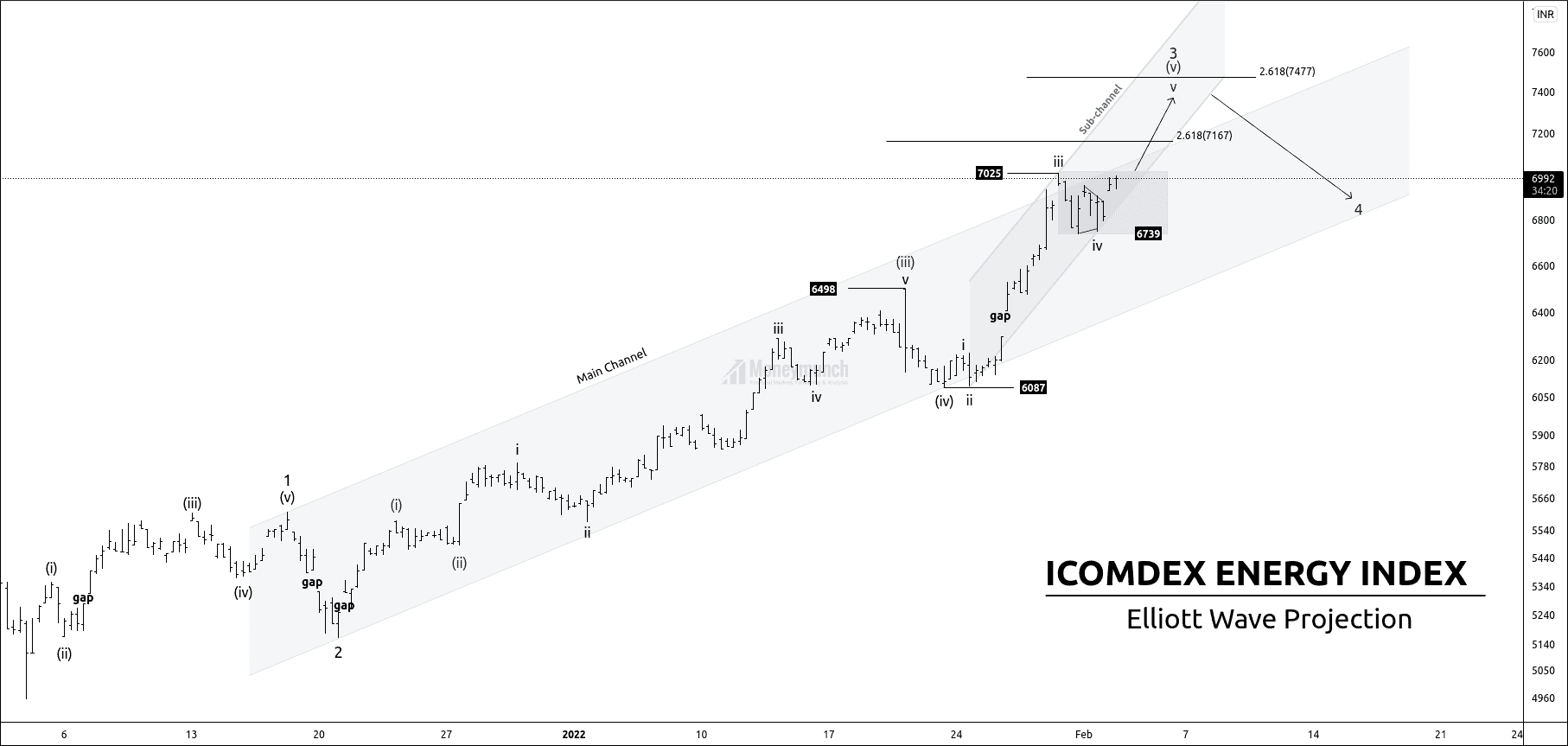

ICOMODEX Energy is forming an impulsive wave 3.

Price has finished the corrective wave (iv) of wave 3, and the price is establishing an impulsive wave (v) of wave 3.

Price is about to make the last leg v. If the price breaks the high of wave iii, it can make an upward move of 7135 – 7290- 7355 -7477.

After the accomplishing of wave 3, the price will fall and break the acceleration channel.

What are the turning points for the prices?

+ Wave 3 can finish at 2.618 (7477) reverse Fibonacci retracements of wave iv.

+ Wave 3 can finish at 2.618 (7167) reverse Fibonacci of wave (iv)

+ 3rd wave can end after the breakdown of sub-channel.

I will upload further information for intraday traders. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock