This is the 21th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Moving Average Convergence/Divergence (MACD) Oscillator

Implication

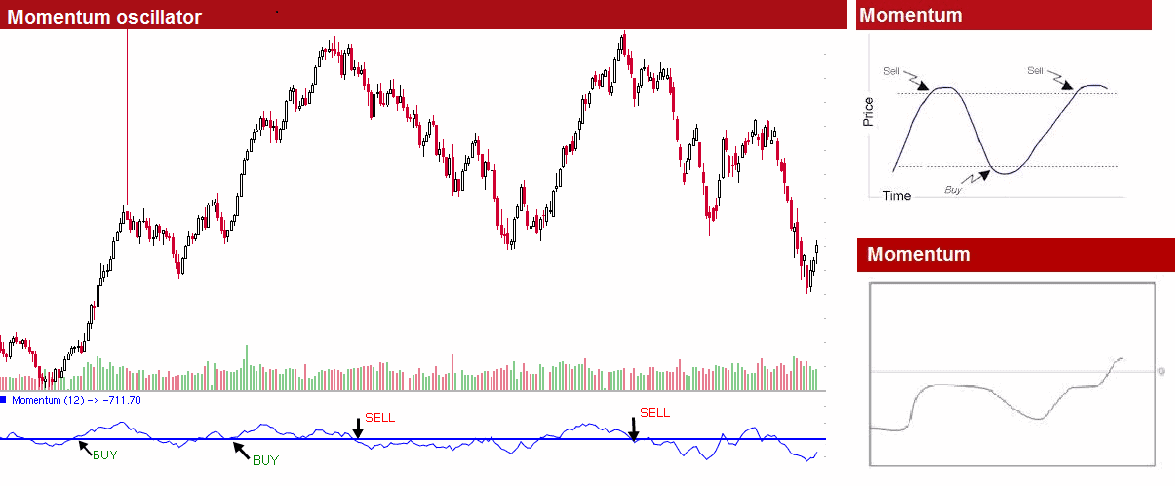

If the MACD crosses the signal line or the zero line (the event), a bullish or bearish signal is created based on the direction of the crossovers.

Description

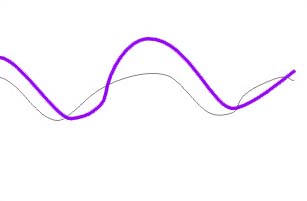

The MACD, “Moving Average Convergence/Divergence”, tells the connection in between two moving averages of prices. The MACD is the difference between a 26-day and 12-day exponential moving average. A 9-day exponential moving average named the “signal line” is plotted on top of the MACD to give bullish and bearish signal tips. A bullish signal is created after the MACD rises above the signal line, or above zero. A bearish signal happens after the MACD comes below the signal line or below zero.

Trading Considerations

The MACD is most effective in powerfully finding trend of markets.

The MACD suggests overbought and oversold situations. An overbought situation happens whenever prices have increased too far too fast and also are set for a downward correction. An oversold situation happens whenever prices have fallen too far too fast and are set for an upward correction. When the shorter moving average pulls away from the longer moving average (i.e., the MACD rises), it’s probably that the financial instrument’s price is too high and will soon get back to more realistic levels.

An indication that an end to the current trend may be near happens whenever MACD diverges through the financial instrument’s price. A bearish divergence happens whenever MACD is making new lows while prices fail to reach new lows. A bullish divergence occurs whenever the MACD is making new highs while prices are unsuccessful to reach new highs. These two divergences are most significant when they happen at comparatively overbought/oversold levels.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?