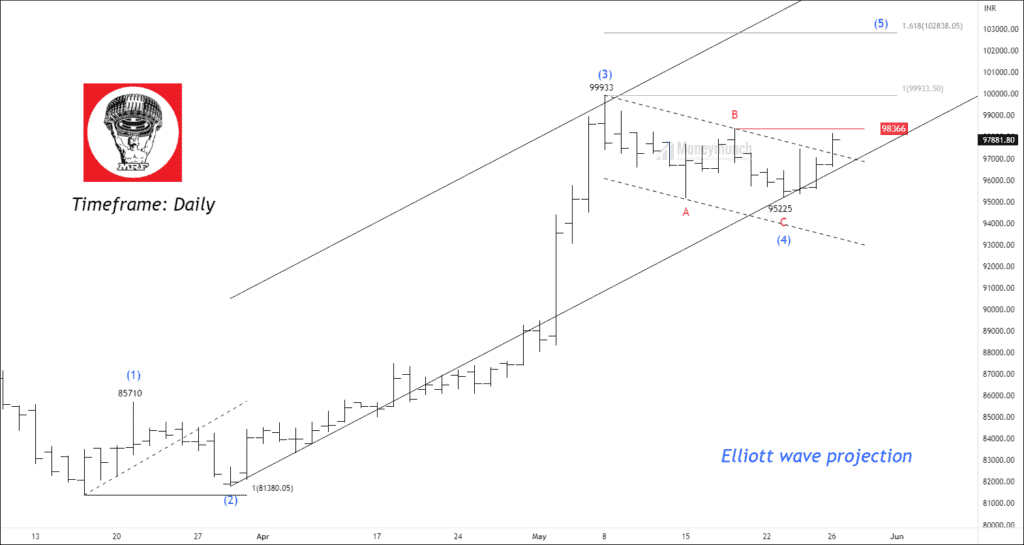

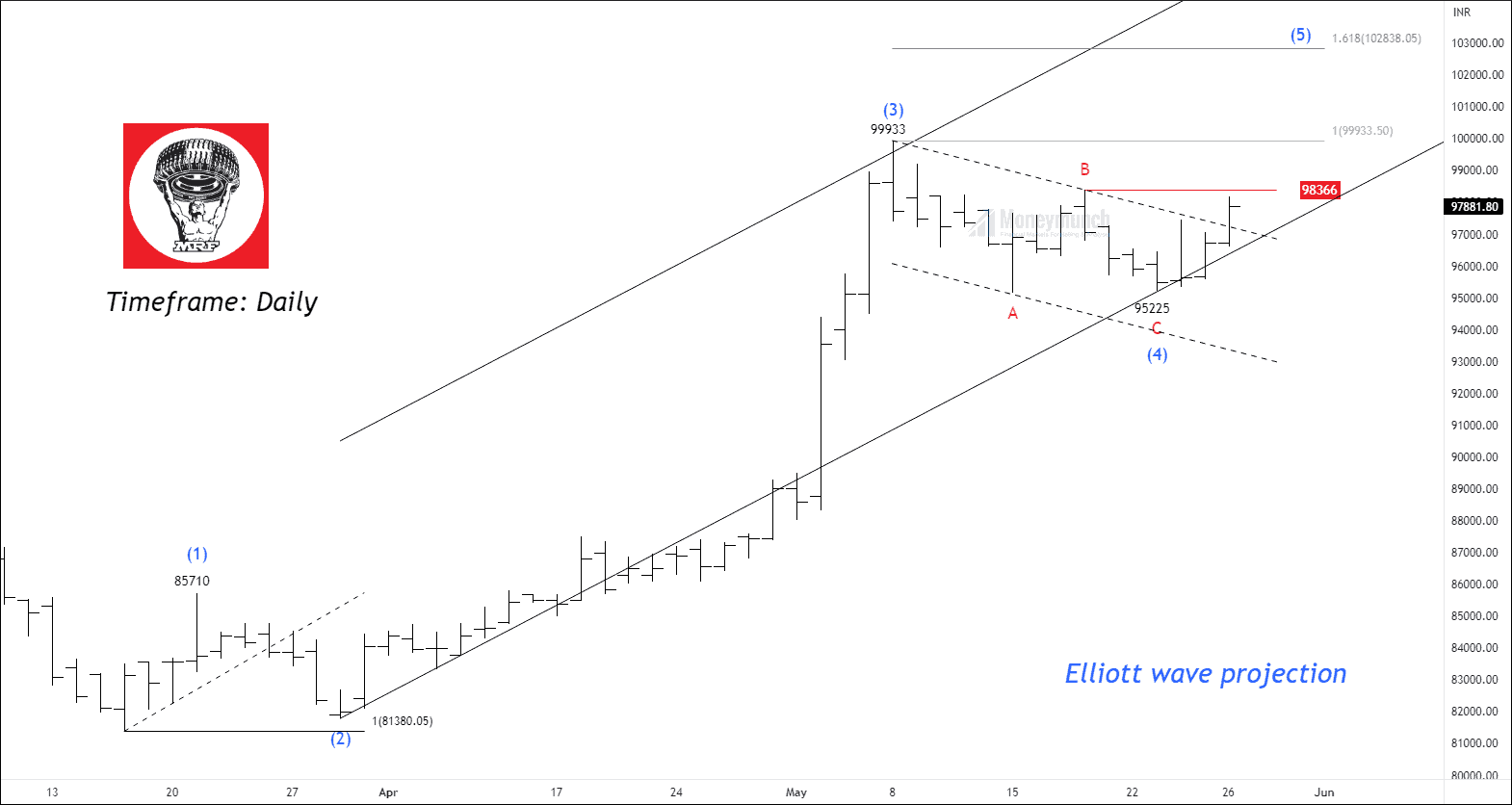

Timeframe: Daily

NSE BHARATRAS Surpasses Strong Resistance at 10195

NSE BHARATRAS is currently encountering a significant resistance level at 10195. However, the price has successfully surpassed this resistance level after a series of 17 consecutive narrow candle ranges. Furthermore, this breakout has also resulted in the price moving above the 200-day exponential moving average (EMA), indicating a strong bullish momentum in the stock.

If the price manages to sustain its position above 10175, traders may consider initiating buy positions with the following target levels: 10350 – 10531 – 10720+. It is advisable to consider the low of previous trading sessions as an invalidation level for this trade setup.

NSE ATUL – Range Breakout Hints at Bullish Trend

NSE ATUL remained range-bound between 6700 and 6575 for over five consecutive trading sessions. However, during the previous trading session, the price broke out of this range with a substantial candle. Additionally, the price formation on the daily timeframe resembles a double-bottom pattern. The neckline of the pattern is at 6967.

The breakout happened at the oversold area, which validates the bullish momentum. If the price manages to maintain its position above 6715, traders may consider initiating buy positions with the following target levels: 6830 6890 – 6965+. Traders are advised to use the low of the previous day as the invalidation level for this trade setup.

NSE CDSL – Equilibrium of Supply and Demand

NSE CENTURYTEX – Weakness Highlights Selling Opportunities

On the daily timeframe chart, NSE CENTURYTEX appears to be displaying weakness. The price had become overbought, reaching an RSI (Relative Strength Index) of 78.93 before falling to 60.72. Furthermore, the price has broken down below a recent support level of 790. Although the price is currently above the moving average, it is declining and struggling to reach the Exponential Moving Average (EMA).

Traders should pay attention to the price action, particularly if it sustains below the 790 level. In such a scenario, it may present a selling opportunity with the following potential targets: 777 – 761 – 753+. It is important to monitor the price movement closely, as a sustained breach of the support level could indicate further downside potential for NSE CENTURYTEX.

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Thank you for consistently delivering insightful and thorough stock analyses. Your research is meticulous, and your ability to identify key factors and make accurate predictions is commendable. Your work is greatly appreciated.

Just purchased the Pro VIP plan from MoneyMunch and I couldn’t be more excited! Looking forward to accessing exclusive trading resources and taking my trading game to the next level. Let’s make some profitable trades together

Excited to join MoneyMunch’s Stock Market plan for three years! I believe this investment will pay off in more ways than one. Ready to learn, grow, and make informed trading decisions with the guidance of the experts.

Adarsh Gupta

Mumbai

782XXXX954

v good, always I watch your feed backs