Next Points for Nickel Bears

Nickel’s Crucial Level is 815 price. Breakout of 815 can generate massive selling pressure. It can be up to 806 – 800 – 792.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Aluminum Still Weak, Qrtly, Mthly, Wkly Charts

Aluminum’s price dropping since October beginning. We may see more downward movements in upcoming trading sessions. It can be up to 138.6 – 136.8.

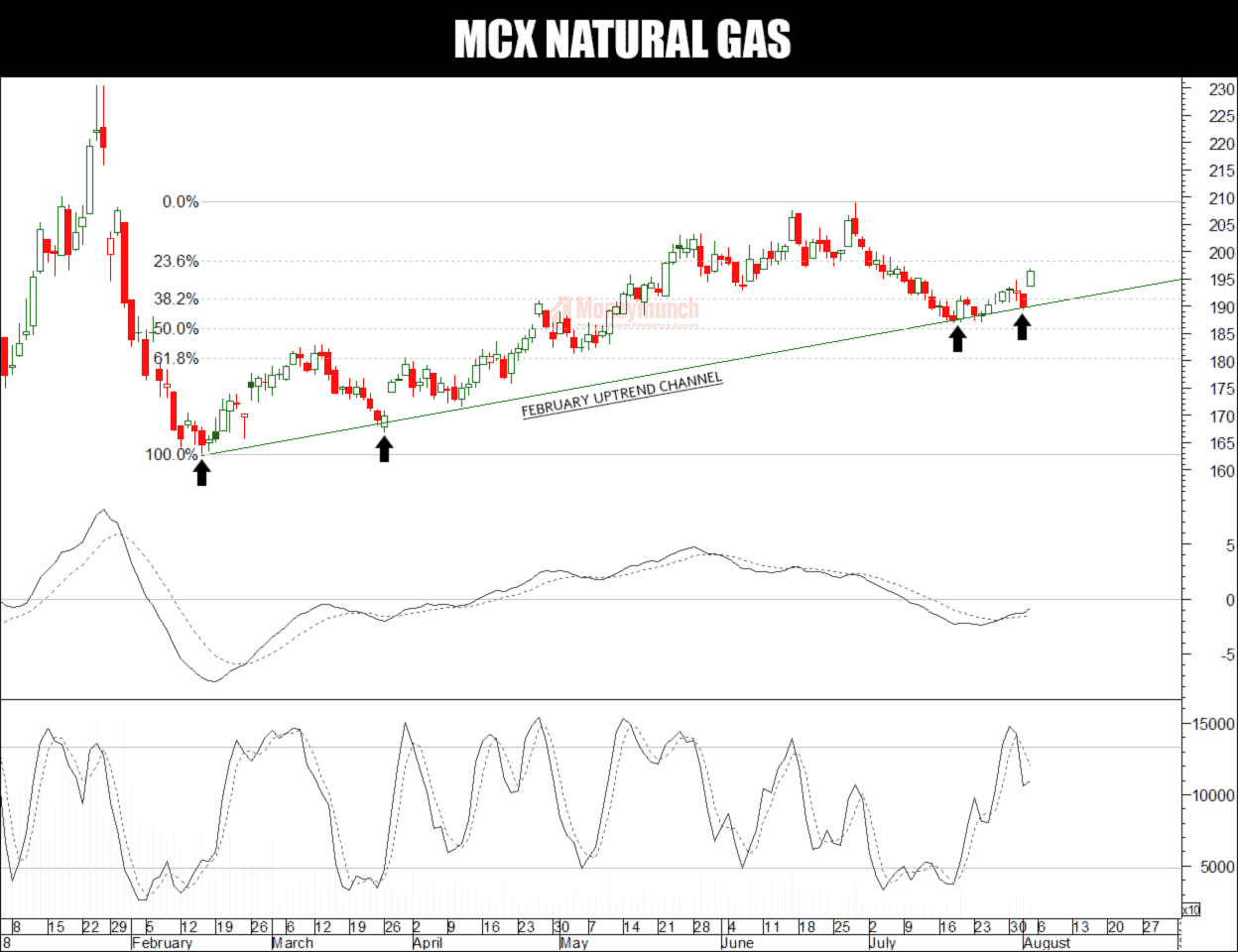

Will Natural gas Follow Historical Patterns?

Natural gas will touch 400 level. Further information will be updated soon.

Crude Palm Oil’s Ultimate Confirmation

Crude palm oil (CPO) is underselling pressure. We will see the level of the following targets soon: 522 – 516 – 510

Lock

Lock