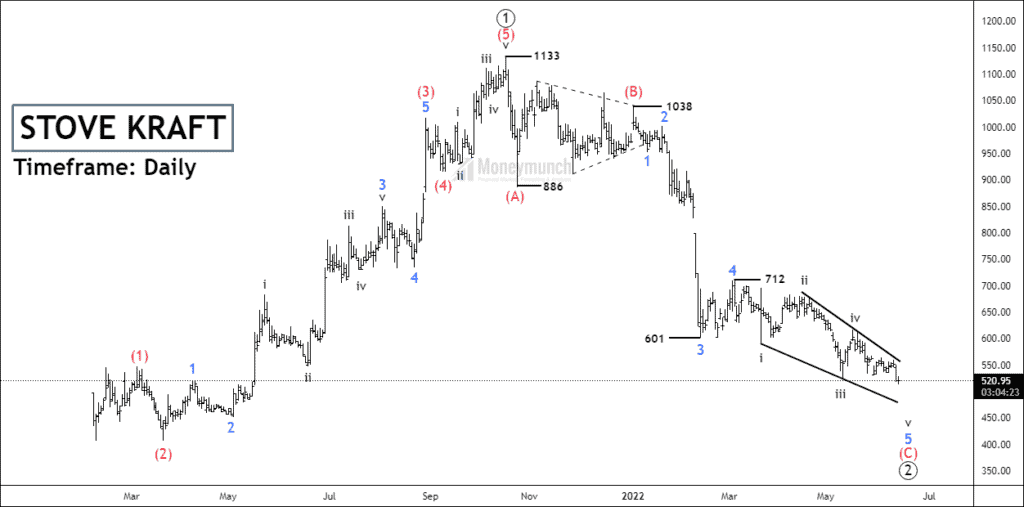

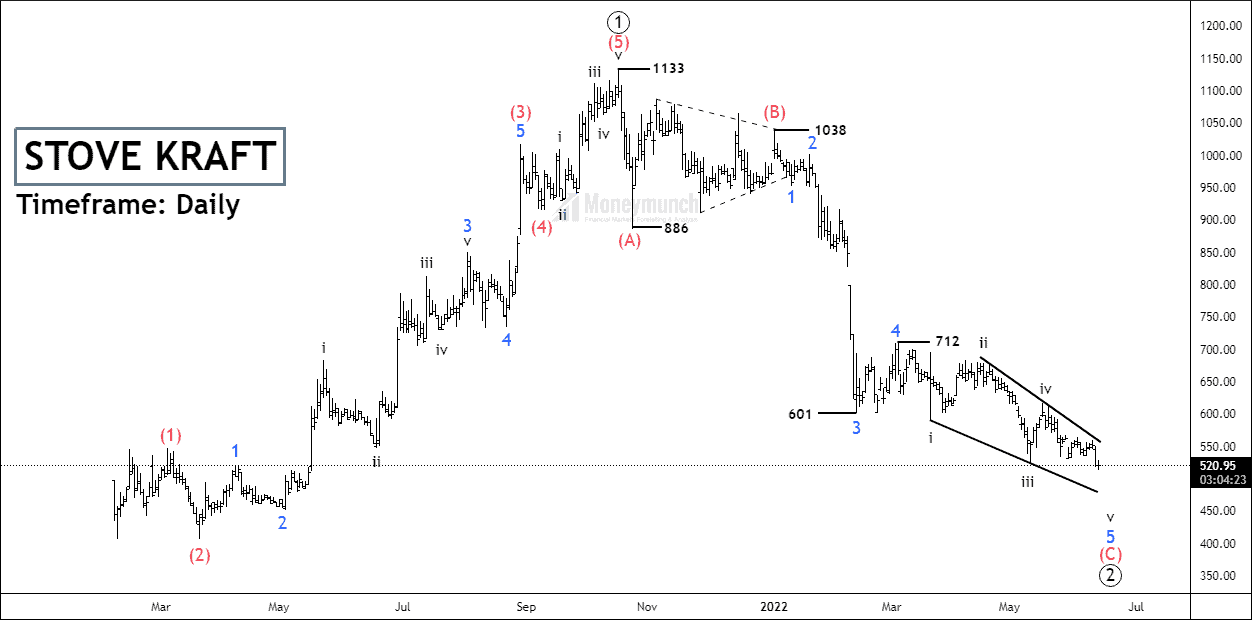

Over the past 7 months, Stove Kraft has formed a corrective structure.

In the present, we see the price has experienced a corrective sub-wave 4 and is forming a sub-wave 5 of wave (C) of wave ((2)). Wave 5 is an ending diagonal in which the price is falling for the final wave v of the ending diagonal. Price has made an all-time high of 1133.7 and started correcting the impulse structure.

Wave C can be accomplished between 480 – 475. The diagonal can provide confirmation to traders.

If price breaks out wave iv at 616, traders can buy for the following targets: 700 – 821 – 950+.

Otherwise, the price will continue to fall until it reaches a bottom.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.