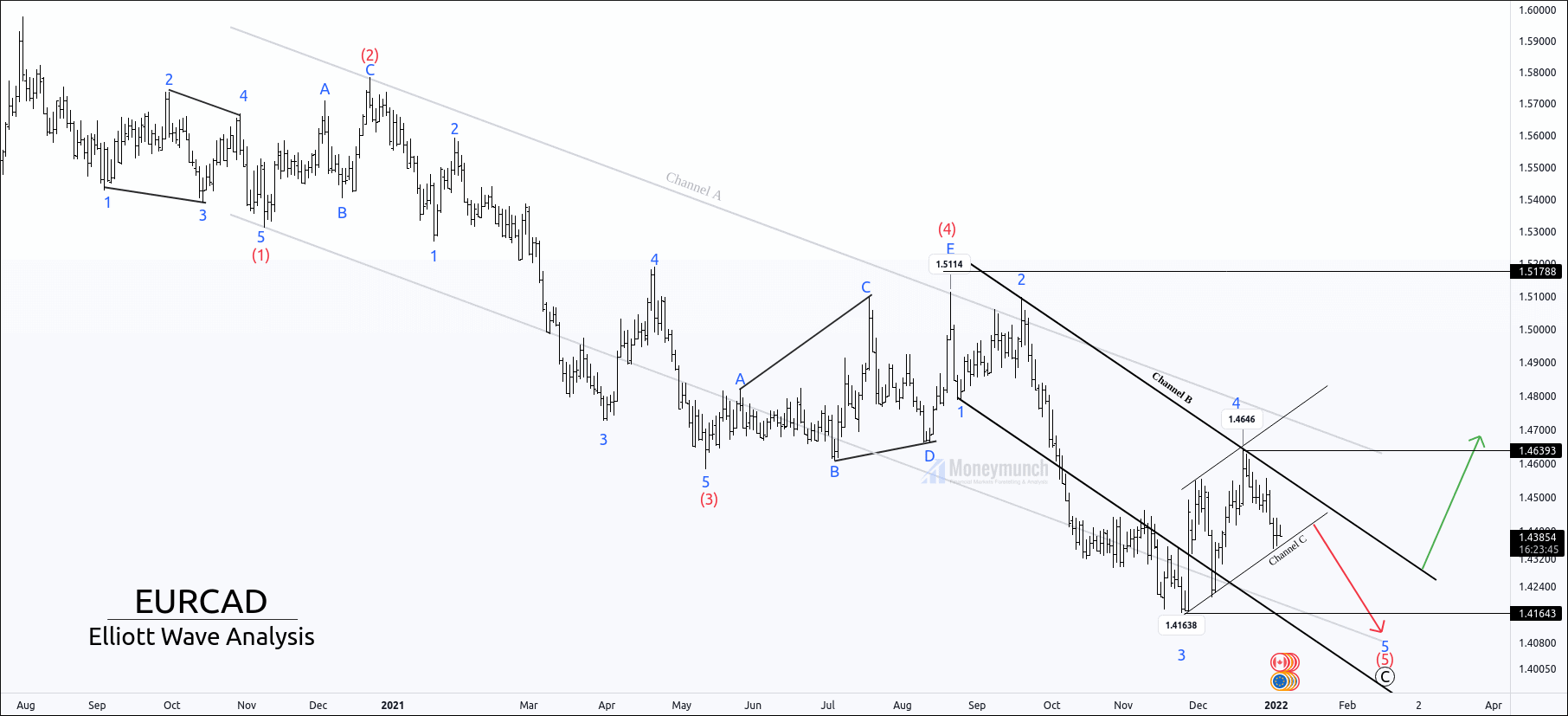

EURCAD has completed corrective wave 4, and if the price breaks the parallel channel C, it may make a new low, which should be impulsive sub-wave 5 of wave (5).

If price breaks down channel C, the following targets for Wave 5 will be 1.4313 – 1.42520 – 1.41652- 1.41156.

After making wave (5), if the price breaks the B channel, it can go for 1.4645 and start a new 5-wave impulse structure.

Please note that the Breakout of wave (4) indicates a strong bull trend.

If the price breaks the channel without a downward, it indicates truncated 5th.

I will upload an intraday chart for further information soon.

Lock

Lock