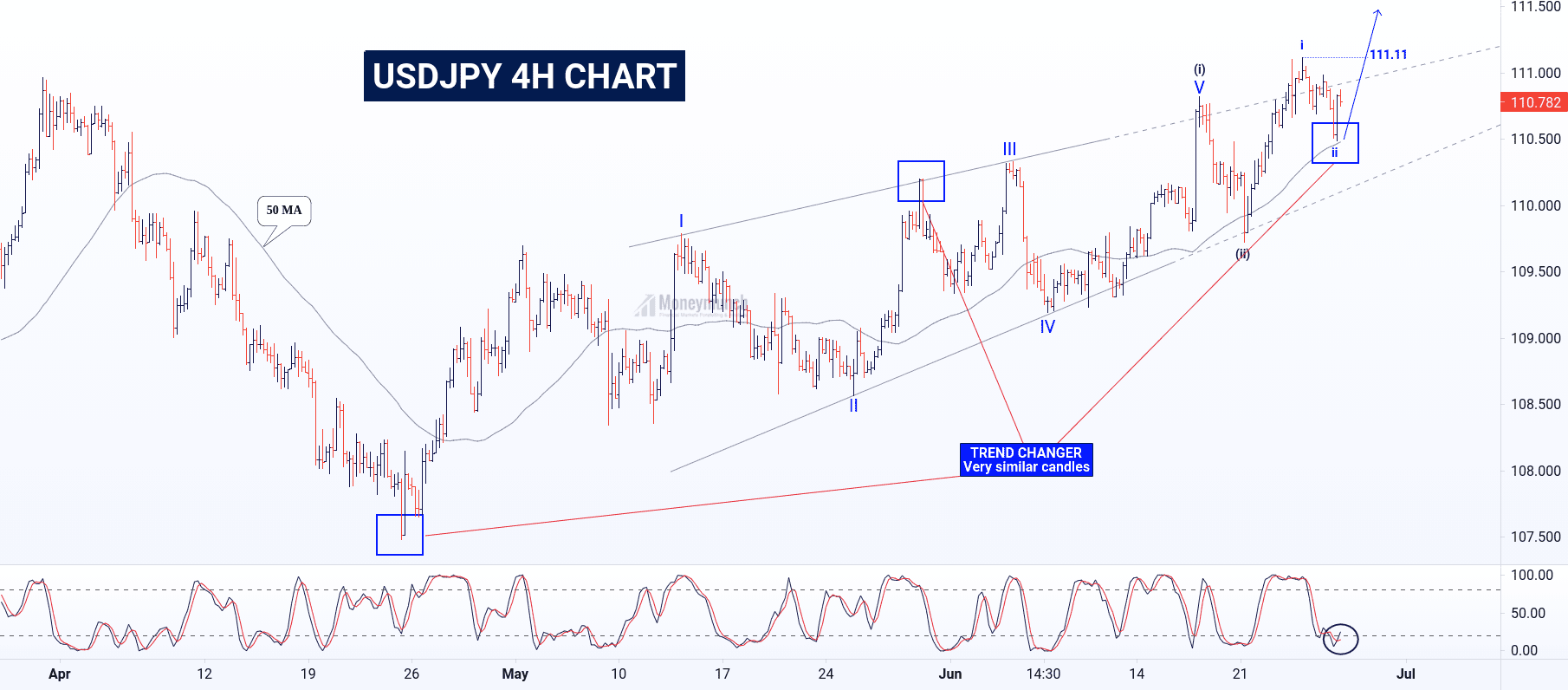

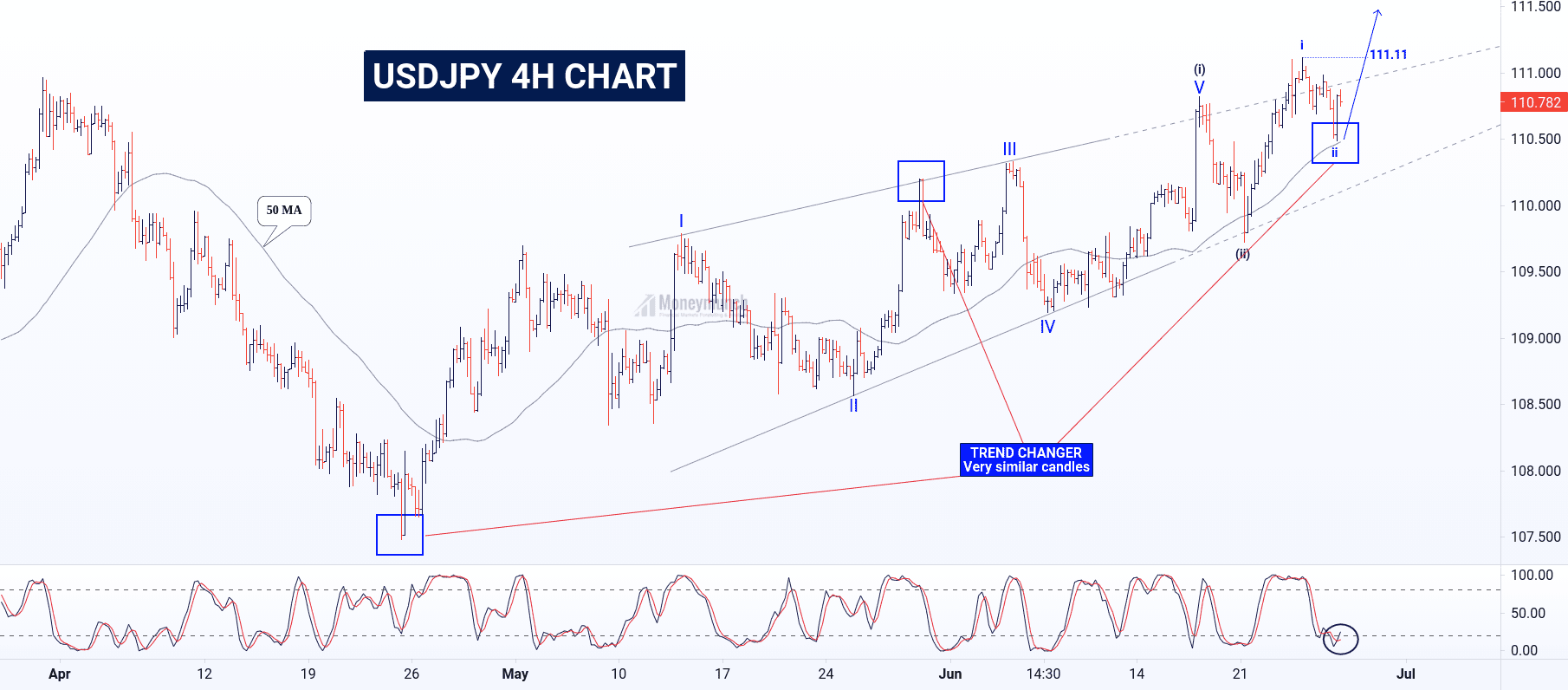

According to the 4H chart of USD/JPY, its uptrend can extend and touch the following target prices: 111.11 – 111.50

Invalidation: prices below ii or 50 MA.Continue reading

Access free trading tips and analysis on major forex pairs, cryptocurrencies, and Indian NSE currency tips. Stay informed and improve your forex trading skills with Moneymunch.

According to the 4H chart of USD/JPY, its uptrend can extend and touch the following target prices: 111.11 – 111.50

Invalidation: prices below ii or 50 MA.Continue reading

Gold (XAUUSD) and silver (XAGUSD) has crashed in the previous week. Gold has lost -113.585 points (-6.05%), and silver lost -2.14315 (-7.68%). Millions of CFD’s traders have lost money in that week.

According to technical analysis and fundamentals research, gold can decline more. Gold has broken the strong support trendline (01) and marching for 02. If it doesn’t close above to trendline of 01 in the first two trading sessions, it will be unstoppable through high selling pressure by speculators. And we will see the target price 2.

Technically, the most popular indicators are indicating a complete downtrend. And Stoch RSI is signaling for a reversal. So, it can pull back up to a retracement level of 38.2% or 01 trendlines. If that not happen, gold can lose 81.635 points more.

In the previous week, gold and silver were falls due to economic events and high selling pressures by speculators. For advance traders, watch significant releases or events that may affect the movement of gold, silver & crude oil.

Tuesday, Jun 22, 2021

00:30 – FOMC Member Williams Speaks

01:00 – All CFTC Speculative net positions

11:00 – Gold Index

20:30 – FOMC Member Daily Speaks

23:30 – Fed Chair Powell Testifies

Wednesday, Jun 23, 2021

02:00 – API Weekly Crude Oil Stock

18:30 – FOMC Member Bowman Speaks

19:15 – Flash Manufacturing PMI | Flash Services PMI

20:00 – Crude Oil Inventories

20:30 – FOMC Member Basic Speaks

Thursday, Jun 24, 2021

18:00 – Final GDP q/q | Initial Jobless Claims

Gold futures preparing to come at $1740 – $1750 – $1760. Day traders must wait for a breakout of the control price line before entering.

The uptrend will end whenever the gold spot price breaks strong support.

The chart above indicating a clear uptrend continuation. We may see sideways movement before it hits the top of the rectangle.

According to the Darvas box (rectangular formation), MCX gold will move upward gently this week. Hence, intraday traders can jump between the range of 45200 – 45300.

Targets: 45560 – 45680

If gold breaks the bottom of the rectangle, don’t buy. And wait for my next update on the gold.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Here, I have used MA, RSI, VOL, & DMI to identify the next move of Brent Oil. According to these indicators, it seems bullish ahead. We may see the following targets soon: $68.8 – $69.8 – $71+

But, if brent oil breaks the hurdle ($66.60) and shows a closing price below it, we will see a heavy downfall. Targets: $64.6 – $62.8 and below

What about MCX Crude oil? It looks downward for a short period. Look at the below chart:

MCX Crude oil can go down for a retracement value of 0.236 in the upcoming days. So, intraday traders can set the following targets to make some money: 4560 – 4500 – 4460 – 4400

But, if brent oil breaks $66.60 upside, then change your position for the following targets: 4800 – 4880+ To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

According to my Parallel Channel (B), short positions in the range of $106 to $106.5 or below with targets at $105 – $104.5 – $104.260 in extension.

Breakdown of Parallel Channel (B) means a big explosion and double confirmation for sellers. Day traders can take benefit easily by examining fake-out…

Three days ago, I had given a trading signal EURAUD.

Click here to read it → The Big Move In EURAUD May Be Right Now

The previous chart:

All targets of EURAUD has come.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.