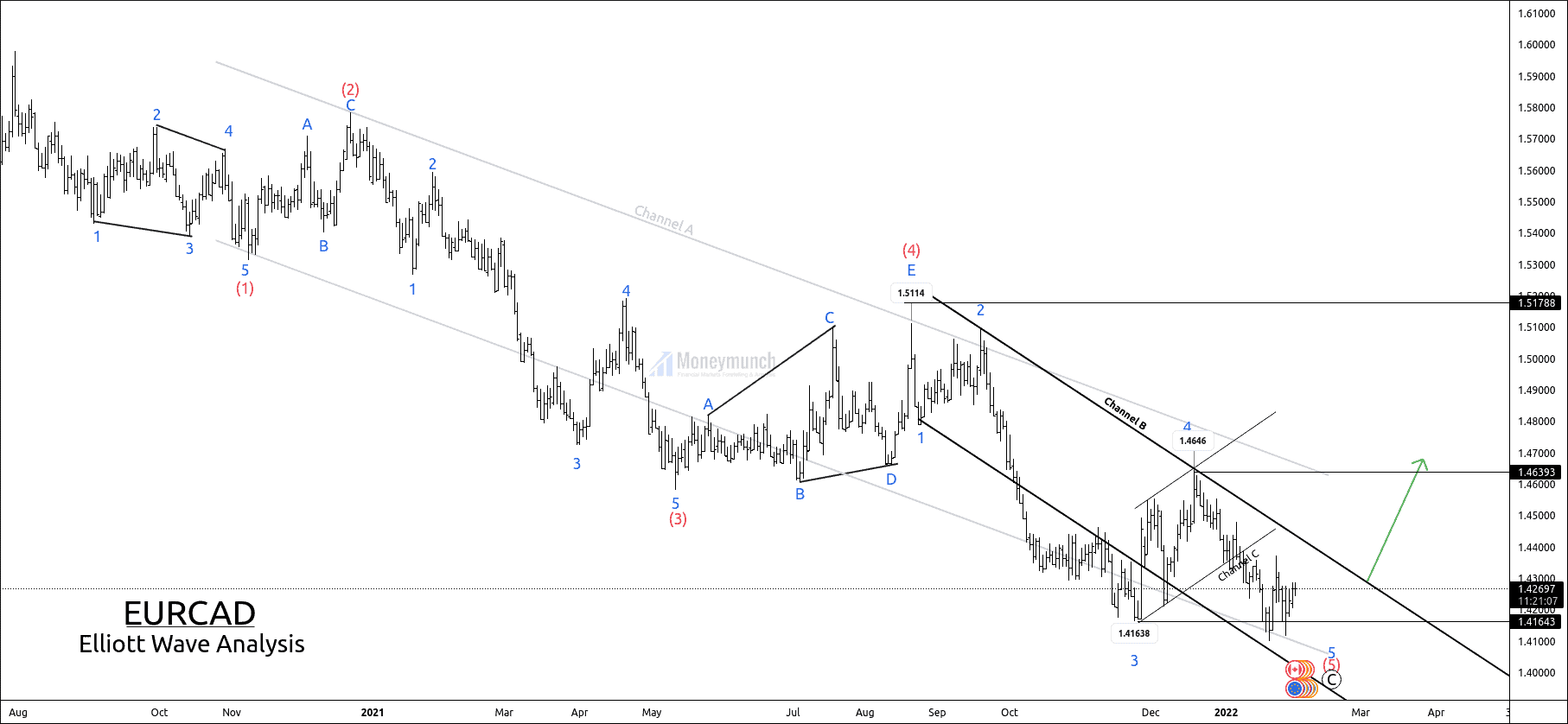

EURCAD is forming a downtrend channel.

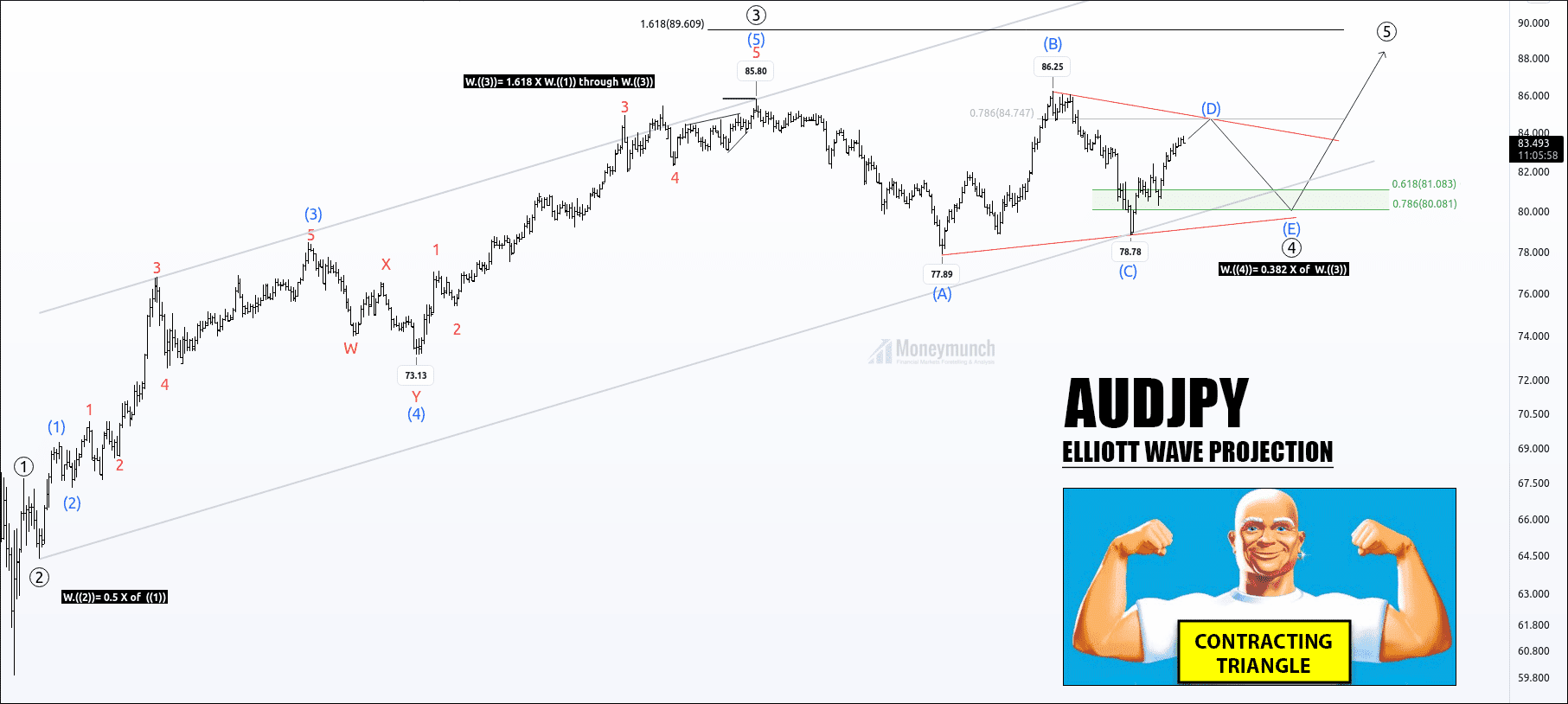

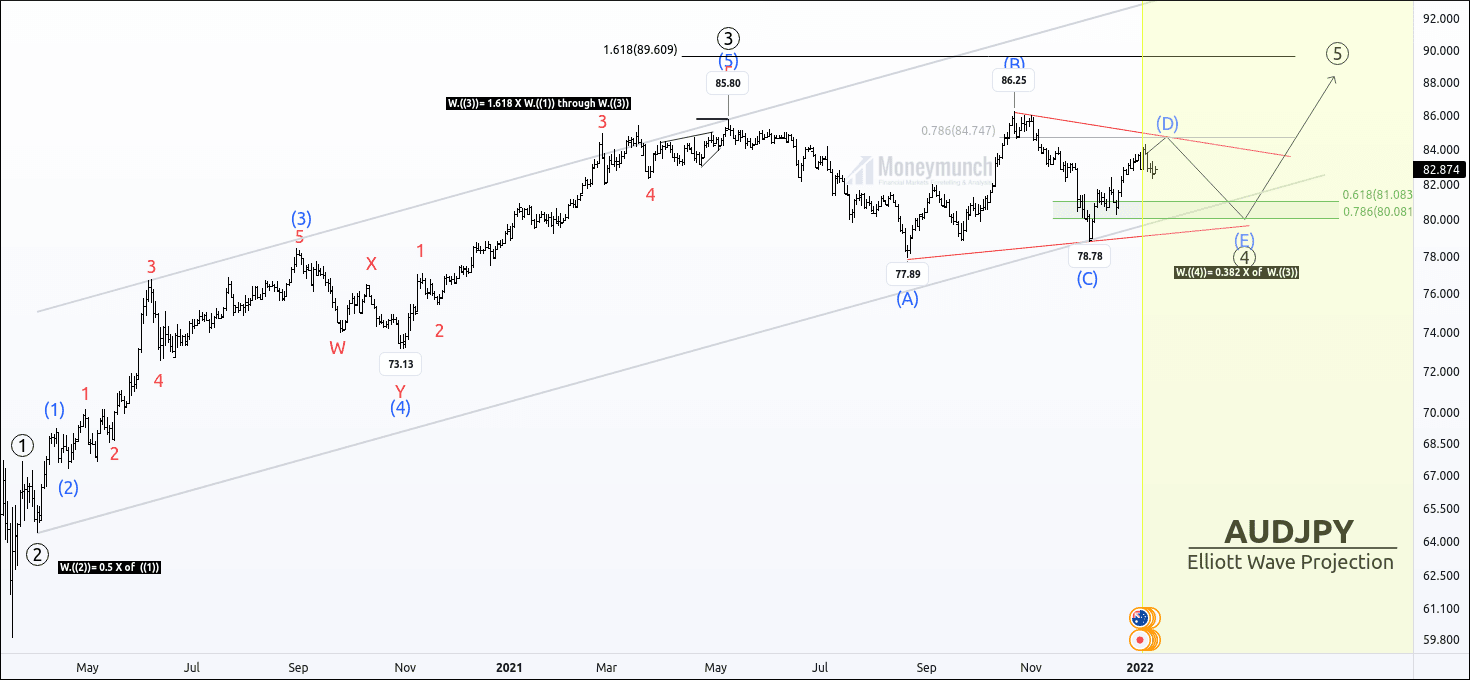

Price is establishing a final sub-wave 5 of wave (5).

In my previous idea, I have mentioned that, If the price breaks down channel C, the following targets for Wave 5 will be 1.4313 – 1.42520 – 1.41652- 1.41156.

Price reached all the targets of wave (5).

Click Here to Read previous article.

Currently, the price is heaving correction, but safe traders can enter after the breakout of the C channel.

After making wave (5), if the price breaks the B channel, it can go for 1.4377 – 1.4466 – 1.4569 – 1.4645+. And Price will start a new 5-wave impulse structure. Invalidation is available for premium subscribers.

Please note that without a breakout, trend changes may not be possible.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

Get free forex & currency ideas, chart setups, and analysis for the upcoming session: Forex Signals →

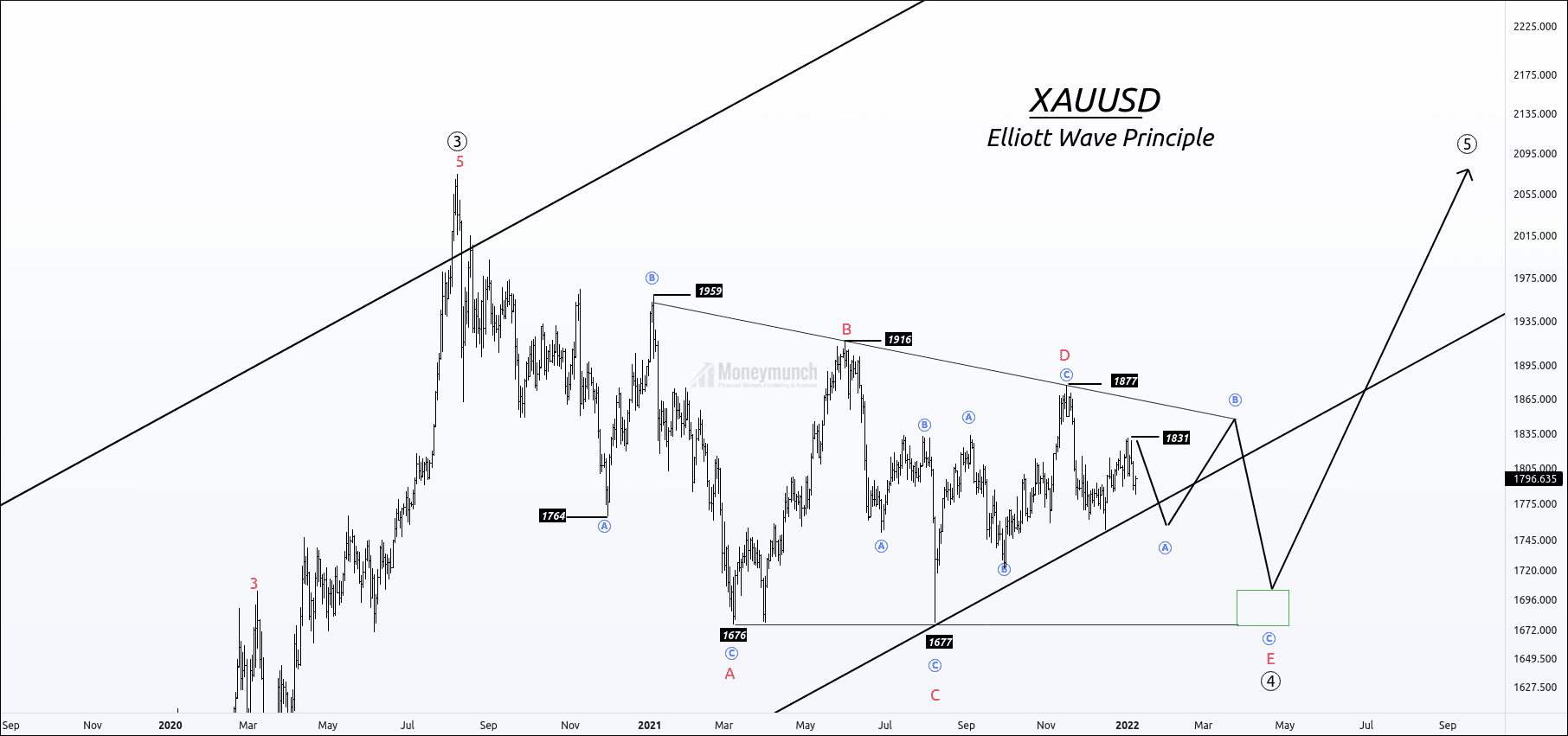

Want to get premium trading alerts on GBPUSD, EURUSD, USDINR, XAUUSD, etc., and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Forex Signals

Premium features: daily updates, full access to the Moneymunch #1 Rank List, Research Reports, Premium screens, and much more. You΄ll quickly identify which commodities to buy, which to sell, and target today΄s hottest industries.

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

Lock

Lock