps some more “green shoots” in China. Europe is sporting “beige shoots” at it is reaching the stage where things are so bad it is difficult to go down further.

- Euro-zone manufacturing activity contracted for the ninth consecutive month in November, albeit at a slower pace than in October. Markit’s Eurozone manufacturing Purchasing Managers Index (PMI) rose to 46.2 in November from October’s 45.4, though it stayed below the 50 mark dividing growth from contraction for the 16th straight month.

- The new export orders index was revised up to 46.4 from the preliminary reading of 45.9 two weeks ago, and it now reads more than a full point higher than the October reading.

- Manufacturing accounts for around a quarter of the euro zone’s private economy and is dwarfed by a services sector that fared badly in November, the data two weeks ago showed.

China seems to be “recovering” not due to the private sector, but government led:

- The final reading for the HSBC Purchasing Managers’ Survey (PMI) rose to 50.5 in November from 49.5 in October, in line with a preliminary survey published late last month. It was the first time since October 2011 that the survey crossed above 50 points, the line that demarcates accelerating from slowing growth.

- An official PMI survey of China’s non-manufacturing sectors also ticked up, to 55.6 in November from 55.5 in October, led by expanded activity in construction services. But growth in air and rail transport and food and beverages both slowed.

- Growth accelerated for large firms for the third month in a row, but medium and smaller companies saw a retrenchment, with the decline more pronounced for the smaller firms, the NBS said in a not accompanying its official manufacturing PMI survey. “The improving numbers are mostly because of government investment,” said Dong Xian’an, economist with Peking First Advisory, referring to the official PMI.

As for the U.S. we have ISM Manufacturing this morning at 10 AM; consensus for 51.7 – flat with last month. Construction spending also hits at 10 AM – expectation 0.4% growth.

Wednesday ADP employment which hopefully with some recent changes is “somewhat” closer to government data on a month-to-month data (before revisions) – expectations of 125K versus 158K. Sandy should be an issue. ISM Non Manufacturing, expectations of a drop to 53.6 versus 54.2.

Friday is the much watched (Jack Welch) employment report – expectations of only 80K versus last month’s 171K, again Sandy impacts here. Unemployment rate expected up to 8.0% versus 7.9%.

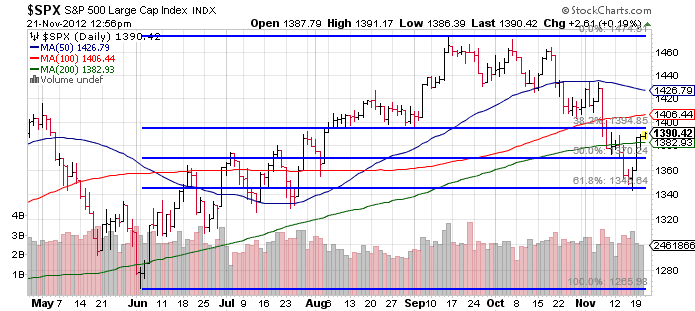

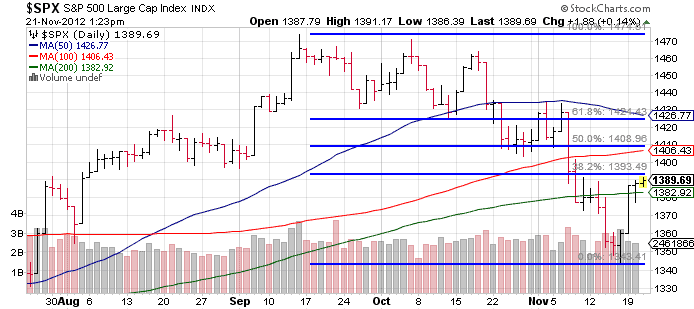

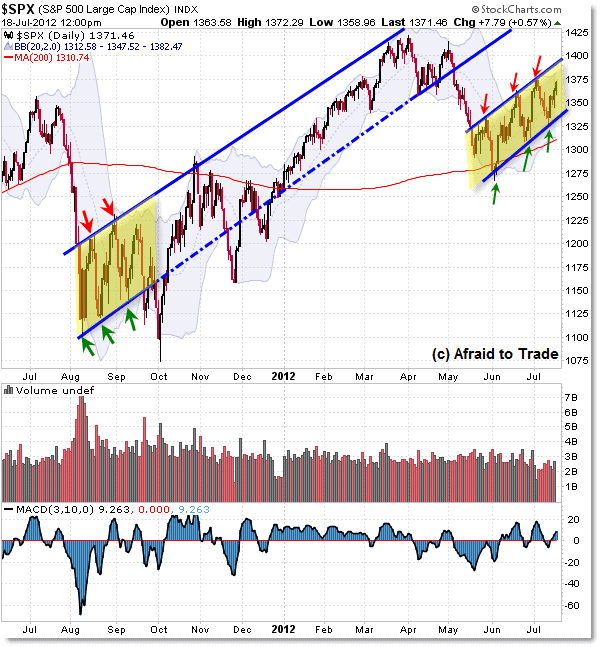

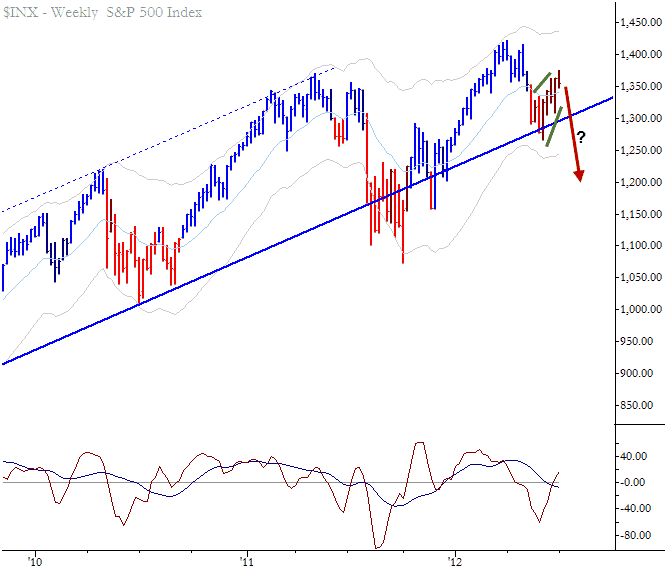

As for the technical picture, we have a gap up this morning on any myriad of “positive” news items – China PMI (despite China stock market falling yet again), European PMI not getting worse (European markets acting WELL), or Spain asking for bailout funds for its banks (no surprise, but algos read the headline and futures popped). Evidence continues to mount for a continuation of an inverse “head and shoulders” bottom move; if this continues there should be a move to the mid 143os to upper 1440s (depending on what you use for the head and neckline – up for some interpretation). Now if that happens this would create the first “higher high” in the S&P 500 since the correction began in mid-September, but if that is all the move has in it would be a particularly nasty spot to reverse since everyone would say “a new high” and the trend is changed. But we’ll see – this market has become famous since 2009 for “V shaped” moves that continue in one direction (not the boy band) without relent so the talk of “performance chasing” and “underinvested longs” and “repeatedly scarred shorts” should be relentless over S&P 1435.

At the time I write this the S&P 500 is gapping up to the 61.8% retrace of the entire two month correction. As posted Friday, the ability for the market to move sideways to consolidate gains was a positive – so the corrections in this move up have come mostly via time rather than price.