Will Nifty Hit 2nd Target?

First, click here and read the nifty call report: click here →

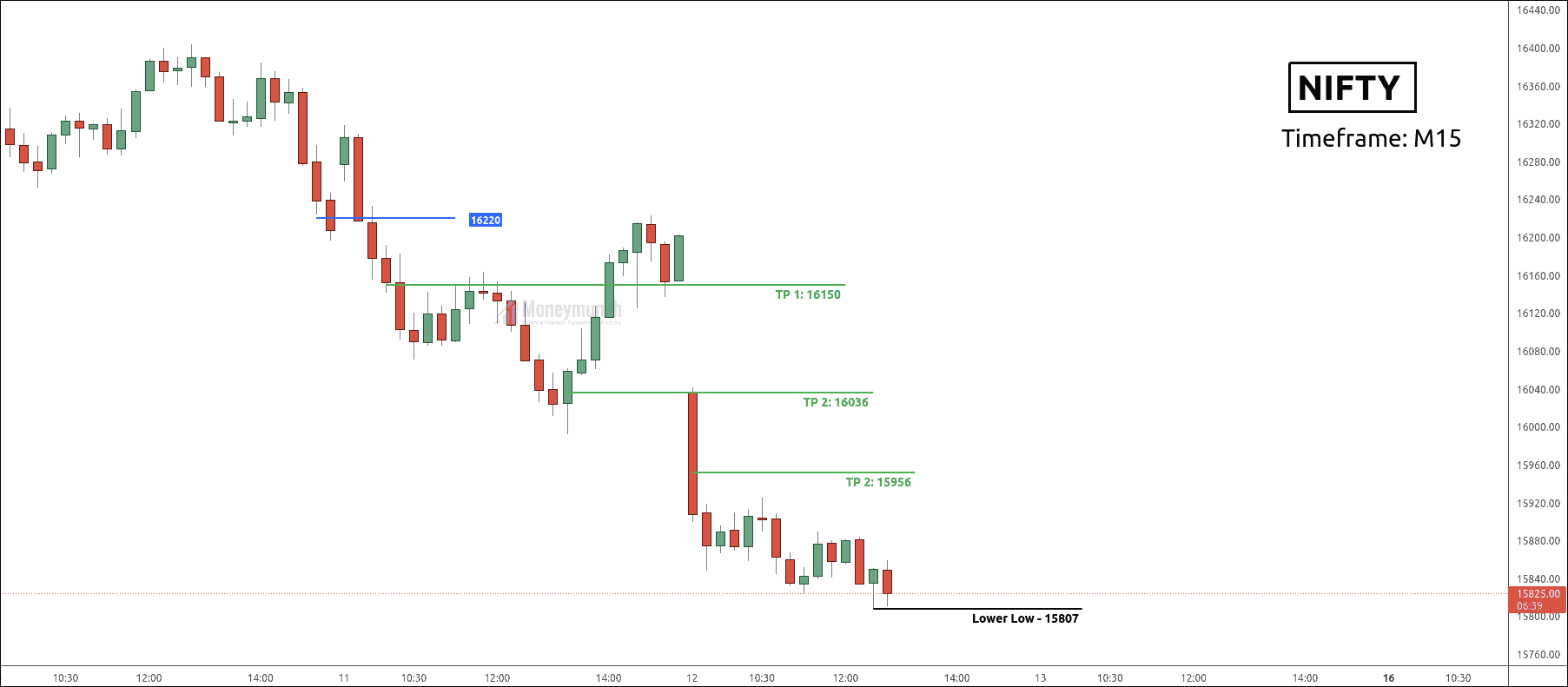

Nifty has achieved the first target of 16161 (239 Points Profit Per Lot). What else do you want in the subscription?

Now the question is:

Will it touch the 2nd target of 16088 and the 3rd target of 16014?Continue reading

Will Axis Bank Reach The Second Target?

NIFTY, ADANIENT, & AXISBANK: Tips & TA

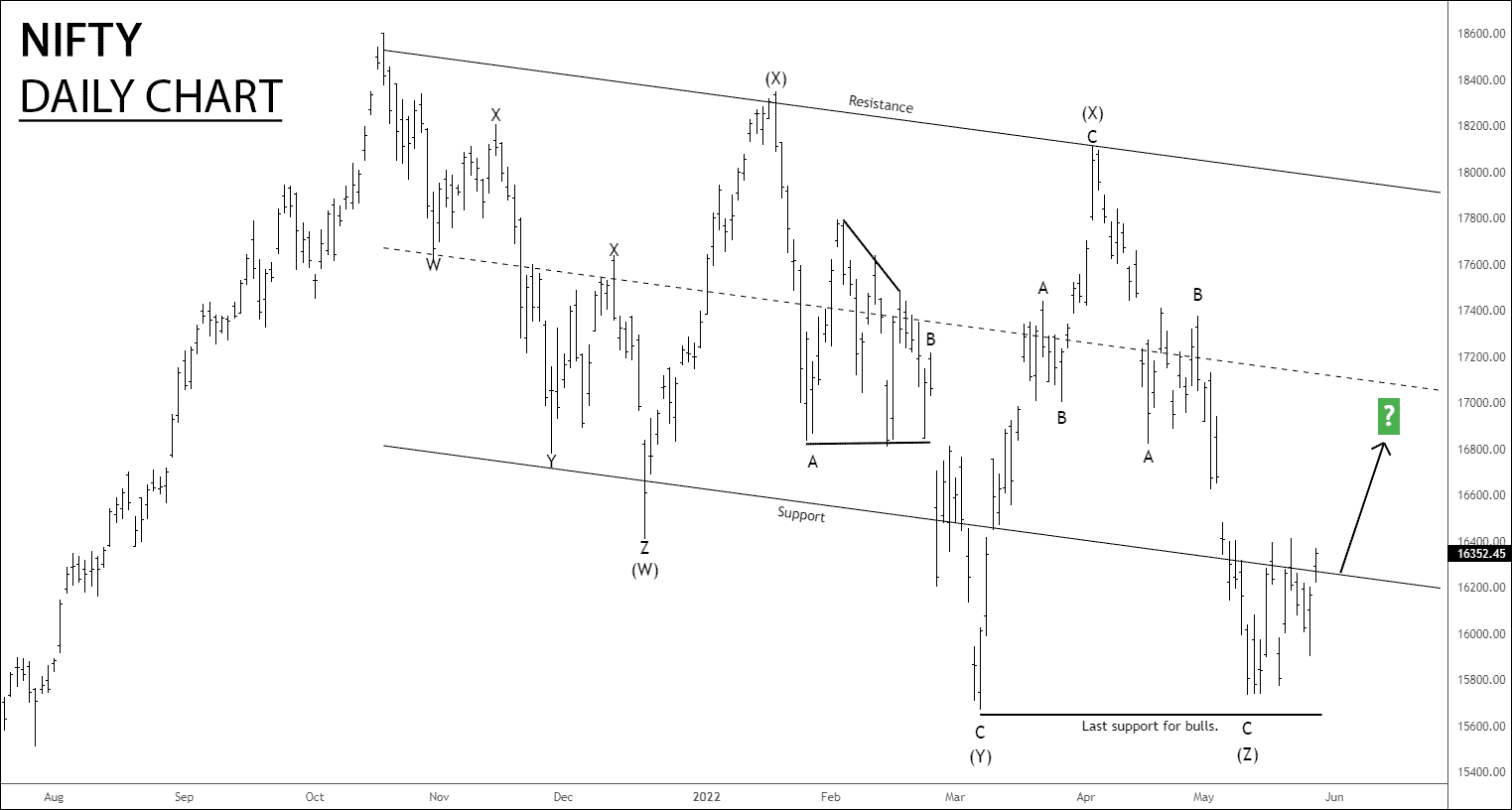

NSE Nifty Has unfolded Bearish Structure

Have you read the Previous report on nifty and bank nifty?

Click Here – NSE NIFTY & BANKNIFTY OUTLOOK FOR INTRADAY TRADERS

I have mentioned in clear words, “After Gap is down, if the price sustains below 16220, traders can expect the following targets: 16150 – 16036 – 15956.“

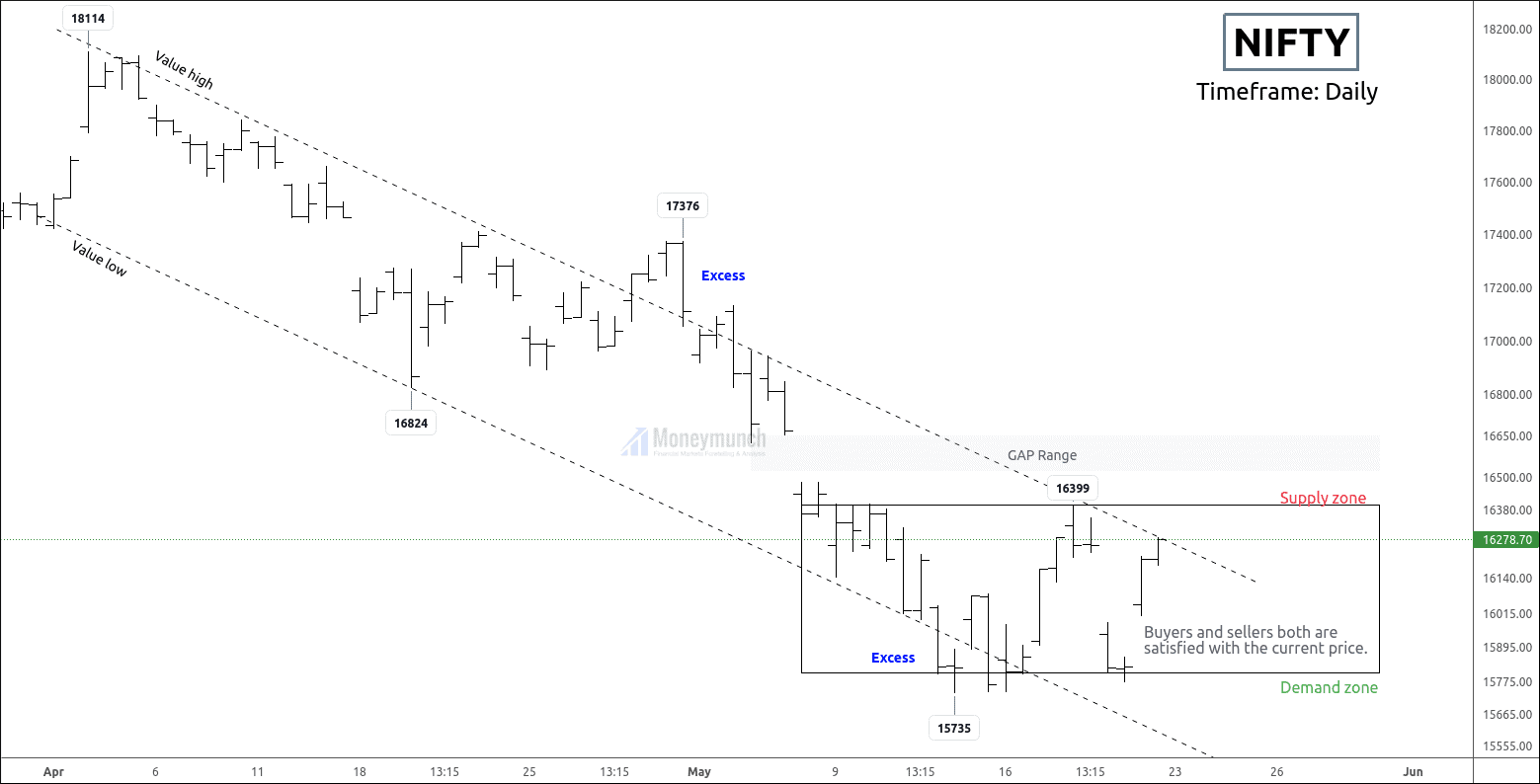

Nifty formed a bearish pattern, and It was a gap down signal.

NSE NIFTY & BANKNIFTY Outlook For Intraday Traders

Is Bank Nifty Resuming Its Bearish Move?

Bank Nifty is occurring in the range between 34700 and, 33370. To get a tradable move, traders should wait for the breakdown of this range.

Traders can short below 34100 for the following targets: 33803 – 33540- 33452. In this phase of declining, traders must wait for a confirmation signal. Buyers can enter above 34700.

Is Nifty Preparing For 15950?

Nifty is forming in the range of 17500 – 16340. Price will face a consolidation if it trades between these levels. We can see big impulsive moves after the price breaks this level.

Today, We will see a gap down in nifty with a speculative boom.

After Gap is down, if the price sustains below 16220, traders can expect the following targets: 16150 – 16036 – 15956.

Bottom always takes time to be formed. A long position is only possible above 16800.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.