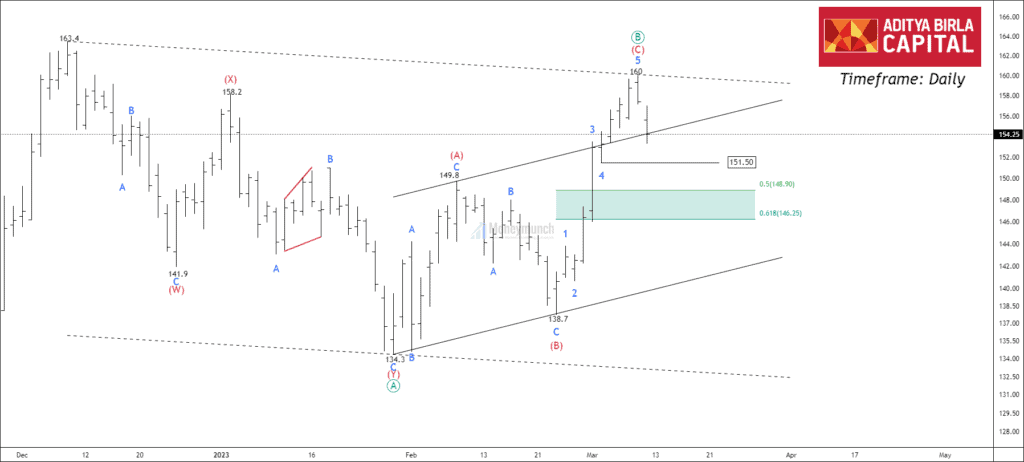

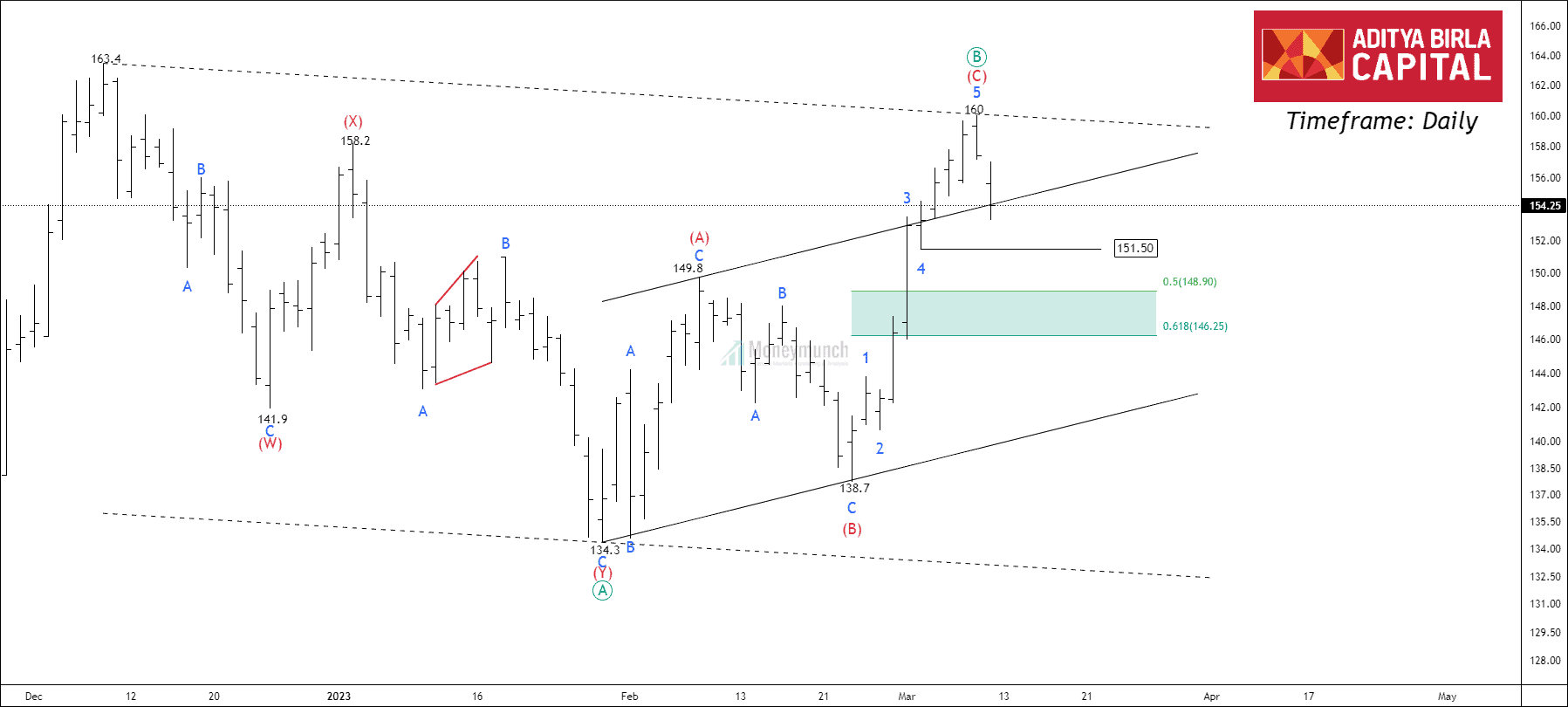

Timeframe: Daily

After making a high of 163.4, the price started falling for the corrective structure, which has been forming for more than 3 months. During a period of falling prices, the ATR of the price started rising, which signals the bear dominance at the high price.

Due to inability of price to make a new high, the prices ended up lower. The falling prices will pause at 151.50, which is the sub-corrective wave 4 of the lower degree. If the price sustains below 151.50, traders can sell for the following targets: 146 – 142 – 135. We are out of the market in case of opposite move.

NSE SHANTIGEAR – Bulls Are Ready To Take Over

On the daily timeframe chart, Price has formed a fractal pattern with a w pattern that signals bulls are controlling the moves and sellers can no longer dominate the trend. The SHANTIGEAR has broken out of the trend line and is trading near the neckline.

If the security sustains above pivot level 357, traders can buy for the following targets: 368 – 382 – 395. Note that this setup is for a breakout of the formation, and traders must not trade the setup if the price fails to sustain above this level.

Traders can take the previous day’s low as their stop-loss.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock