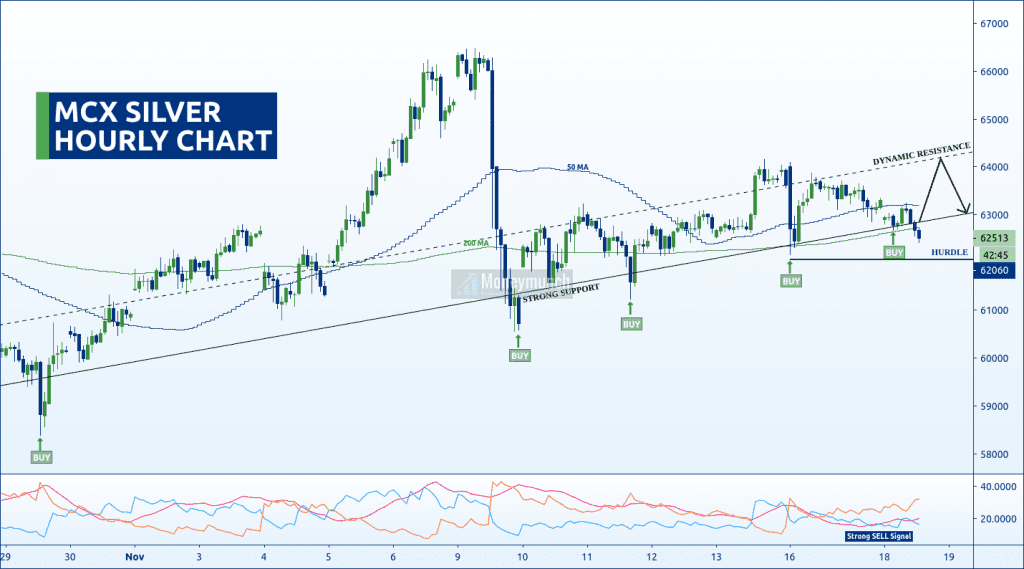

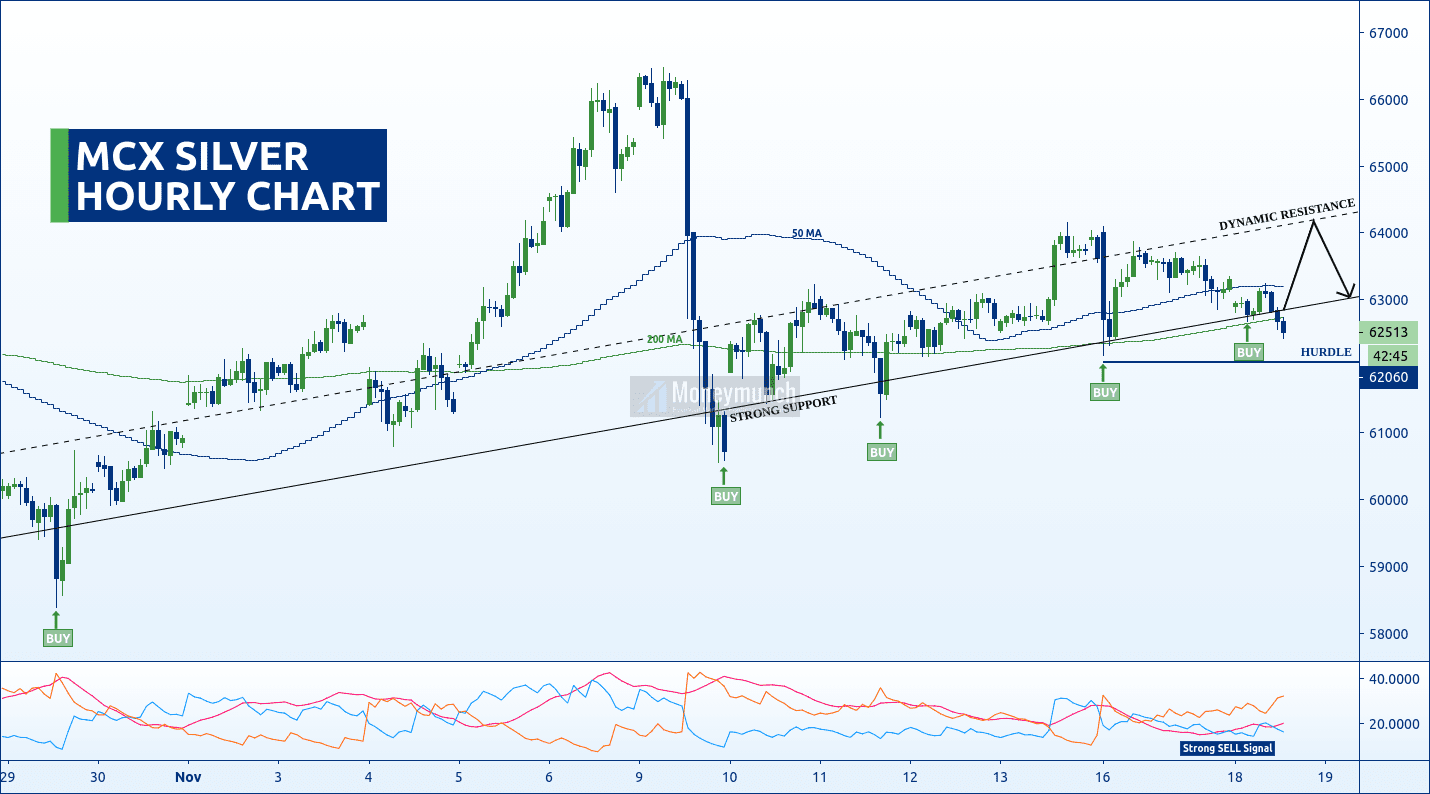

Silver is growing slowly. According to this chart, silver is trying to move upside from the strong support trendline. It’s a potential reversal point based on a support trendline.

Currently, it has broken a strong support trendline. We have chances to see a tail, fakeout, or excess here. That can be up to a hurdle. And the hurdle breakout is a direct sign of a downtrend.

After all, 200 MA is recommending further advance here. So, we can pick the silver mega lot for the targets of 63000 – 63360 – 63660 – 64000+.

Safe traders can wait for a 50 MA breakout before entering as well.

If You Own MCX Copper, Look Out Below

Click here: Copper detailed reports & tips

Click here: Copper detailed reports & tips

In that newsletter, I had written in bold words, “according to a moving average and parallel channel’s support trendline, copper is strongly bullish. It can show us an all-time new high before the end of this month. So, the day traders can buy for the levels of 536 – 540 – 556+“.

On 16 Nov trading session, copper has made a high of 551 and touched the first two targets.

Click here: Will MCX Crude Palm Oil touch the 900?

How many of you bought MCX CPO? I had written, “currently, MCX Crude Palm Oil (CPO) shows an uptrend. By following the ADX, we can say that the trend will rise because ADX is greater than 25 (ADX>25), and +DI is above the -DI. Let’s have a look at the volume. Volume spikes double of the average, so this also shows an uptrend, and it will go to the 900 – 920 – 960+“.

Currently, CPO is running nearby 926 levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Your trading alerts are intact. Hats off