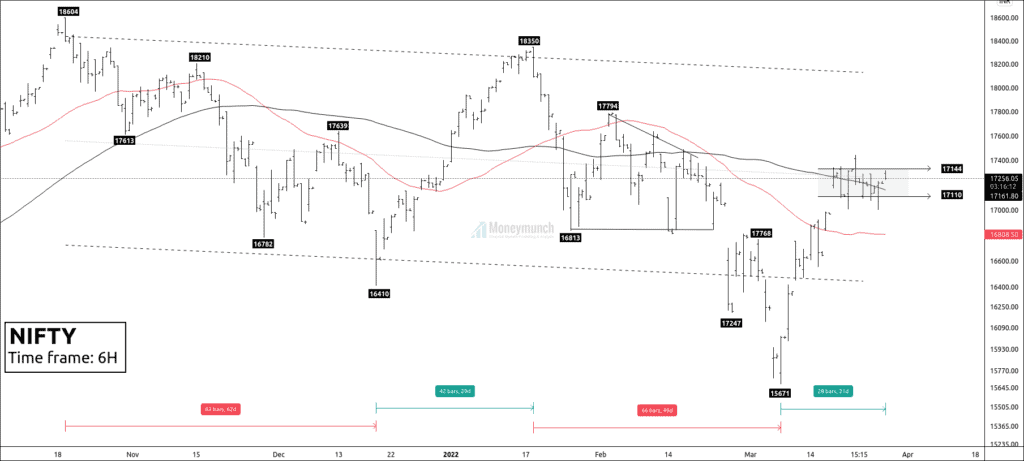

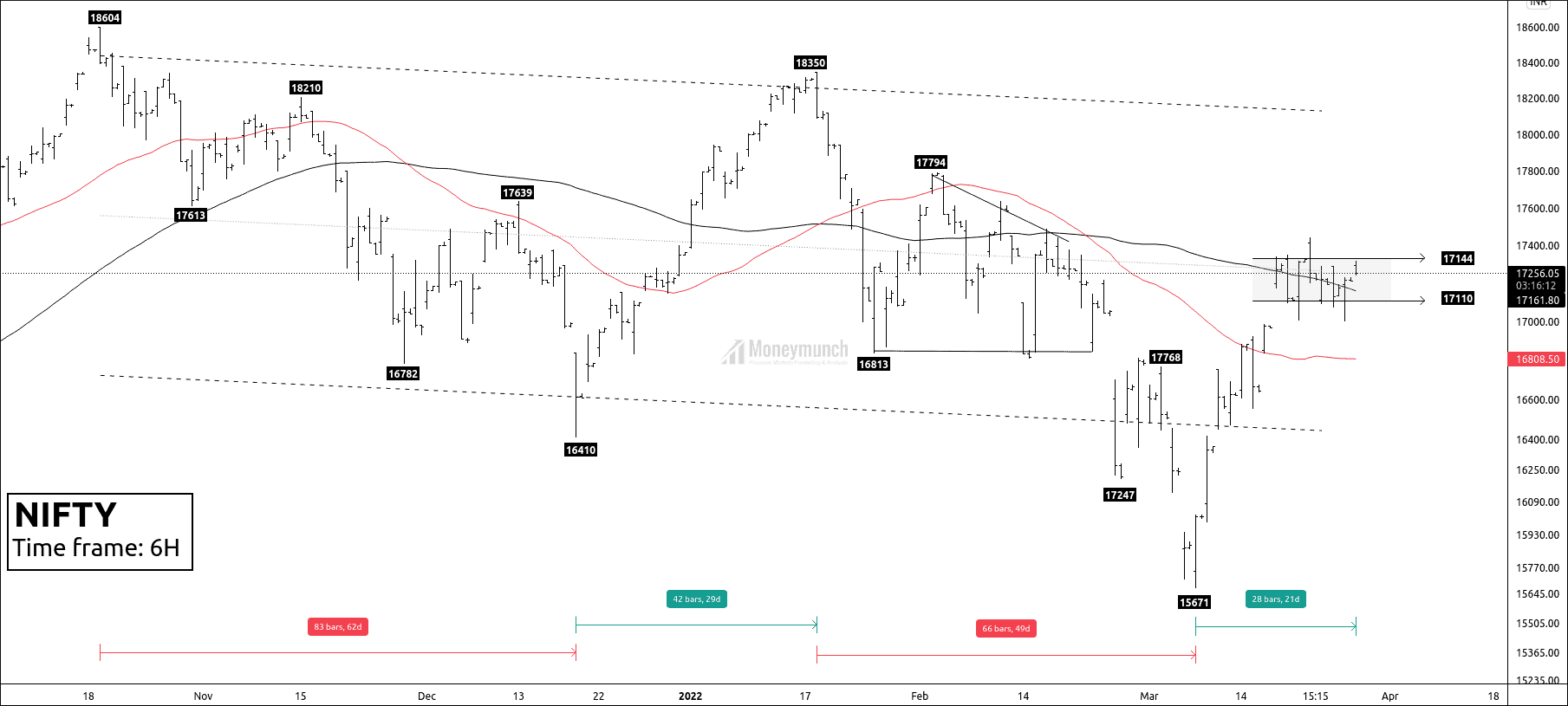

Nifty has been forming a downtrend channel for 140 days. After creating excess on the descending channel, the price has surged sharply.

Price surge stopped between the range of 17110 – 17144. It connotes that nifty can give a big move after the breakout of the parallel channel.

If the Nifty breaches the upper band, we can expect 17365 – 17562 – 1760.

The breakdown of the lower boundary can drive the nifty up to 17026 – 16955 – 16880.

Otherwise, nifty will be the value area until it breaks these levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

Sir nifty abhi consolidation karrahi he. and fake breakouts derahi he.

wow, very clear and crisp, understandable easily

very informative sir….thanks

Thank you for sharing sir. You calls are very accurate. Lets give a try to your paid service