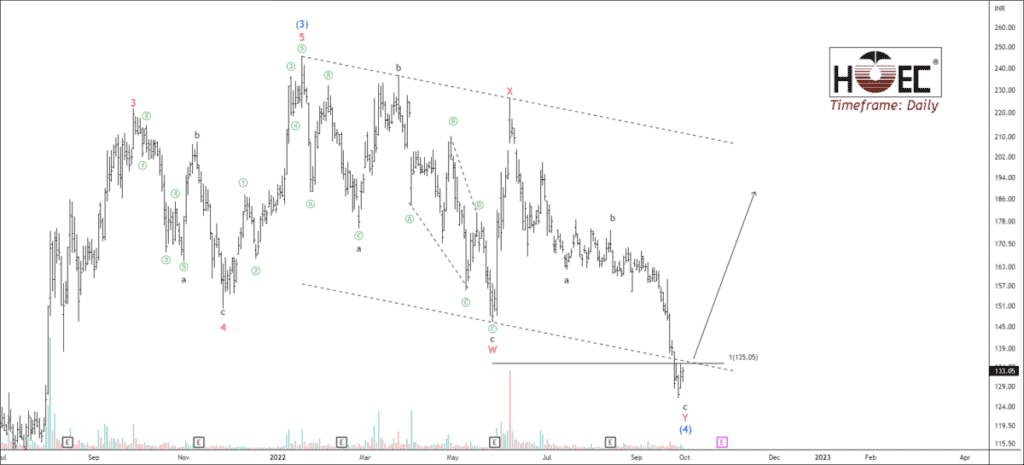

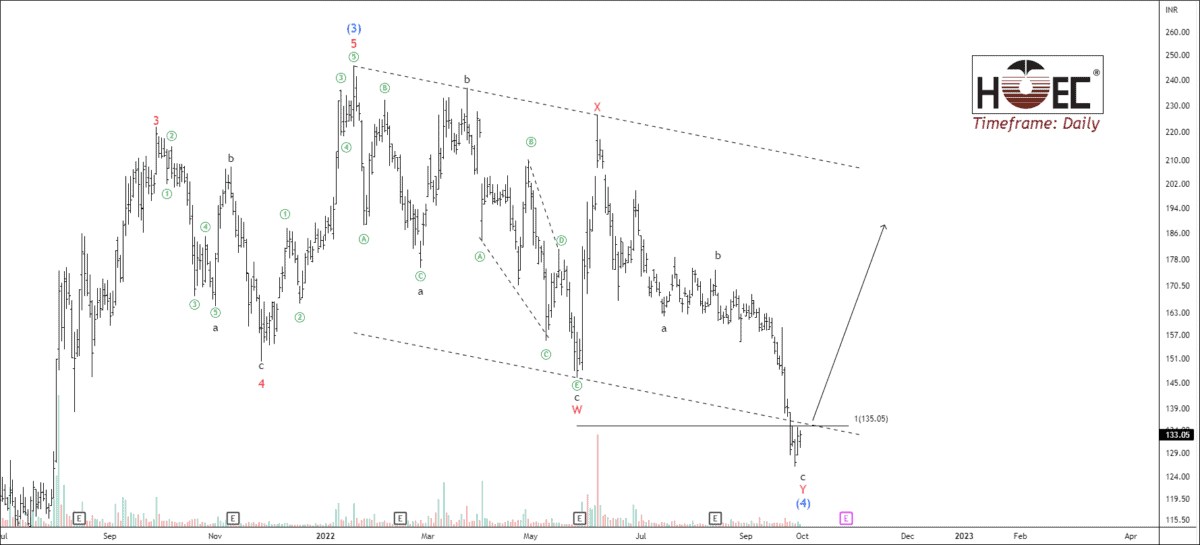

Timeframe: Daily

NSE HINDOILEXP had been forming double three corrections for more than eight months. Wave 5 has ceased to exist at 245.70.

Wave Y has traveled 100% Fibonacci extension of wave W. Therefore, Wave W = Wave Y. In this cycle, wave W is a basic flat, and wave y is a zigzag correction. Wave Y has crossed the low of corrective sub-wave 4 of a lower degree. The bulls couldn’t face the supply pressure. They ended up losing their momentum.

In this situation, traders should not be hasty to trade, but wait for the ideal entry. If the price sustains above 100% Fibonacci ratio at 135, traders can buy for the following targets: 142 – 163 – 176+.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Perfectly counted!

Sir 2 targets completed hogaye he. Maine bhi usme profit banaya he. :)

Please analyze NIFTY

Looks promising!

Nice work , thanks for sharing

I agree with your wave Counts.