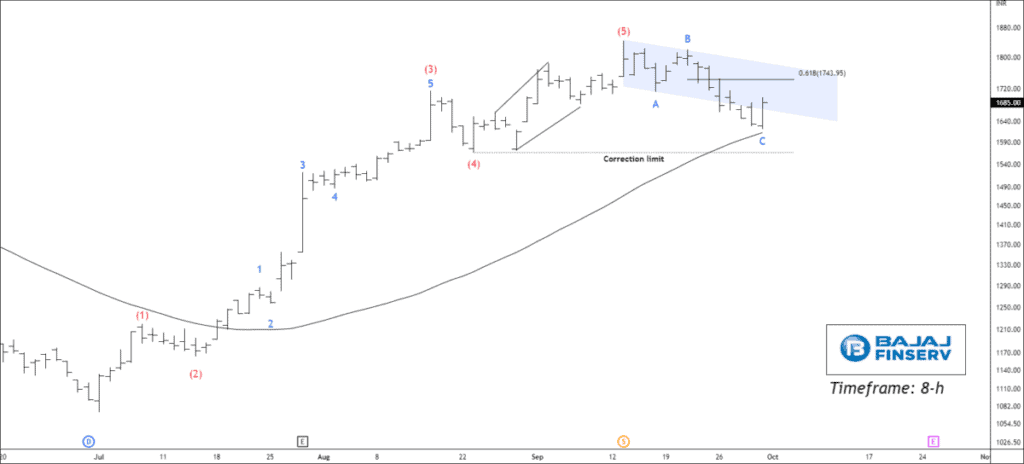

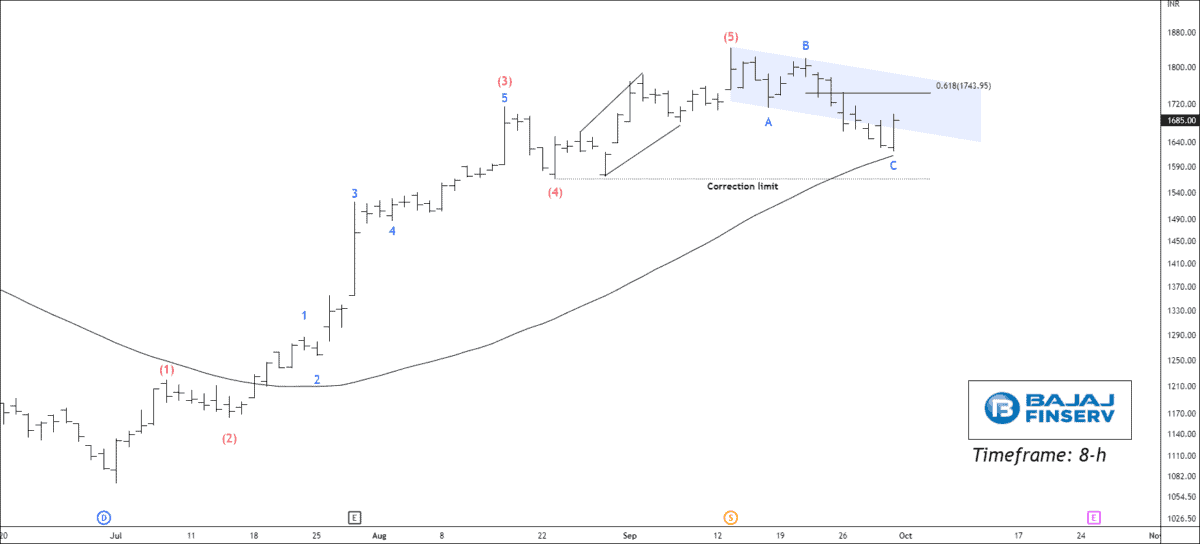

Timeframe: 8-h

Bajaj Finserv has accomplished the corrective wave C at 1621. Taking advantage of an impulsive structure with strict risk management can be beneficial.

According to the Elliott wave principle, Wave 4 can cease to exit in the territory of previous wave 4. The ending point of the correction is the starting point of an impulse structure. 50MA is also providing support to the unfolding impulse structure.

If the price sustains above 1676, traders can trade for the following targets: 1691 – 1720 – 1742+. After the breakout of 1743, traders should extend their targets to a new high.

Please note that a breakdown of the corrective channel will drive the price to 1566.

I will update further information soon.To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Beautifully counted wave structure. Keep it up!

Good Explanation. Keep rocking.

I agree with your calculations