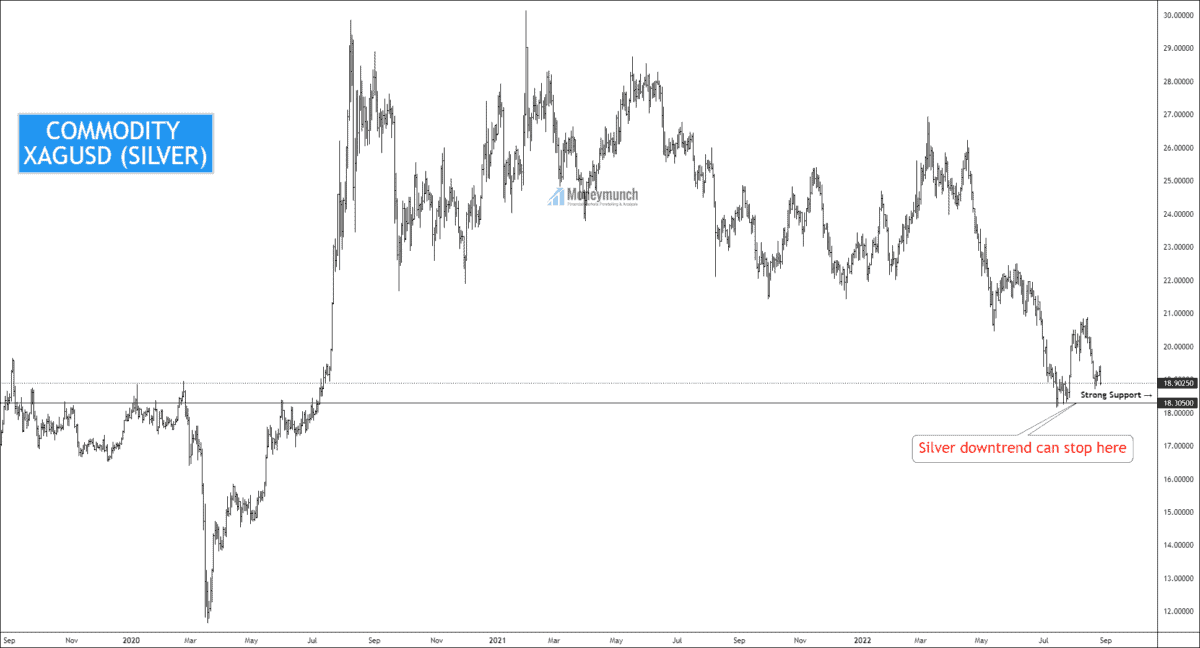

XAGUSD investors must fear to 18.305 level. At the current stage, it is strong support.

And if that happens with a breakout, be ready for the 17.00 and 16.00 levels because it’s a very crucial point for short-term investors.

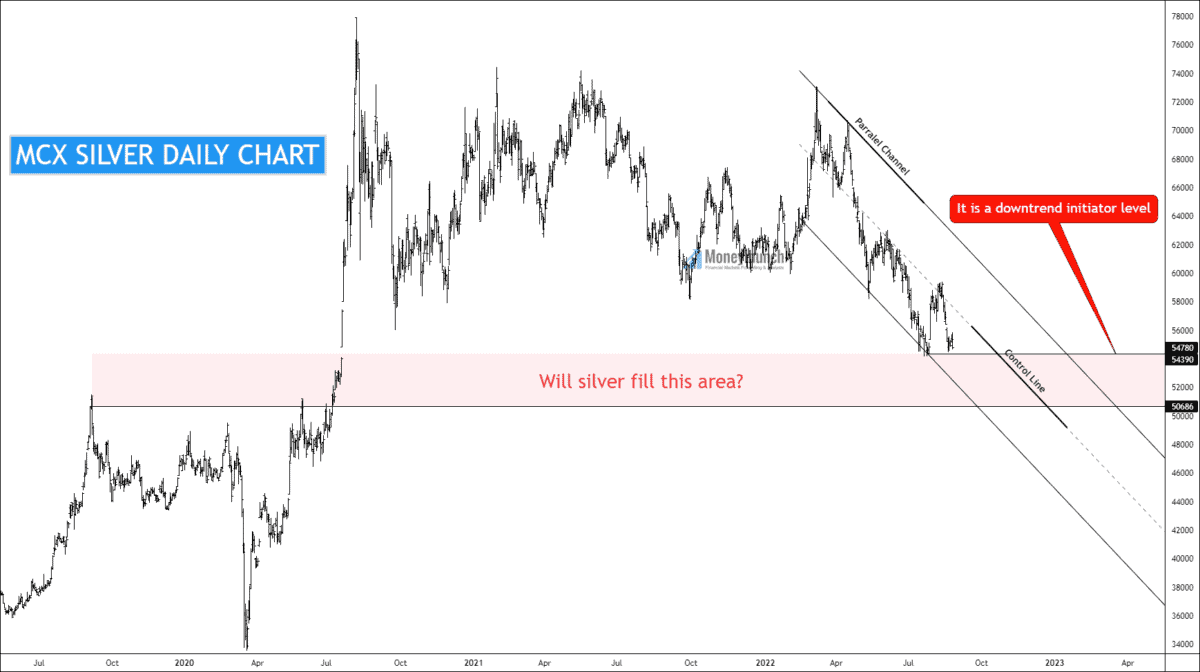

My point is to explain XAGUSD first because it closed at 18.902, and whenever it comes to hit the 18.305 level at that moment, the MCX silver will try to fill the following area (see the chart below).

Continue reading

Lock

Lock