I am starting this topic with a simple question,

Are you finding consistent profit in your trading? If yes, then you can skip this article, and congratulations!

Now, Let’s discuss talk about the rest of the traders.

Indeed, most traders don’t find profits consistently instead end up losing their money. It does not matter which market they trade.

There can be many reasons for not getting consistent profits.

Like, it can be risk management, trading system. It can also be trading psychology.

But the truth is, you are trapped! Ladies and gentlemen, I am showing you the numerous powerful psychological trap ever.

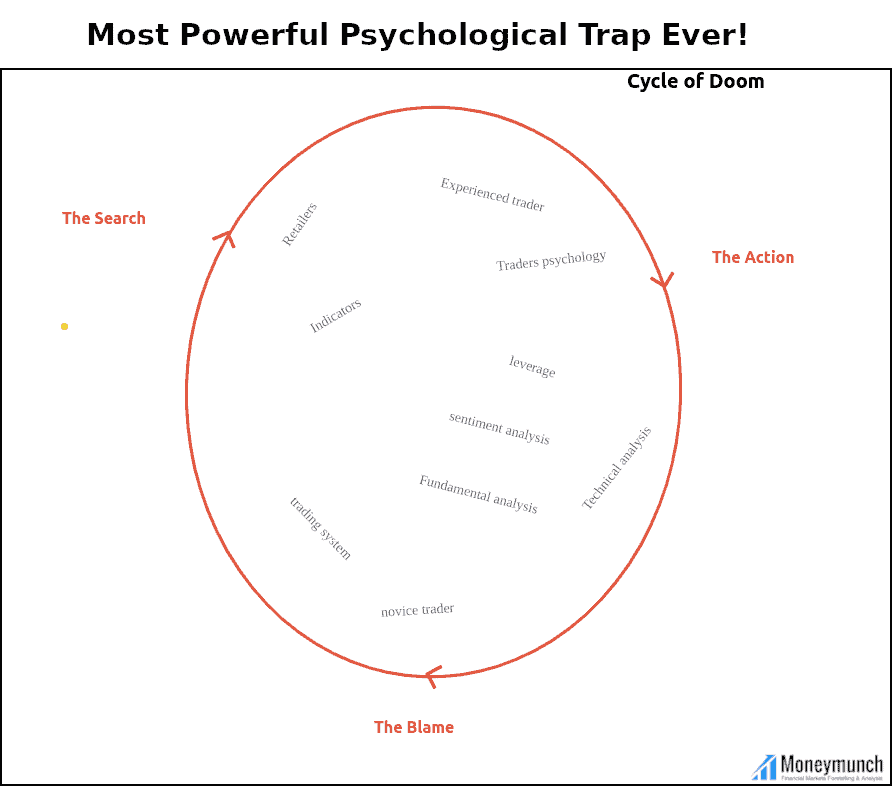

The Cycle of Doom

The cycle of doom involves three phases.

- Phase 1: The search

- Phase 2: The action

- Phase 3: The blame

To become a successful trader, however, you will have to get out of the cycle of doom.

How can you destroy the cycle of doom?

First of all, you have to understand the cycle.

You need to understand what is going on! So you can identify and move beyond the Cycle of Doom in the world of consistently profitable trading.

Phase 1: The search

In this phase, you are searching for a trading system. You may find it from different sources like well-known trading books, educational websites, trading courses, trading forums, YouTube. Or you may find your trading system from speaking to other pro traders at meetings or conferences.

Just with this step, you have got into the cycle of doom. Now you are devising a strategy that will give you a profit and which is convenient for you.

If you cannot find a trading strategy that you are comfortable with, you are probably in phase 1. You will live phase 1 only once you find a trading system that truthfully exists, a system that you look forward to trading. Phase 1 of the doom is complete once you find a trading system that your finger couldn’t wait to trade.

Now you have entered the second phase.

Phase 2: The Action

Phase 2 is the most exciting part. You begin to trade the system. You will have fun in this phase because every trading system looks decent, and the excitement of a new system is irreplaceable.

This excitement comes from unrevealed things.

Will this new trading system work?

Will you become a billionaire?

Such thoughts create more hope in your mind and increase the excitement. You get so excited about trading a new strategy that you forget you have time to test that strategy.

Only five percent of the traders do test a trading system before moving into the action phase. You may find that the trading system does well for an extended period.

At some stage, things look hopeless.

Maybe profit pours early, But eventually, the losing trades pile up.

A drawdown eventually appears. There are several losing trades in a row.

This trade may have appeared just as you decided to increase the risk per trade, and the system ran into a bumpy road.

This drawdown is the beginning of the end of phase 2.

It is proof that you lost faith in your trading system. And begin to move into the next phase.

Phase 3: The blame

You are not trusting your trading system because the trading system has not found consistent profits. And now you decide to dump the crappy trading system.

In this phase, you blame your trading strategy for the losses you incur. You decide it is time to move on to a new trading system.

Return to phase 1

You have completely given up on your trading system. You will enter phase 1 of searching for a new trading system. The search is on again. The circle repeats itself. Most traders think that profit is due to a trading strategy. This cycle makes it clear that trading strategy is not responsible for profits.

Another way to look at this is to consider two traders who are using the same system. Trader A is constantly finding profitable trades, but trader B has losing trades in a row.

How to defeat the cycle of doom?

Do you want to trade consistently? And you are expecting profit as well? You must stick with a trading system that you believe. If you don’t have faith in your trading strategy, then you cannot earn consistently.

There is one way to get confidence in your trading is to back-test it. Because of that can help you to find your weak points from your trading system. Make a few rules with your strategy.

For instance,

If you don’t want to use indicators, then try price action or any other theory. And you must have trust in it.

I’m going to focus on the following topic in the next chapter:

1. How to do backtesting?

2. How to create your trading strategy?

Now you are familiar with the cycle of doom, and you know how to break this trap. It is hard to break this cycle, but it’s not impossible.