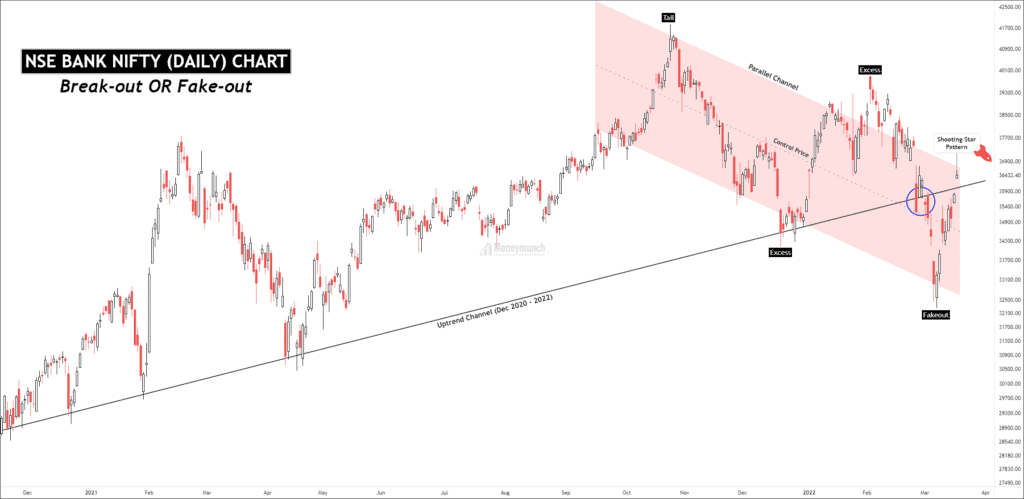

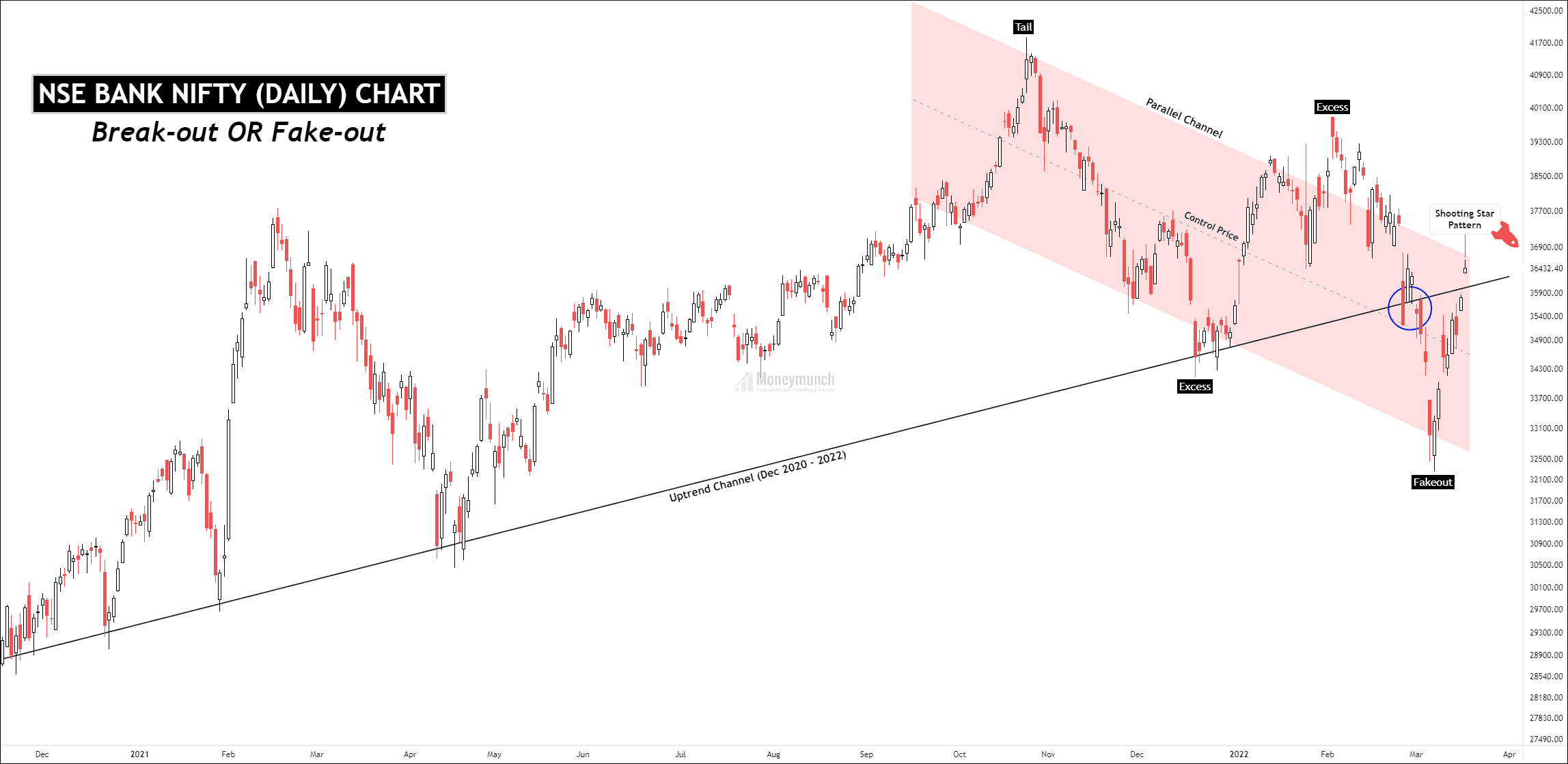

NSE Banknifty Break-out OR Fake-out?

Key levels: 36496 – 37060

Bank Nifty was following the uptrend channel from Dec 2020, and it had broken on 02 March ’22. There’s a new parallel channel unfolded.

In the last trading session, Banknifty has created a shooting star pattern. And this pattern is a single line pattern that indicates an end to the uptrend. At the same time, it is close to a parallel channel resistance line. Moreover, advance traders must look at 100 EMA on it. These signs are signaling further decline. And that could be from the parallel channel’s resistance line to control price.

An uptrend possibility comes from key levels breakout. So intraday traders can use it as an invalidation level. Moreover, Banknifty prices can hike up to that level this week.

If Banknifty doesn’t cross/close above the second level, you should prepare for the following targets: 36000 – 35800 – 35400 below

Where can be spotted after a breakout of 37060 level? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for sharing this chart. Making good profits from your calls.

Simple but effective analysis.

Fabulous analysis! Keep It Up.

Please share daily analysis on indices. It helps a lot.