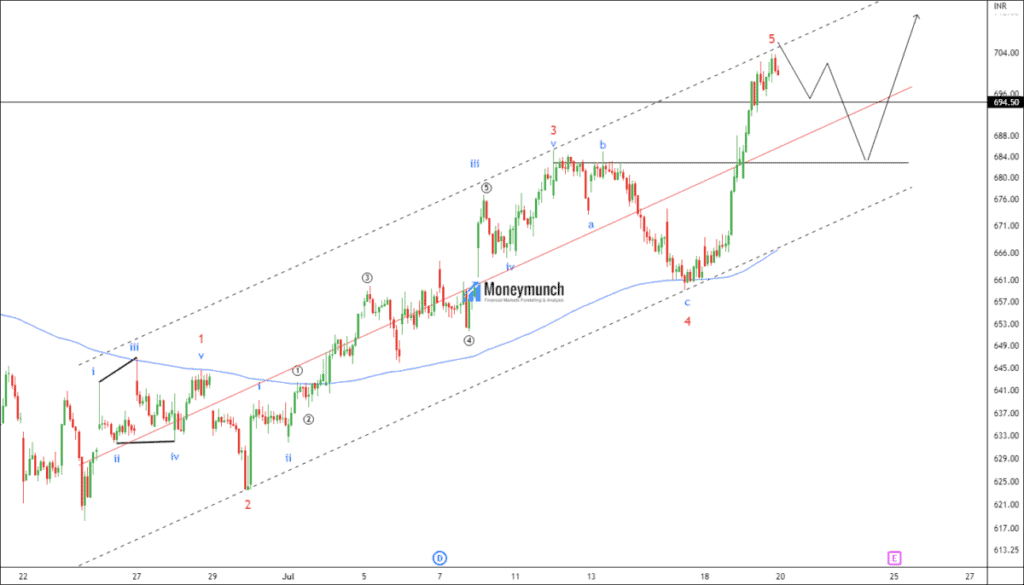

AXIS Bank has accomplished corrective wave 4, and the price is trading at impulsive wave 5. Note that 5th has completed a reverse Fibonacci distance of 161.8%.

Axis Bank may fall up to 50% of the 5th wave if it breaks down 694. In addition, it is facing the resistance acceleration channel.

If the price sustains above wave B, it can skyrocket for the following targets: 694 – 705 – 719.

However, the price can also take support from our key level 694.

Fibonacci relationship:

- Wave 2 retraced 78.6% of wave 1.

- Wave 3 extended 1.618% of waves 1.

- Wave 4 retraced 50% of wave 3.

- Wave 5 extended 61.8% of wave 1 through 3 and 1.618% reverse Fibonacci of wave 4.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.