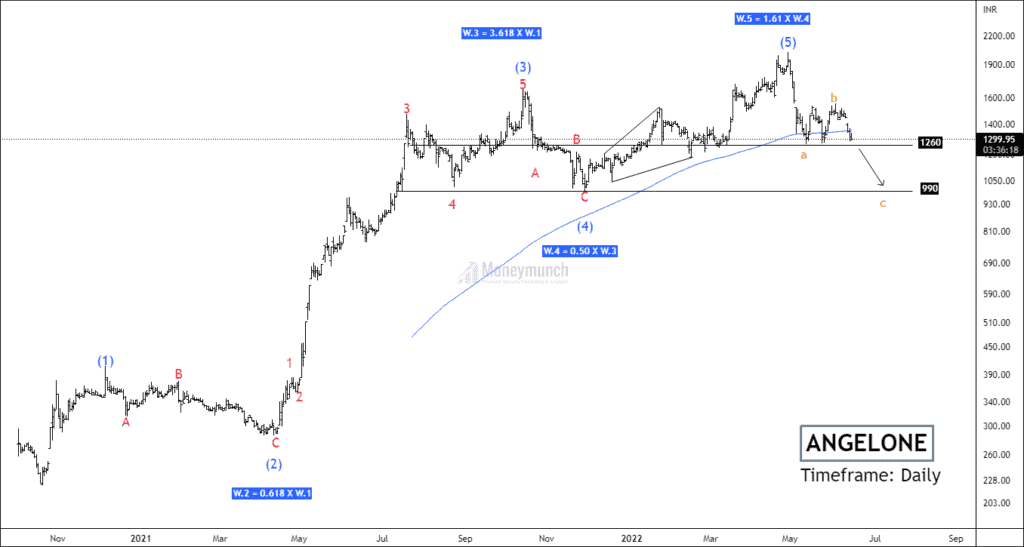

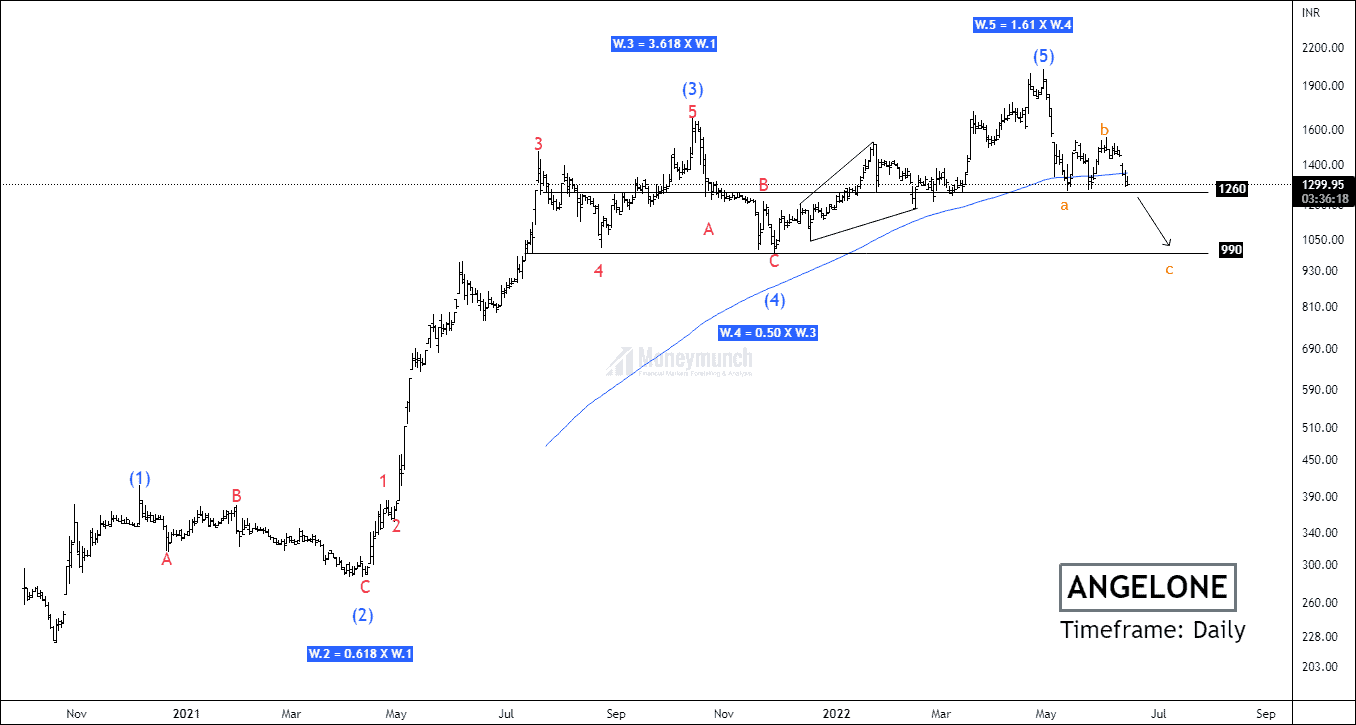

Angel one has accomplished the final impulsive wave 5 and is falling to correct the structure.

Calculations based on Fibonacci:

From the first wave at 201, the impulsive cycle began.

- Wave 2 has retraced 61.8 % of 1st wave at 286.

- Wave 3 has extended 3.618% of 1st wave at 1689.

- Wave 4 has retraced at 50% of the 3rd wave at 990.

- Wave 5 has advanced 161.8% of wave 4 in 2022.

Price has started forming corrective structure, where it occurred in wave b at 1555.

If the price breaks down the low of wave A, traders sell for the following targets: 1202 – 1123 – 1024.

Price has also broken down to 200 EMA, which is a bearish signal. Buyers should avoid this stock until the price breaks the high of wave B at 1555.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

I am totally agree with your analysis. Elliott wave is the best theory for swing traders as well as intra-day traders. I also traded your ONGC’s trade setup and have made 20k in just 2 days. Thanks a lot. waiting for upcoming premium call.

Brilliant idea and great explanation. I will surely wait for this signal. Thank you!

I have been watching your chart for over 7 months. I traded some of those signals and became profitable. I am glad that I have got my hard-earned money back with the help of your calls. Thanks a lot, moneymunch.

I am interested in buying your service but I hope the offer is active! Your trading tips are next level. I think its easy to make money from your service.

Ongc ke targets done hogaye. It was a good experience with my first premium call.

You recovered my premium plan fees in just 1 day after joining. I am satisfied with your team.