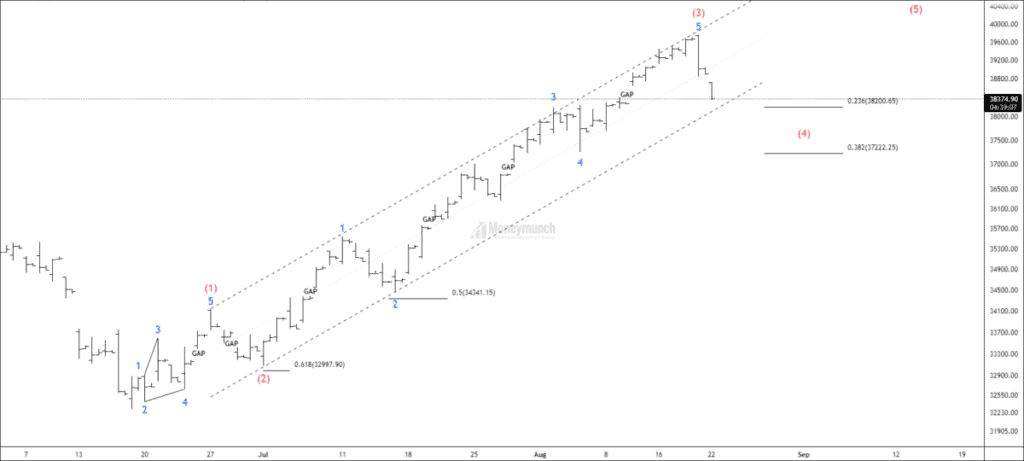

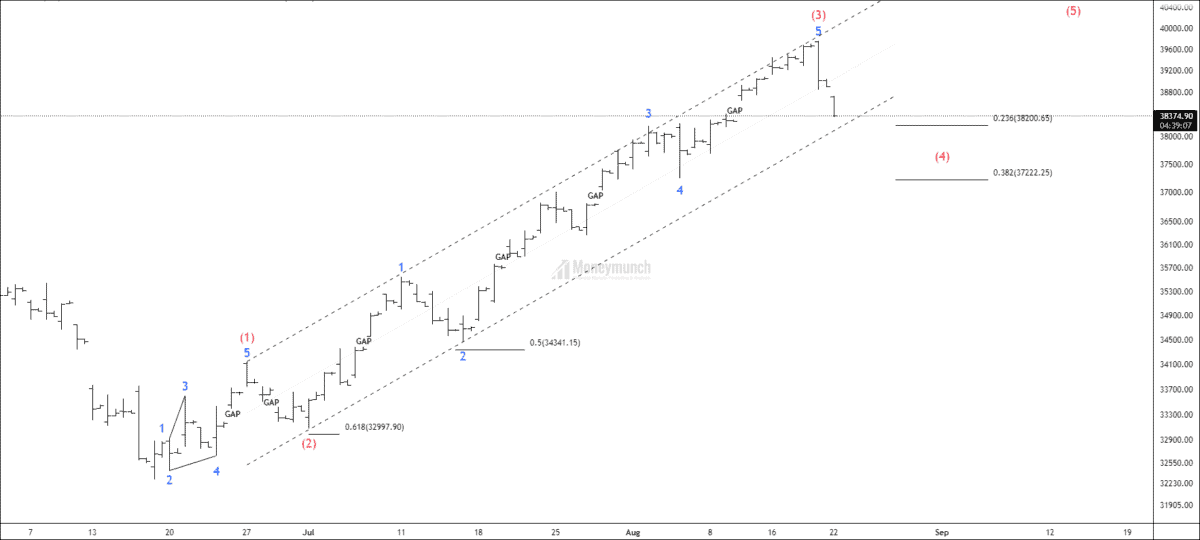

Banknifty has accomplished the corrective wave (3) and collapsed for the corrective wave (4). The acceleration channel shows the power of an extensive wave (3). Wave 3 is an extensive wave with the Fibonacci extension of 361.8% of wave 1.

It is critical not to overlook these two crucial points when trying to determine the ending point of wave (4):

- Banknifty is holding a significant support level at 38200. Breakout of this level will also break the acceleration channel.

- The common retracement of wave (4) is 38.2% at 37222.25. Moreover, this is the exact level where the previous wave 4 occurred. In most cases, the 4th wave ends near sub-wave 4 of lower degree.

After completion of wave (4), traders can ride for wave (5) for the following targets: 39000 – 39700.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Wow… you got very sharp eyes!

Nice work, Thanks for sharing

nice explanation..! thank you.