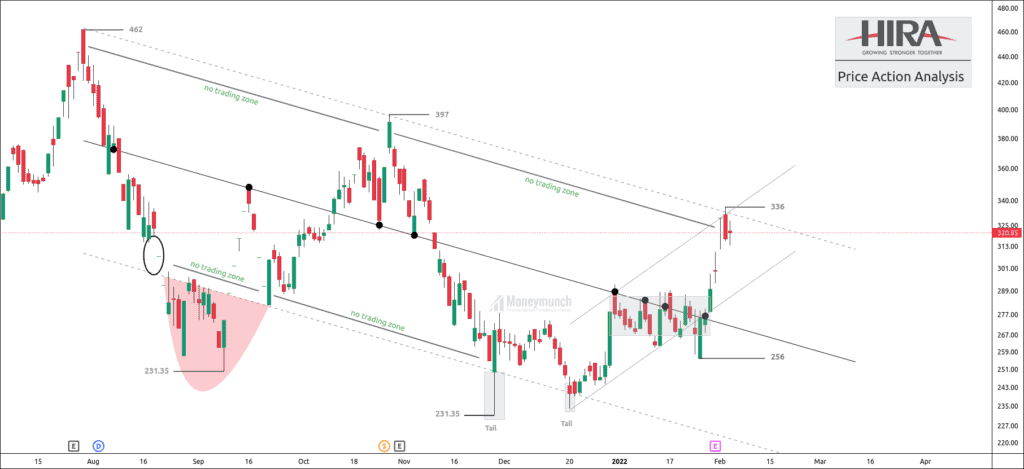

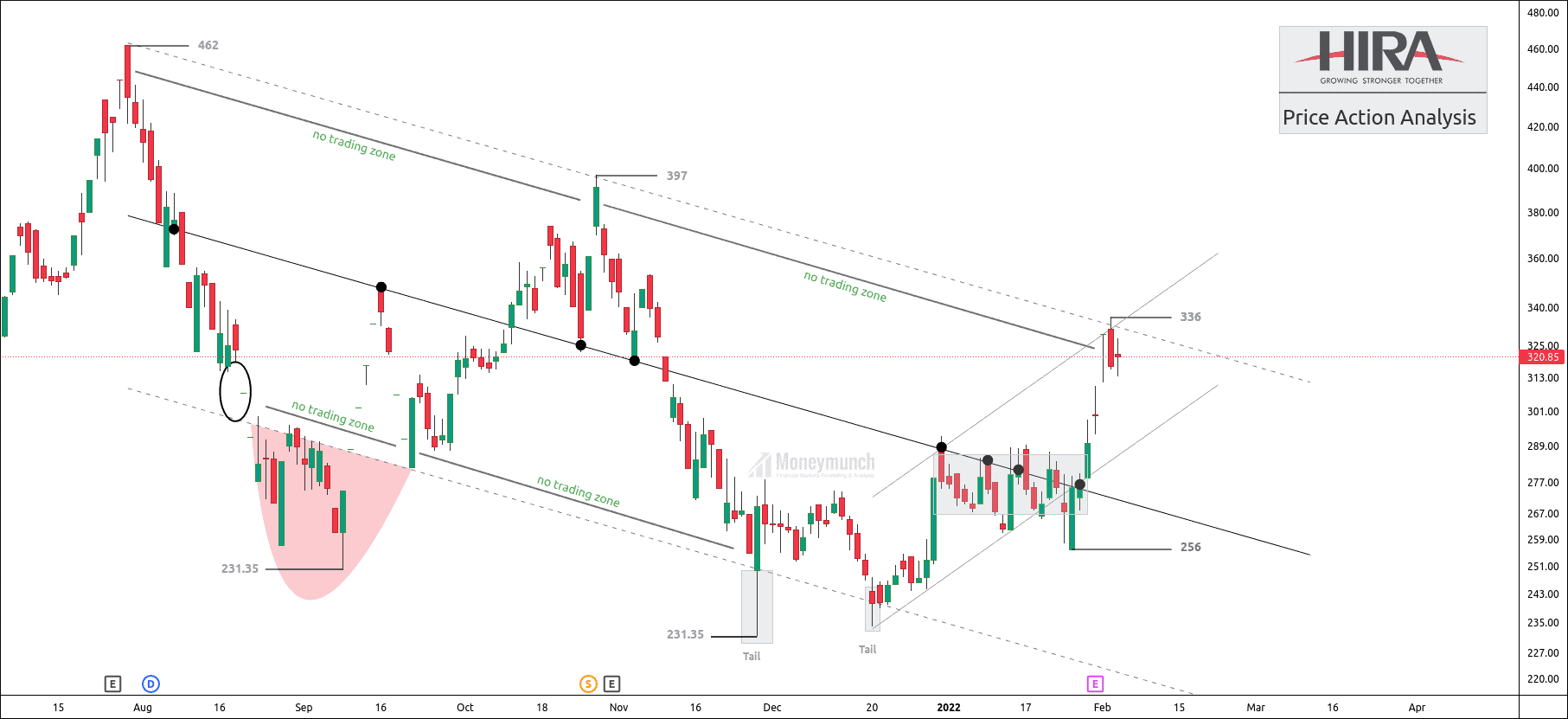

GPIL has formed a downtrend channel for the last six months.

Price has created 5 no trading zones. No trading zone is an area where trading activities haven’t taken place. It has constituted 2 excess on the lower band and 3 rejections, 2 rejections from the upper bend.

The control line has made eight touches.

Currently, the price is on the upper band of the parallel channel.

Don’t forget that price has provided two successful rejections from the upper band.

The trader can initiate a short position for the following targets of 313 – 304 – 290.

Invalidation: Breakout of the parallel channel.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Excellent Outlook.

Thank you for this chart analysis. I was waiting for this your opinion.

I think we can fully rely on this chart because technicals are clearly bearish, and it’s a good opportunity.

Good quality and good looking…

𝕾𝖚𝖕𝖊𝖗👌👌𝕰𝖉

Great one