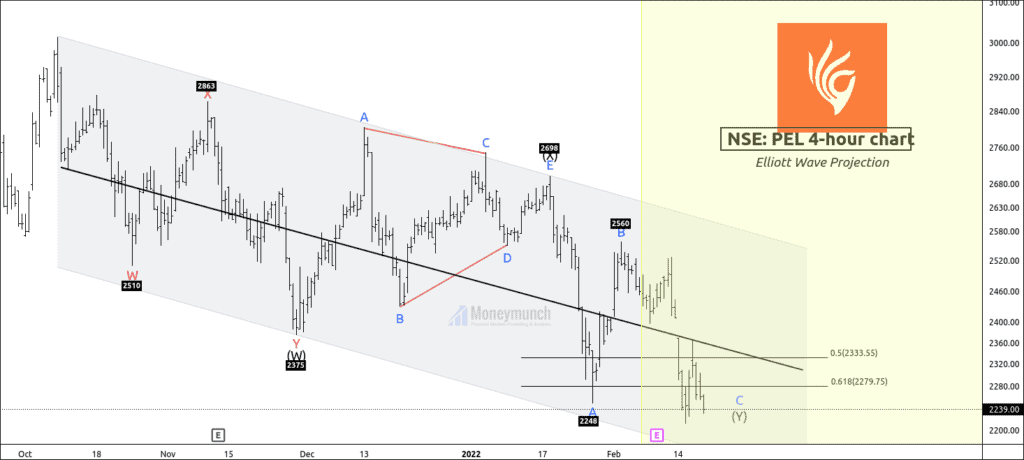

PEL: PIRIMAL ENTERPRISE

Before:

PEL has formed a double three corrective structure. Price had completed wave B of complex correction W-X-Y.

As the price formed in the downward channel and the Y wave was to cease, the price had bearish sentiments.

I had mentioned in clear words,” Traders can initiate short positions for the following targets: 2400 – 2376 – 2301 – 2279.”

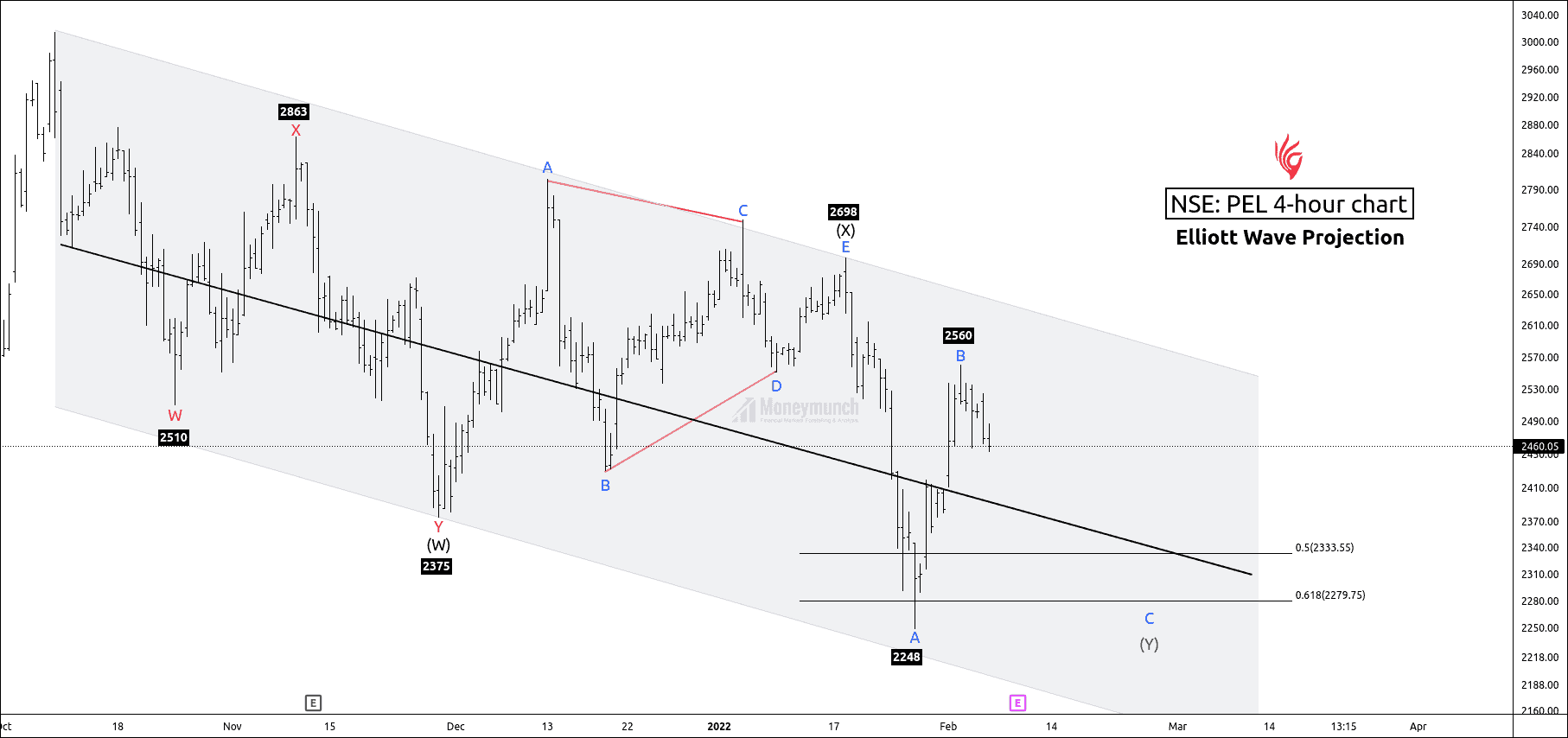

After:

8 February:

Price reached the first target of 2400 and made a low of 2996.

14 February:

Price reached the 2nd target at 2376.

Price reached the 3rd target at 2301.

Price reached the 4th target at 2279.

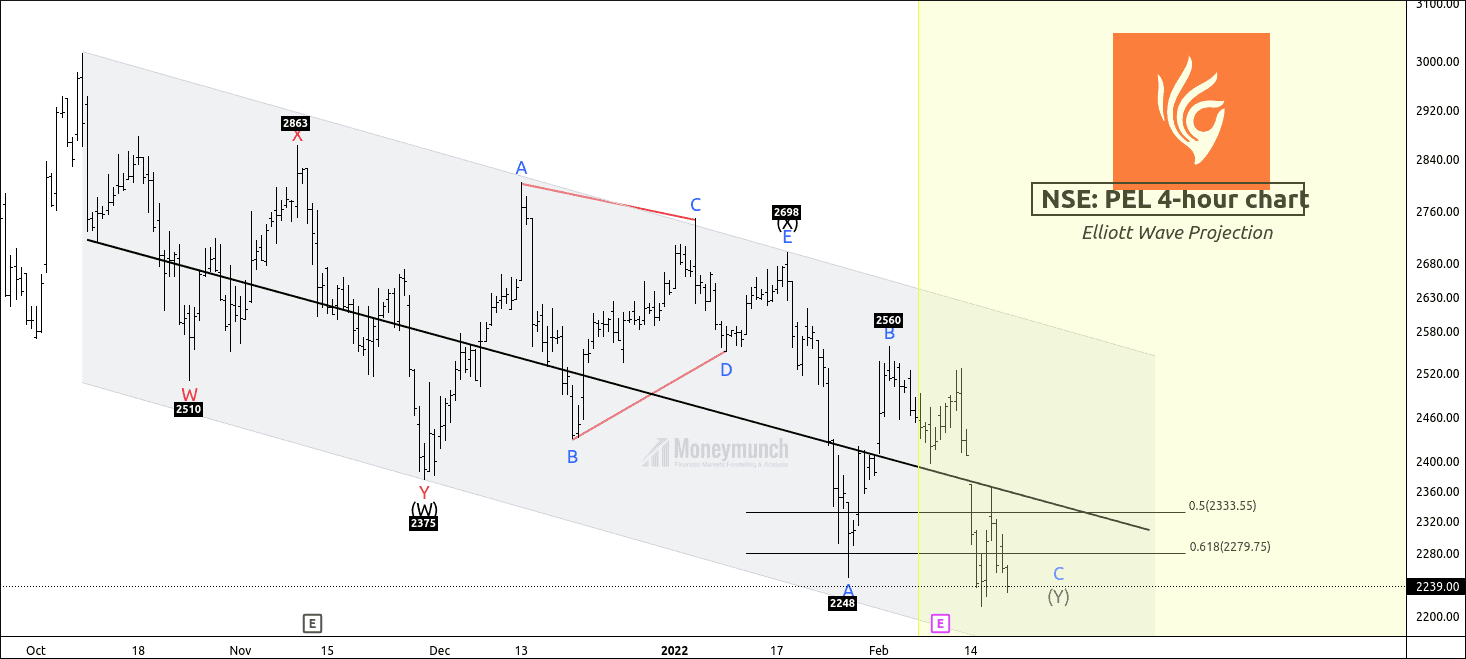

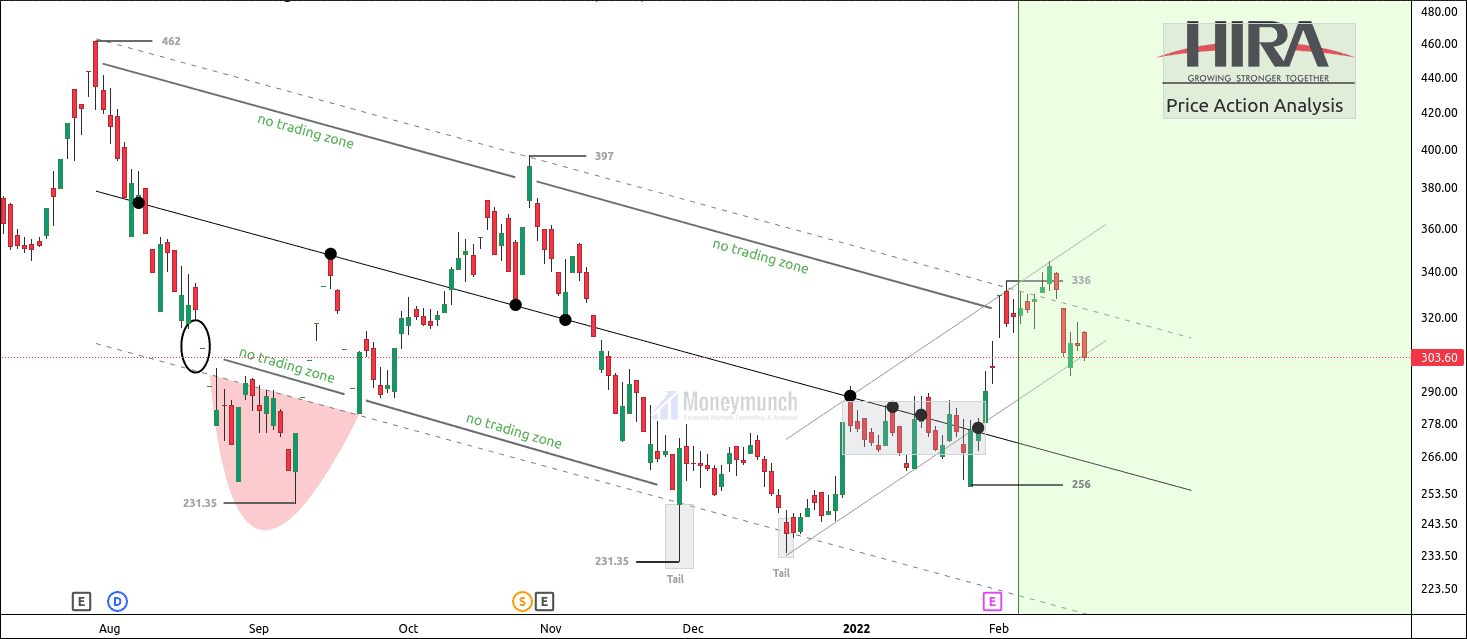

GPIL: Godawari Power

Before:

PEL has formed a downward corrective structure. Price was at the upper band of the parallel channel.

The upper-band indicates supply pressure where sellers exceed buyers.

The price has provided two successful rejections from the upper band.

GPIL had bearish the sentiments.

I had mentioned in clear words,” The trader can initiate a short position for the following targets: 313 – 304 – 290.”

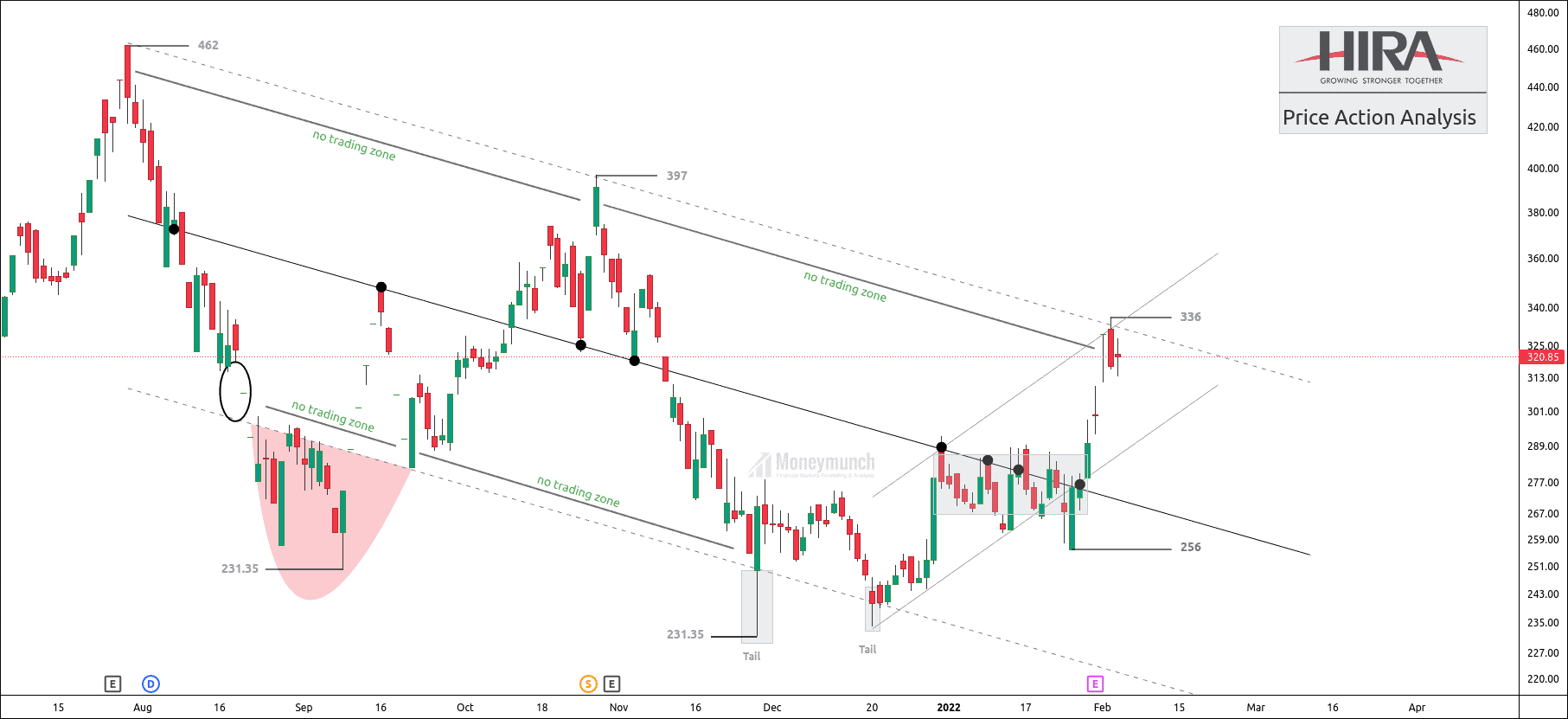

After:

At the upper band, the price couldn’t break the upper band of the parallel channel.

14 February: GPIL reached the First target of 313.

15 February: GPIL reached the second target of 304.

What’s next?

Price is at the lower band of the parallel channel. And if the price breaks down the minor parallel channel, it can travel up to the control line of the downward channel.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Thank you for sharing these analysis.

It help me to recover my minor losses. Looking forward for the upcoming charts,

Sir, I am interested in buying premium services.

Please guide me. Appreciate the hard work!

Beautiful work!